Time to take stock

The aim of the conference "AUTOMOTIVE industry–2017" was summing up work of the enterprises in the automobile industry...

The aim of the conference "AUTOMOTIVE industry–2017" was the summing up of work of automotive industry of Russia in 2017 forecast 2018-2020 years.

In mid-December JSC "avtosel'khozmash-holding" and Association of Russian Automakers (NP oar) conducted the 26th total automotive conference on the theme "Results of work in the automobile industry in 2017 the prospect of development of the industry in 2018," in the course that discussed the strategy of development of the domestic automobile industry, the state programs of import substitution (including the automobile industry), the export potential of automobile manufacturers, an analysis of the structure of the Russian automotive market, and also development prospects of the automotive industry.

Key stages of the strategy

Strategy of automobile industry development of the Russian Federation for the period up to 2025 years told head of Department of development of sectors of economy of the Ministry of economic development of the Russian Federation Rustam Abulmambet.

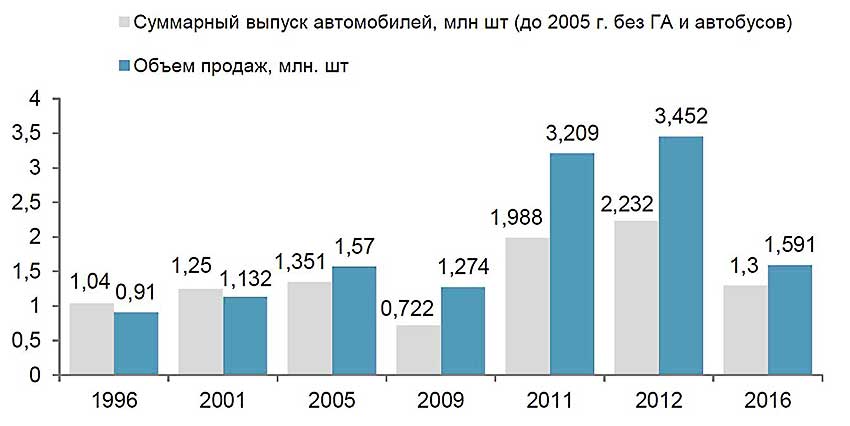

He in particular noted that the development of the Russian automotive industry was by attracting global manufacturers. So in 1996, the reduction of customs duties up to 30% of the cost for all types of passenger cars has led to outpacing growth in the import of used cars. In 2001 followed by reductions in customs duties up to 25% of the cost, and four years – the signing of 27 agreements on the regime of industrial Assembly (industrial Assembly 1). In 2009 as an anti-recessionary measures for support of industry increased the customs duty is up to 30-35%. For used cars introduced higher rates. 2012 marked the entry of Russia in WTO and commitment to the gradual reduction of duties up to the average level of 15% to 2017. At the same time the decision on the introduction of utilization fee on cars. In the result is to protect the market for certain types of used vehicles rose to 100%. In 2020 it is planned the termination of all existing agreements on modes of Assembly.

From the above it can be concluded, that the growth of the automotive market has only been possible since 2005 years due to rapidly increasing incomes. With this time the active interest to Russian market have become a global OEM.

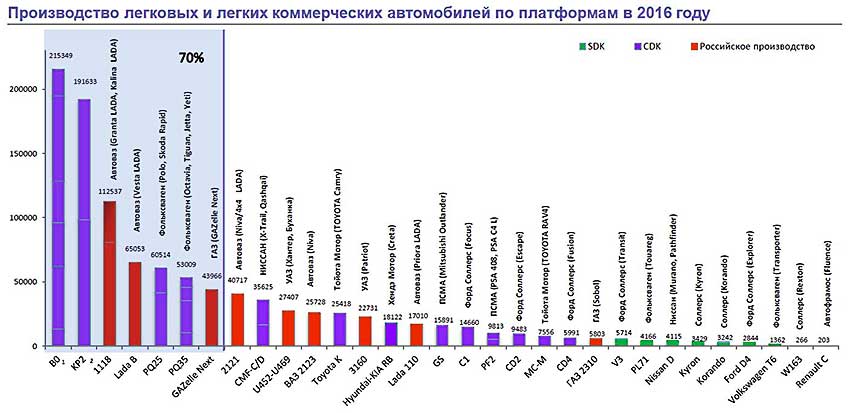

The results of the industrial Assembly, according to the reporter's opinion, were: the inflow of investments in the amount of almost $23 billion in 2005-2016 years., increased production capacity in 1.7 times, 25 thousand jobs created, a large part of the value added remains of not there is a transfer of competencies. As a consequence, traditional Russian producers lost the competition for the market. Moreover for 10 years, the share of domestic platforms on the market has decreased in 3 times.

