Bloomberg gives buses the green light, but is worried about the cobalt

23 May 2018

According to BNEF, the buses in 2040 will cover 80% of the world bus fleet

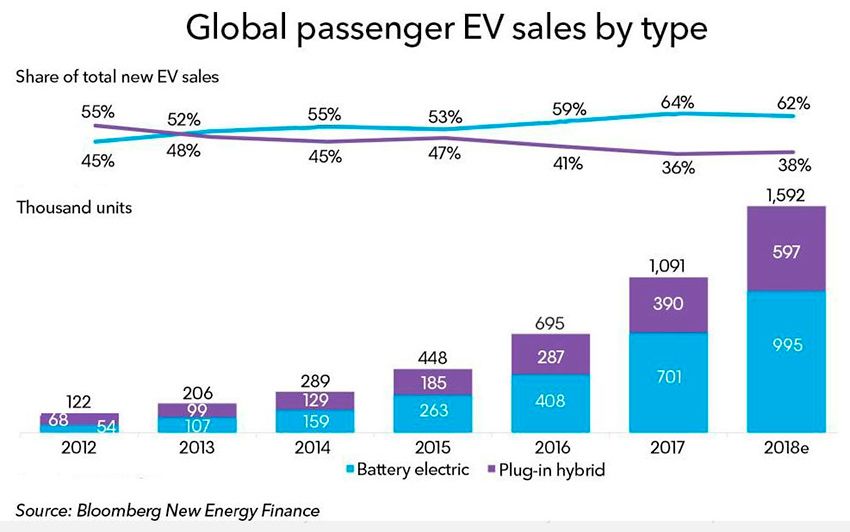

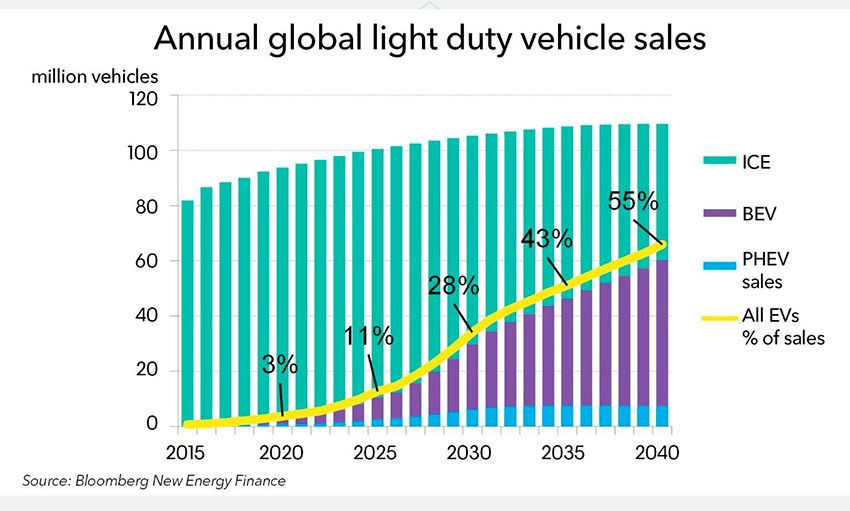

In the next forecast of development of electric transport – Electric Vehicle Outlook (EVO), published annually by company Bloomberg New Energy Finance (BNEF) stated that sales of electric cars made in 2025 11 million a year by 2030 – 30 million, and by 2040 – 60 million and then they will account for 55% of the global automotive market.

