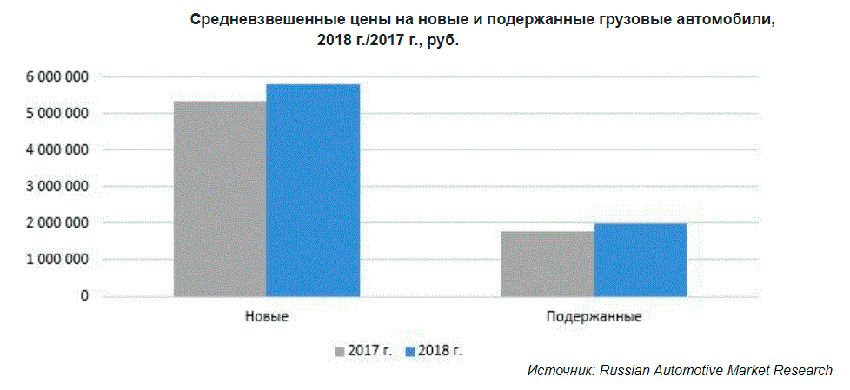

In 2018, has increased the weighted average prices of both new and used trucks

New trucks went up in 2018, 8.5%, and is used by 6%

According RAMR in 2018, the average prices for new trucks grew by 8.4% compared with the 2017 year and amounted to ₽5 million 795,1 thousand, Respectively, of weighted average prices of used trucks increased by 11.9% to 1 million 990,8 thousand

Capacity of market of new trucks in 2018 amounted to ₽472 billion 416 million, which is 11.5% more than in 2017. the Capacity of the secondary truck market in 2018 also increased by 6.3% to ₽522 billion 311,9 million

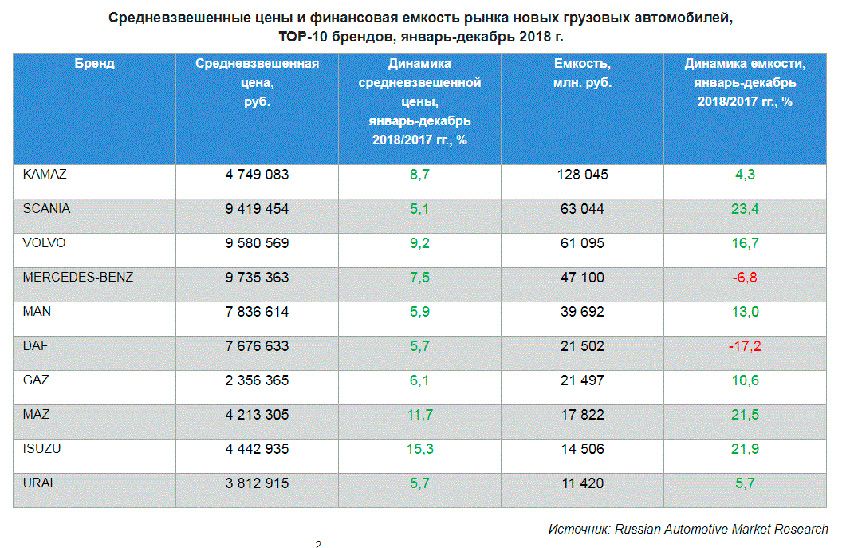

the Market of new trucks

In 2018, with the highest increase in average price among the Top 10 брендов1 showed Isuzu (+15.3%) and MAZ (+11,7%).

Among the Top 10 brands of trucks in terms of financial capacity leader in 2018 became the KAMAZ with ₽128 billion 45 million, with the growth of market capacity of this brand was 4.3%. Brands-cars Mercedes-Benz and DAF went negative on financial capacity (-6,8% and -17,2%, respectively) that is associated with a drop in sales of new trucks of these brands more than 13%.

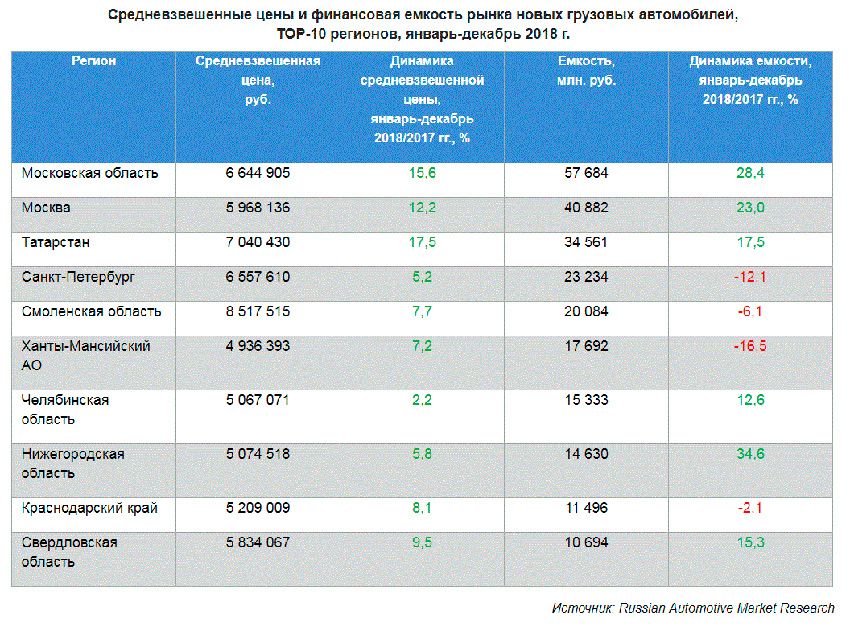

By the end of 2018, among the Top 10 regions with the highest increase in average prices on the new trucks was recorded in the Republic of Tatarstan (+17,5%).