Global manufacturers were forced out of the Russian market, but not able to balance the market.

During the specified period have created overcapacity in insufficient volume of production to platform. In the segment of passenger cars to date only 3 platforms there is a minimum break-even production corresponding to the level of not less than 100-150 thousand cars on one platform in year. Support policies actually subsidized the losses of the industry and allowed to retain excess capacity. The total volume of anti-crisis support of the industry in 2014-2016 totaled 113 billion a long way, however, to date, each additional 1 billion ₽ sent to support demand, able to stimulate additional sales in the volume is 5-10 thousand cars. In the industry's accumulated negative financial result. The market balance can be achieved with care of the less successful competitors or when migrating to global manufacturers in Russia, additional production for export of deeply localized automotive engineering.

The automotive market generated global brands, but at this unbalanced the financial.

The main directions of development of export, for approval of Rustam Abulmambet are concentration of production on the domestic platforms, the supply of domestic components in the supply chain of the global OEMs, the conclusion of agreements on free trade target markets. The potential of export to the year 2020 is estimated at size of 200 to 300 thousand units of motor vehicles annually.

If we consider contract Assembly here R&D owned by a foreign manufacturer and only he can make changes to design, implement nomination of acquisitions, transfer of ownership, license, and manage value-added

Only the actions of the state support exports and the implementation of all previously taken on commitments will create incentives for recovery of the industry.

Electric vehicles and drones threaten to attack

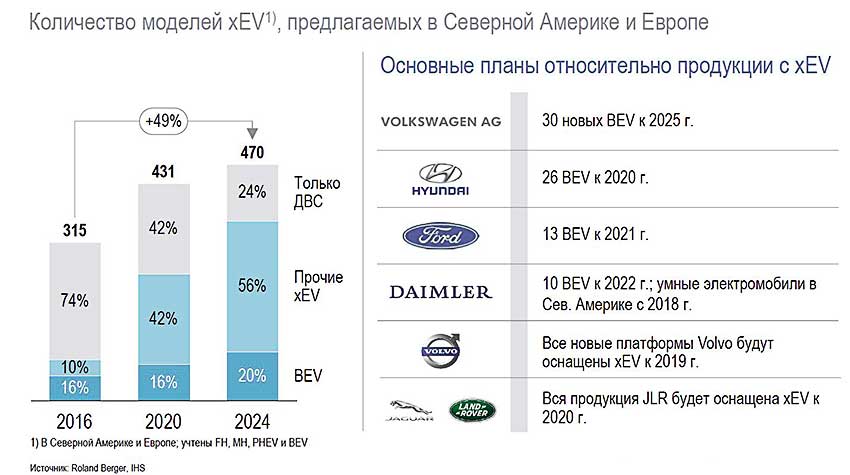

According to the head of Department, the rapid change of technology brings the emergence of new markets. Global trends in the automotive industry caused the development of electric vehicles, Autonomous driving and connected cars. At the same time the development of digital technologies, artificial intelligence systems, strengthening environmental requirements, customization – create demand for products with a fundamentally new properties. Don't accidentally on entering the market of electric vehicles said the largest automakers: Toyota, Volkswagen, GM, Ford, Renault-Nissan, BMW and Mercedes-Benz. For example, Ford plans to 2020 to increase the share of electric vehicles in the total production up to 40%.

A prototype of the drone on the Ford Fusion Hybrid 2017 years

In the United States and the EU emergency braking systems and collision warning will be required to installed on all new cars to 2018-2019, by the Way, the U.S. plans to invest about $4 billion for 10 years support the development of self-driving cars. On this background, not taking energetic action, Russia will become a platform for Assembly of obsolete models.