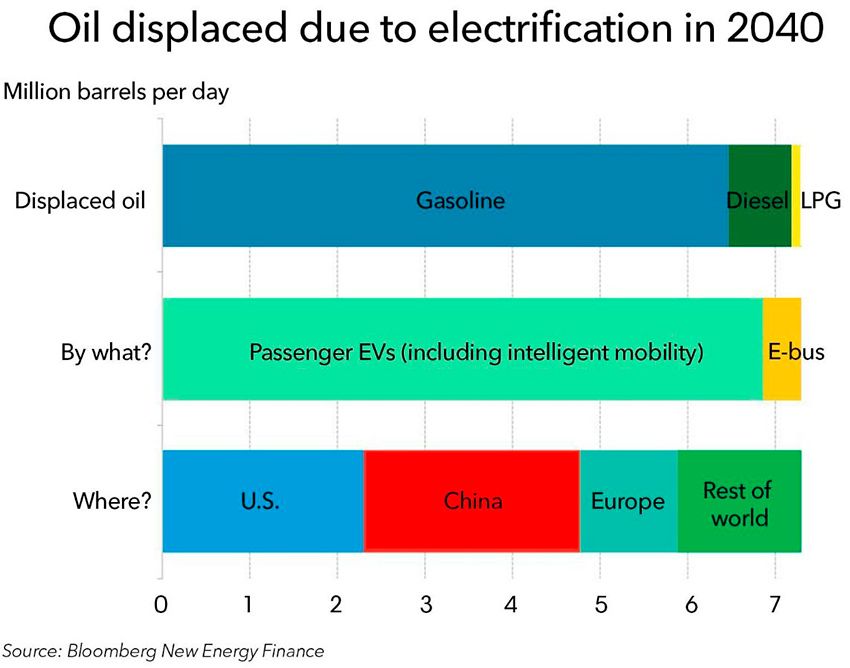

Accordingly, in 2040, the fleet of electric vehicles and electric buses of all types on the world's roads will be 33% or 559 million That will help to replace the consumption of about 7.3 million barrels of oil a day.

In comparison with last year's report in the current EVO EVO 2017 2018 predictions BNEF still, albeit slightly, but were higher in terms of the percentage of penetration of EV. So, last year, BNEF predicted by 2040-mu the achievement of electric vehicles share of 54% in sales and the size of their global fleet of 540 million during the same 33 percent share in the world fleet.

The current forecast is concentrated on the buses, for which the BNEF forecast is that by 2040, 80% of city buses will switch to electric. So, by 2030, the segment of municipal buses proportion of buses will rise to 84%, despite the fact that conventional passenger cars and commercial electric vehicles will reach in worldwide sales only to 28%. The total world fleet of electric buses in 2040 will reach 2.3 million

Sales of passenger EV in the world over the past seven years abruptly went up the hill

Earlier, Bloomberg has compared the electric buses at a total cost of ownership with diesel buses and acknowledged that they have quite konkurentosposobnoi.

In the current forecast Bloomberg presses especially on the role of China in promoting electric vehicle on the planet. So every third electric car in the world in the period from present day to 2040 will be implemented in China.

Peak sales of traditional petrol and diesel vehicles Bloomberg has identified for China by 2020. After this date the trend of their sales will be exclusively downward.

Global Outlook of electric car sales will directly depend on the speed of development and breadth of charging infrastructure in key markets and the implementation of a "model joint use vehicles" (shared mobility), i.e. car-sharing, and other forms of co-ownership.

So, BNEF predicts that the global fleet "joint mobility" will increase from just under 5 million cars to over 20 million by 2040. Accordingly, by that time, more than 90% of the "sharing" of cars will be electric cars. Share Autonomous vehicles, i.e., drones (of Abakarov) will be about 40% of the total Park of "sharing".

Naturally, the rate of electrification of vehicles will vary from country to country. So, according to the BNEF forecast in 2030, electric vehicles will account for 44% of passenger car sales in Europe, 41% in China, 34% in USA and 17% in Japan. The lack of charging infrastructure and charging electric vehicles budget hamper development of the market in India, where the proportion of electric vehicles even in 2030 will not exceed 7% of the new car market.

Bloomberg calculated the trend by 2040 will bring an EV to the leaders of the global market

In recent years, prices for lithium-ion batteries for electric vehicles fell, so by the monitoring BNEF this factor, since 2010, from $1000/kWh to $209/kWh or almost five times in less than seven years. The average density of energy in batteries of electric vehicles is also improved by about 5-7% per year.Political support.

Governments around the world offered generous incentives the purchase of electric vehicles (EV) to help develop their market. At the same time, tougher standards on fuel consumption will still require significant electrification of the vehicle fleet, and the project of China – NEV forcing carmakers to produce electric vehicles with more stress than I would like most of them.

And this is happening in China at the national and state levels. So, in 2017, 21% of all global sales of EV had only 6 cities in China where there were significant restrictions on the purchase of new and operation of conventional cars with internal combustion engines.

In Europe, the specter of potential prohibitions pushes buyers and manufacturers from the machinery diesel fuel (aided by the timing couldn't be happened in USA "deselect the" illegal emissions from the diesel models of the Volkswagen Group). The problem of air quality in cities is quickly becoming a Central element of municipal policy in Europe, which also stimulates sales of electric cars.

Observed just after the tsunami counter-obligations on the part of automakers, including the "Big German Troika": VW, Daimler and BMW, and also Renault-Nissan-Mitsubishi, Geely-Volvo, and other global automakers, which polls announced aggressive plans for the electrification of its model lines within the next 10 years.