A leader in the market among the Russian regions is Moscow oblast. In January-December 2018 in this region were sold at ₽57 billion 684 million new trucks. The capacity of the markets of Moscow and Tatarstan, which are also included in the top three in this indicator is ₽40 billion 882 million and ₽34 billion 561 million, respectively.

Dynamics of the Top 10 regional markets in terms of financial capacity during the reporting period was positive, with the exception of four regions – St. Petersburg (-12,1%), Smolensk region (-6,1%), Khanty-Mansiysk Autonomous Okrug (is 16,5%) and Krasnodar Krai (of-2.1%). The reduction in financial results in these regions due to the decline in sales of new trucks more than 9%.

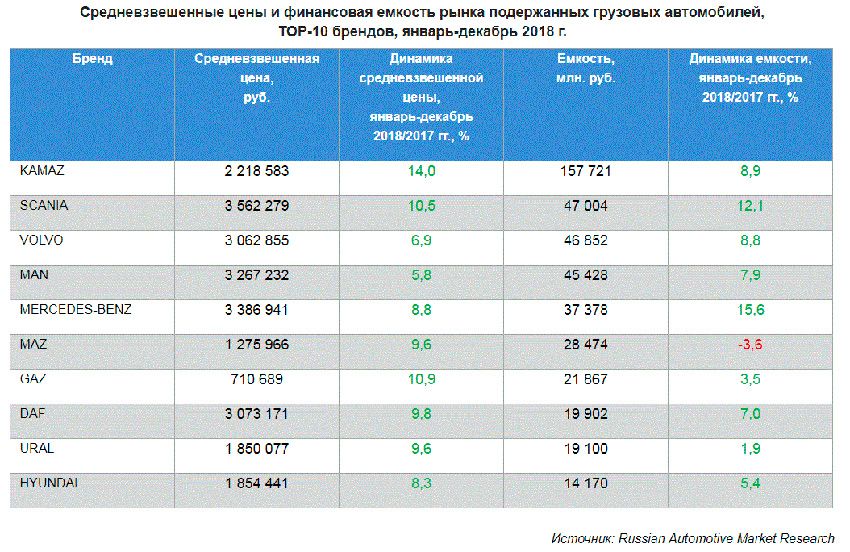

the Market for used trucks

By the end of 2018 all the brands from the Top 10 also showed an increase of the average prices.

Among the Top 10 brands with the greatest capacity market in 2018 was noted at KAMAZ – ₽157 billion 721 million, with the growth of market capacity of this brand was 8.9%. Also in the top three in this indicator was included Scania and Volvo, the growth of market capacity of which amounted to 12.1% and 8.8%, respectively.

Financial results sales of Belarusian MAZ, on the contrary, has decreased, which is associated with a significant decrease in demand for this grade of used trucks (-12,1%).

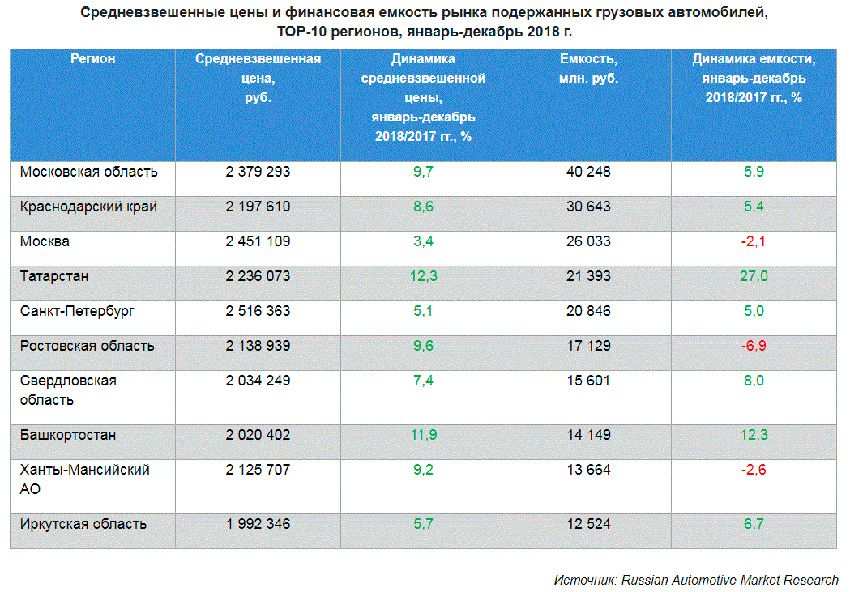

the highest average price for used trucks among the Top 10 regions recorded in Saint-Petersburg (₽2 million 516,4 million), Moscow (₽2 million 451,1 thousand) and Moscow region (₽2 million of 379.3 million).

A leader in the market of used trucks among Russian regions also remains Moscow oblast. In the region in 2018 were sold at ₽40 billion 248 million used trucks. The capacity of the markets of Krasnodar Krai and Moscow, also included in the top three in this indicator is ₽30 billion 643 million and ₽26 billion 33 million, respectively.

The negative trend of the capacity in individual regional markets amid rising average prices due to the decline in sales of used trucks by more than 5% in these regions..

|

|

|