The main goal for the national automobile industry should be – the appreciation of the Russian manufacturers 80-85% of the domestic demand for modern automotive equipment without state financial support and supply 12-14% of cars produced for export. A main purpose: the reorientation of state support measures with a view to the development of the market of new technologies.

By 2020, state support measures will be focused on: the development of national scientific and engineering competencies, the promotion of a car or its elements with fundamentally new properties, the development of Autonomous driving, the introduction of vehicle telematics, development of engineering infrastructure.

Toyota Prius with Russian self-driving car system development Yandex

The current volume of state support will create the necessary motivation for the improvement of the industry, and reorientation of support on the development of new technologies – will bring Russia's auto industry on a new level. Along with so, for the development of new types of transport necessary to meet the demand, production, operation capability and safety.

According to experts, in the next 15 years there will be a change of leaders on the automobile market. The level of technological development of Russia allows counting on success in an leadership in the market. For this we need to do the following steps.

1. To create a consortium in the field electrical, drone, connected transportation – the organizational form, key products, conditions of participation of the state, conditions of participation business.

2. To form a legal framework in the form of legal form, development of R & d, technology development, creation of standards.

3. Government support measures should provide: demand generation, support, R & d, the possibility of exploitation PPO, security.

Naturally, measures of state regulation should be based on international experience in combined with existing conditions and financial capabilities.

It is planned in 2020 to establish system control and artificial intelligence positioning system

In 2022: to create an open digital platform design and certification BPTC/EV technical vision, traction battery module/power electric cars.

2025 is planned the introduction of mechatronics, microclimate/machine interface, modular (electric) platforms.

Bid on revolution

The revolutionary trends in the automotive industry – impact on the automotive industry in his speech highlighted the representative, the Principal, Russia and the CIS firm "Roland Berger" ("Roland Berger Strategy Consultants") Edward Cherkin.

Relevant today are the global trends in the automotive industry: implications for revolution in automotive, the main breakthrough trends, the most prepared markets for to achieve a breakthrough.

Many industries, according to the reporter's opinion, become focused on customers and increased the efficiency after the reduction of technological and legal barriers. Among them: rent, advertising, music, photography. All these breakthroughs were developed almost equally and significantly reduced the "problem" of the industry.

The "problem" from the car was taken more than 100 years, the industry has been successful even providing some damage for companies. In this regard, we can mention the following aspects.

Very low utilization of private vehicles: personal vehicle in average use is 60 minutes in day, i.e. less than 5% of the time in the day

Deaths in road accidents: each year nearly 1.3 million people die in road accidents, accounting for 2.2% of total mortality in the world, and about 20-50 million people get injured or become disabled.

Traffic jams on the roads: drivers all over the world are in traffic jams more than 10 billion hours a year, which is about 10% of the time for the wheel.

Emissions: on the vehicles have more than 5500 million tonnes of CO2 emissions, or 17% of total emissions of CO2.

The costs associated with these costs are expressed in more than 100 billion dollars in damage due to traffic jams, more than $500 billion in damages due to an accident, additional damage due to emissions of CO2 (invaluable).

Looking in the future include the following: a number of trends will affect the automotive industry in the short and long term. We are talking about the customers, OEM, competition, supply chains, technology, law, capital markets/Finance. In each of them observed their tendencies, which must be carefully considered.

According to Edward Cherkin, today there is rapid development of the four disruptive Megatrends in the automotive industry.