Thus, the number of available models of electric vehicles should increase from 155 at the end of 2017 to 289 by 2022. Chinese automakers, of course, go even further, and companies such as, for example, Chang'an, in General, will switch solely to electric vehicles after 2025.

The share that electric cars occupy the global automotive market remains small in most regions, less than 2%, but some countries have significantly moved forward in the next 20 years the world will be serious changes in the automotive area.

However, there are problems. So consumer infrastructure still remains a barrier in many countries, moreover, problems with the supply of raw materials such as cobalt, can create some obstacles on the way to cheaper batteries.

The forecast is from BNEF energy, automotive industry and mining industry show that sales of electric vehicles (EV) will increase worldwide, with a record 1.1 million in 2017 to 11 million by 2025, and then rise to 30 million by 2030, as electric cars will become cheaper than traditional cars with internal combustion engines (if they also "help" to storegate law, plus will drive gasoline and diesel fuel to unimaginable heights taxes but then it will take vysokoskorostnoe "electric" electricity – taxes-budgets to where it is necessary to replace carbon fuels – ed.). It is expected that the number of cars in a conventional internal combustion engine will start to decline every year since the mid-2020s, because then electric cars will have to be a serious alternative. So, the initial cost of the EV will be competitive in unsubsidized basis, starting in 2024, and 2029 parity will be achieved in most segments, as the price of batteries will continue to fall.

Accordingly, China is the leading player during this transition, since according to the calculations of sales in the region will account for almost 50% of the world market EV by 2025 and 39% by 2030. Electric vehicles sales in the domestic market of China, by 2025 will amount to 19% of all new car sales. Similar figures for Europe is 14% and the USA – 11%.

Yet electric cars are a small but growing segment. The onset of the buses will go faster than electric cars.

Despite the fact that in the coming years, Bloomberg is optimistic about the demand for EV, there are still two major obstacles: the risk of a lack of cobalt in the early 2020s, which may slow down the current process of rapid cost reduction, rechargeable batteries, recent, and aggravate the problem of charging for the infrastructure development.

Electric hegemony China

China is unequivocally the leader in segmente electrobuses, and several major Chinese cities are on the path to full electrification of their bus fleets by 2020, and some dealt with it even earlier, for example, Shenzhen. The rapid growth of buses of China is associated with the national industrial policy, since we are talking about environmental problems and energy security issues. China's emphasis on electrification of transport, because he believes this is a fundamental strategic goal of the industry for the next decade.

Yet national, regional and municipal governments in China are promoting the EV market forward. However, national subsidies will gradually be eliminated by 2020, however, starting from 2019 manufacturers will be forced to participate in quaterwave the program "New Energy Vehicle". Like the California program quoted emissions, this quota system is effective and for the Chinese EV market, requiring automakers to quotas on sales of traditional vehicles by obtaining quota in the sale of EV. Accordingly, the manufacturers that will not sell enough electric cars on their own, will be forced to buy such quotas competitors. Such a rigid approach is sufficient to achieve the 2025 strategic goal in 20% of car sales in the domestic market.

Will continue tough policy of the city of municipalitetov in additional restrictions on the purchase and use of vehicles with internal combustion engines (in the United States have to introduce these measures against pickups and SUVs – but this is an attempt on "fundamental individual rights", which no US President afford to just not be able to clamp on the planet have all, of course, but American voters – ed.).

The EV market will slow down in 2030-x due to infrastructure constraints, especially in Metropolitan areas, where opportunities for Parking are all to narrow and narrow (so that car sharing from fashion trends may be in some places of the planet simply no alternative opportunity to use the car as such – ed.). It is expected that the fleet of electric vehicles in China in 2040 will reach 200 million.

The growth of electric vehicles market is threatened by a shortage of cobalt and not lithium.

Today the total capacity of lithium-ion batteries in the world is about 131 GWh per year. Given the declared and constructed plants for the production of batteries by 2021 this amount will grow to more than 400 GWh, and 73% of the world capacity for their production is concentrated in China.