1. Mobility: the future of passenger and freight transportation.

2. Digitalization: Analytics on Big data, connectivity and AI

3. Autonomous driving: replacement drivers for cost reduction and growth security.

4. Electrification: hybrid and electric powerplants, batteries and actuators.

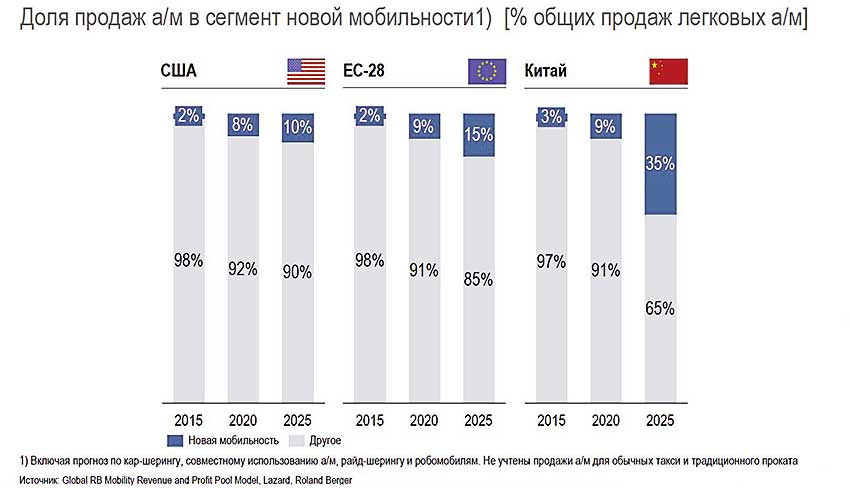

Sharing a car will evolve rapidly, attracting large capital and increasing its capitalization.

Car sales in the segment of new mobility to 2025 will exceed 10% of the total sales of new cars in USA the EU. It is expected that sales of vehicles with new mobility will grow to 2025 year from: new principles in the field of car ownership, increasing urbanization, improvements in technology and business models mobility.

Its role in these processes will play a breakthrough capacity of China is higher because of the relatively low number of cars (1 car for 7 people against 1 car per 2 residents in the EU and 1 car 1,25 residents in USA).

After 2025 years the emergence of robomobile may significantly increase the proportion of sales of cars with a new mobility.

According to experts, the new mobility is also in a key differentiator in the logistics industry. In as evidence, we cite examples of innovation opportunities in the transport and delivery of goods.

In the field of long-distance transport it should be noted that Uber has purchased Otto for $650 million in 2016 (for unmanned vehicles), and model Freightliner classic Truck from Daimler AG admitted to self-driving car on public roads.

In the delivery at the air Matternet launches in Switzerland the delivery of goods by using unmanned drones, while Amazon applied for the patent associated with the center of execution of orders and delivery of goods unmanned drones ("beehive").

Not far behind, and ground shipping. So Starship and Marble developed Autonomous robots for delivery of goods, and Postmates and Yelp Eat24, together with food delivery services plan to expand the business on related field (medicine, parcels and t D.).

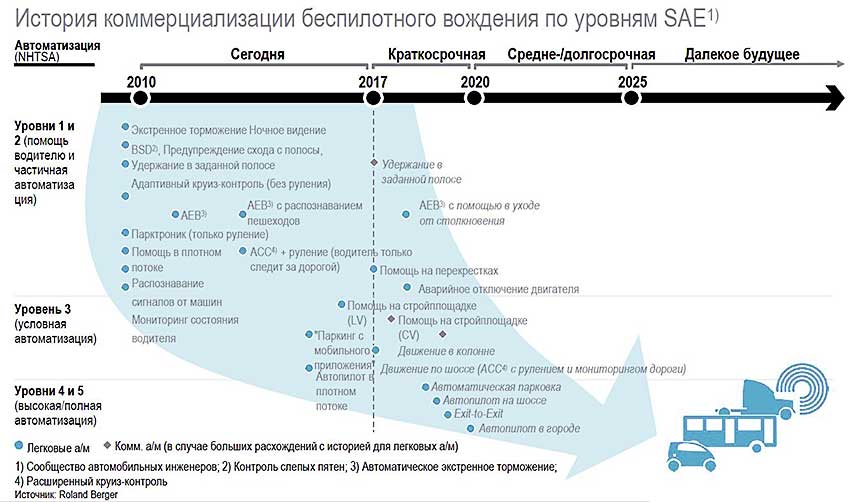

Unmanned driving rapidly embodied in life and new players and Autonomous vehicles are already a reality.

At the same time, the future penetration of unmanned vehicles depends on the overcoming of barriers and the development of mobility.

While unmanned driving is important the degree of penetration (levels 4 5 SAE). In this case considers two development scenarios. Breakthrough/optimistic scenario. It includes shares which can be spread by high popularity of sharing services, high penetration of unmanned vehicles in share the services of premium passenger cars and the mass segments, unmanned vehicles for sharing under the name "robotaxi" (RoboCabs) provide mobile services at the request of physical and legal entities, the active use of unmanned vehicles for sharing, significantly reducing costs.

A slightly different picture emerges when a pessimistic scenario. Distributed mobility develops only innovators in big cities, the penetration of unmanned vehicles affected in the main premium flagship model, the continued use of the drivers making the most of the business models of sharing untenable.

According to Edward Cercena a number of countries has lowered the barriers for testing of unmanned vehicles and prepared laws for their launch.

In Singapore, trials are allowed in August 2014 year the business Park One-North, a national Ministry of land use and transport is developing a technical platform to run monitoring of research by unmanned driving.

In Germany Yes, part of the public highway in the vicinity of Munich dedicated to testing drones in may 2015. In addition, the master plan for the adoption of relevant laws published in September 2017.

In turn, the UK first introduced a liability insurance for drivers of unmanned vehicles insurers take on responsibility accident participation of unmanned vehicles.

There is no doubt that in the future the number of connected cars will increase; an incentive for new business models and technologies will become digitalisation. Growth drivers here would be: increased security (e-challenge), infotainment (entertainment, information, navigation), advanced HMI (speech recognition), the integration of virtual personal assistants update "over the air", a new offering from manufacturers, new business models, Autonomous driving.

Interesting examples of regulation on local and regional levels.

Western Europe. "The ultra low emission zone" in London 2020, it will be a daily charge penalties for cars high levels of emissions, Paris plans to ban all diesel vehicles to 2020, Athens and Madrid to ban all diesel cars to 2025.

China: the government of Beijing wants to electrify all taxi (70,000 vehicles) in combat air pollution; in Shenzhen all taxis and buses must be electrified in the next 5 years, and in Taiyuan entire fleet of taxis and buses that have already been translated into electricity.

Germany: municipalities of Munich and Stuttgart are considering a complete ban of diesel vehicles in the city, and a number of politicians and leading automobile manufacturers lobbying for a software update 5.3 million diesel models in lieu of an outright ban of such machines.

Considerable progress to the speaker, there has also been in the field of commercial vehicles. For example, in the field of utility transport given permission to replace the entire German car fleet. Concern Ford will increase the annual production with 150 machines (series StreetScooter Work XL) in 2017 up to 2500 units by the end of 2018.

Other global companies are already ready to buy elektroorgana.

In the field of main transportation: Cummins unveiled plans for launch of 2019 production electric truck class 7 (GVW up to 15 t) to 300 miles (483 km).

Tractor from Tesla today can travel 200-300 miles (322-483 km) without driver.

Daimler will become the first manufacturer to supply electrogrooving their customers (UPS).

In the passenger transport sector: BMW has invested $55 million in Proterra, the electric bus for North America. Recently passed its tests on a plot of 1100 miles (1770 km). Firm Proterra is on 60% market share of public buses in North America. In USA already operates more than 400 buses.

In other segments: received 200 orders electrogrooving from UPS, 5500 orders from companies housing truck rental; one of five finalists among the next-generation trucks to USPS; development of a system of delivery drones on the base of the truck.

I must say that the level of electrification in Europe depends on goals emissions of CO2 – market share ranges between 20 and 32% 2025.

Recent developments indicate the acceleration of breakthrough trends the 4 Megatrends in the automotive industry.

1. New business models in mobility will change the way car ownership, personal mobility and logistics of goods.

2. The terms of achievement of levels 4 5 unmanned vehicles becoming closer in with the development of economy, legislation and technologies.

3. In the field of digitization artificial intelligence opens up almost endless possibilities due to the fact that technology on the basis of connectivity already logged in use

4. The major stimulus for electrification among automakers is the growing regulatory pressure and accelerated technology development.

In line with the development of automobile industry

On the main directions of the activities of NP "Association of automakers of Russia" (NP "oar") on 2018-2020 stopped its Executive Director Igor Korovkin.

According to the reporter activity (NP oar) focuses on the following directions.

Implementation of the road map "strategy of development of motor industry of Russia for the period up to 2015".

The expansion of the market of Russian-made automobiles and update the vehicle fleet.

The implementation of the "strategy of development of export of automotive industry products" (decree of the RF Government dated 31.08.2017, No. 1877р) and Agreement between the UAR and REC on cooperation in the expansion of exports of automotive vehicles from 17.11.2017, No. 1457-2017,

The establishment of an Autonomous (unmanned) vehicles, the implementation of the roadmap "Avtonet 2.0" the National technology initiative.