Further investments will still be needed, so by 2030, Bloomberg ogedep that global demand for lithium-ion batteries for electric vehicles will reach 1500 GW•h

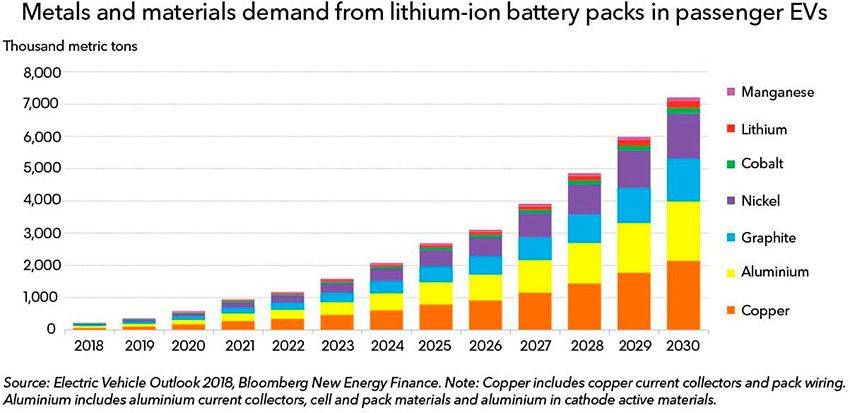

The growth of demand and prices of key components for batteries will progress by 2030

All this pushes up demand and prices for key production materials for battery, such as cobalt, lithium and Nickel.The demand for the components that are required for lithium-ion batteries (electrodes, electrolytes), and will increase with almost 0.7 million metric tons in 2018 to more than 10 million metric tons by 2030.

Manufacturers pursue different strategies of production of the battery, so some prefer to make inside their companies all the elements, starting with the active materials to finished battery packs. Others prefer to buy the stuffing in the form of electrode active materials or electrode terminals from external suppliers and simply make your own battery box.

Commodity prices are growing rapidly, speeding up the introduction of battery type NMC, which contain 70% less cobalt than traditional batteries and can be quickly implemented as a result of further increase in prices for cobalt and lithium. This will help to reduce the cost of batteries, but for the price of batteries has fallen significantly below the coveted $100 /kWh, you may need the next technological revolution.

The supply of cobalt still look quite threatening problem. Despite the transition to chemicals with a low content of cobalt, based on current broadcast claims made by the manufacturers of the battery, by the early 2020s still definitely planned significant deficiency of this chemical element. Recycling of waste battery and reduce the use of cobalt other users, though, and can somewhat mitigate, but not eliminate completely all future deficits of this raw material.

As a result, deliveries of cobalt today is one of the most serious potential risks for the development of the electric car market over the next 5-7 years. In the long term it is expected that high prices will lead to the emergence of new suppliers, and will accelerate the development of new types of batteries with other chemical elements.

And, here is the supply of lithium in the short term will not be of a risk for the development of electric vehicles. The high price of lithium over the past few years has led to a significant increase in investment in new production capacity for mining and processing. Although it cannot be expected that the supply will go so rhythmically, but the stocks will be sufficient to meet the projected demand, at least for the next 5-7 years. Further investments in the production of lithium will be required from the mid-2020s.

The buses represented one of the most promising ways of reducing harmful emissions and improving air quality in cities. On the roads of the world has already moved more than 300,000 buses, and the vast majority of them located in China.

Many cities in Europe (including Russia) and North America are also taking decisive action on the electrification of its municipal bus fleets in the next decade.

the Displacement of oil with the energy of Olympus.

Electric buses and electric cars will allow to decline by 2040, a total of 7.3 million barrels of oil per day, now spent on transport needs. The most common type of fuel consumed today, the world passenger fleet is entering the gasoline, which accounts for 94% of the liquid fuel consumed by passenger cars. By 2040, diesel will account for only about 5% of the demand for fuel for vehicles, moreover, most of them will be in Europe. In addition, we expected that the passenger cars and drones will displace more than 20 million conventional cars.

Today China accounts for almost 2.5 million barrels of oil per day, followed by the United States and Europe, respectively, with 2.3 and 1.1 million barrels per day. In the short term, a large part of the recorded demand will be associated with the consumption of diesel fuel and 2023 gasoline.

By 2040, diesel will account for slightly less than 10% of the total fuel for transport, and replaced by electric vehicles, demand for gasoline will exceed 6.4 million barrels per day.

The introduction of electric vehicles, including those that will be used in the unmanned version, as well as sharing and car-sharing will begin to have a significant impact on the demand for oil, displacing nearly 6.9 million barrels of liquid fuels consumption in 2040.

While passenger electric vehicles and the connected vehicle will have limited distribution in the short and medium term, the buses are already beginning to significantly affect oil consumption. This is especially true for China, where in 2018, they will replace approximately 240 thousand barrels per day. At the same time, the gasoline will continue to dominate in the Park of passenger cars and diesel in the fleet of buses and trucks..

|

|

|

Element was not found.