Create electrifying wheeled vehicles.

The development of production of innovative products of the automotive industry in the Russian Federation.

Information support development of the automotive industry; international cooperation.

To protect the market from the illegal import and circulation of counterfeit and falsified products the automotive industry.

Professional qualifications in the automotive industry, creating a system of certification of personnel on compliance with professional standards of the industry.

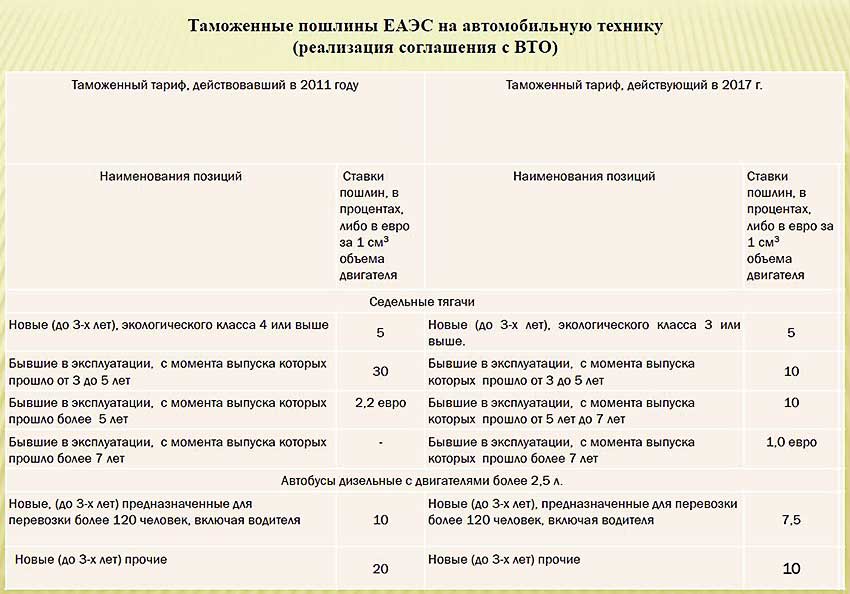

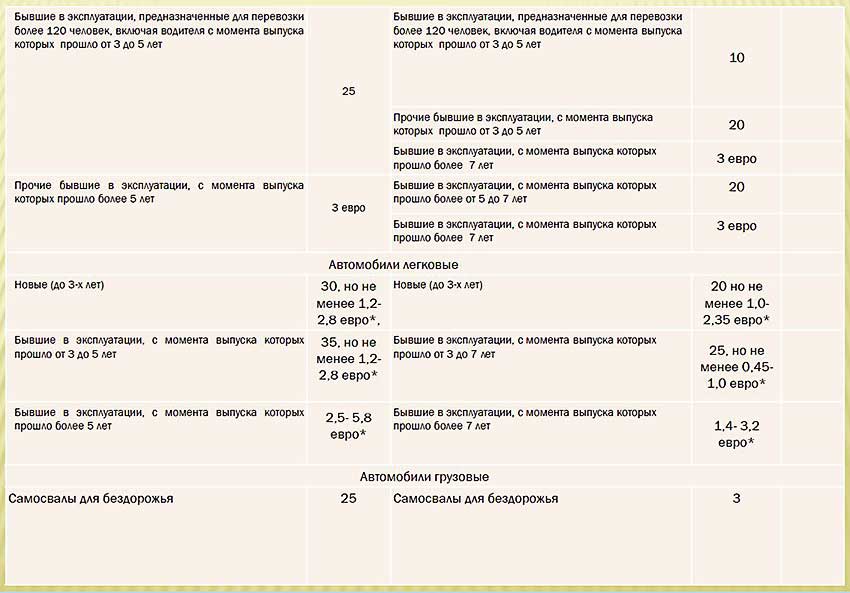

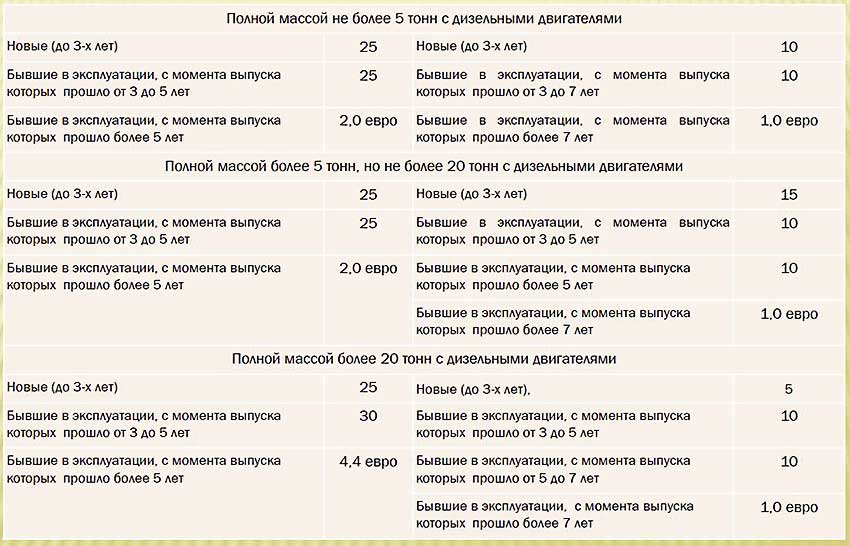

Then Igor Korovkin has informed about duties of the EAEC in automotive equipment in the implementation plan of the agreement with the WTO. In particular, was the comparison of the tariffs in force in 2011 to Russia's accession in WTO and the tariffs of 2017.

Attention was paid to the quality management system of the enterprises-suppliers of the automotive industry. We are talking about the International system of voluntary certification of quality management systems of enterprises-suppliers of the automotive industry ISO/TS 16949 V 2002. Among automobile manufacturers this standard is adopted: BMW, DAIMLER AG, FIAT, FORD, GENERAL MOTORS, PSA PEUGEOT-CITROEN, RENAULT, VOLKSWAGEN.

Associations: l ANFIA (Italy), l AIAG (USA), la FIEV (France), le SMMT (England), le VDA (Germany).

In the Russian Federation is the evolution of the system of voluntary certification of the quality management organizations of the automotive industry with the following chronology.

2002: GOST R 51814.1 (ISO/TS-16949:2002.).

2003: Gosstandard of Russia was "a System of voluntary certification of quality management of the enterprises-suppliers of the automotive industry" in compliance with standard GOST R 51814.1 (ISO/TS-16949:2002.).

2009: GOST R 51814.1 (ISO/TS 16949-2002.) → GOST R ISO/TU 16949-2009.

2017: the Abolition of the international standard ISO/TU 16949 and accordingly, the GOST R ISO/TU 16949-2009 in connection with the approval of the standard IATF 16949-201.

2017: the Council approved the SAR is comparable to standard IATF 16949-2016 standard Partnership ST SAR 3. 16950-2017. "The quality management system. Requirements organizations in the automobile industry". Introduced in action November 1, 2017.

The project developed a System of voluntary certification of quality management automotive industry.

System goals: confirmation of compliance of the quality management system requirements established in ST UAR 3.16950 in the documents developed in the framework of the system of voluntary certification of organizations in the automotive industry; confirmation of the stated organizations of the opportunities to consistently produce products (or provide services) of the planned quality established specific contracts (contracts) terms and also provide continuous quality improvement; creation of confidence in the consumers the acquisition by them of goods (services), the quality corresponds to the established requirements; continuous improvement of production efficiency.

As told Igor Korovkin, the following is the decision of the Council:

1. To consider expedient creation in the structure of the Partnership System of voluntary certification of quality management systems of organizations of the automotive industry (hereinafter System).

2. Approve with based on the comments and proposals:

The rules of functioning of system of voluntary certification of quality management systems of the organization of the automotive industry.

Regulation on the Mark of conformity of system of voluntary certification of quality management systems of organizations in the automotive industry.

3. Executive Director I. A. Korovkin to register the system in the legislation of the Russian Federation.

4. To introduce the System in action the date of registration.

5. To recommend to the members of the Partnership and also other OEM at the procurement of automotive components and content of Russian companies, the assessment of quality management systems of companies to carry out on the standard of ST SAR 3.16950-2017.

What lies ahead

The main directions of development of the automotive industry in 2018 were the subject of the speech of the head of sectors of the economy Analytical centre under the Government of the Russian Federation George Mikryukova.

According to him, the development of automobile industry in 2018 will depend on a number of trends.

1. The market will continue growth at the expense of macroeconomic factors and of the adaptation of consumers to the new price level.

2. The main driver of the market will demand in the regions.

3. The volume of state support of the industry will remain on the current level, but growth of its efficiency requires new tools.

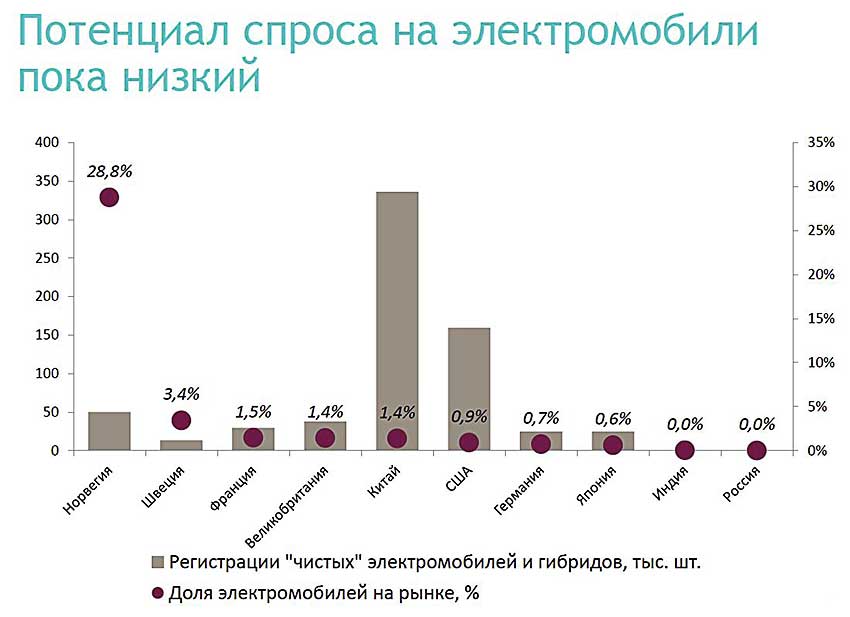

4. Development of electric transport without state support is impossible. The volume of demand for the electric vehicles is minimal.

5. The vector of development of the industry is still not defined.

Attention was paid to dynamics and forecast of domestic market and production of cars. The evaluation 2017 our country will be registered 1.45 million vehicles produced 1.3 million units. According to the forecast in 2018, the same indicators respectively of 1.6 million and 1.45 million

The speaker noted that the contribution of the Moscow market decreases as 16% 2016 and 14.6% in 2017. The volume of state support of car industry the industry in 2017 will make 137,4 billion.

Was the data on the areas of support industry in 2016 and 2017 Preferential loans and leasing (including compensation of lost income for loans issued in 2009-2010, 2013-2015 and 2015-2017) in 2016 amounted to 13.9 billion rubles, and on November 1, 2017 year of 24.8 billion rubles.

Grants of Russian organizations on compensation of part of expenses in connection with the production of wheeled vehicles in 2016 amounted to 28.8 billion rubles, and on November 1, 2017 year RUB 17.5 billion.

Subsidies for Russian producers to support the warranty on wheeled vehicles, the relevant standards Euro-4 and Euro-5 in 2016 amounted to 36.6 billion rubles, and on November 1, 2017 year of 60.2 billion rubles.

Subsidies to Russian organisations of motor industry on the contents of jobs, payments for loans and compensation of part of expenses in connection with the production of wheeled vehicles 2016 amounted to 44.2 billion rubles, and on November 1, 2017 of the year to 30.8 billion rubles.

Other subsidies amounted to 6.2 billion rubles, and on November 1, 2017 year of 4.1 billion rubles.

Just in 2016, the auto industry got on its development of 129.7 billion rubles, and on November 1, 2017 year – 137,4 billion.

George Mikryukov noticed that the potential demand for electric cars at us in the country is still low. It is much less than in countries such as USA, UK, France. Sweden, Norway, China, Germany, Japan, India and others.

Rustam Abulmambet

Edward Cherkin

Igor Korovkin

George Mikryukov

.

|

|

|