The market for new trailers and semi-trailers in Russia held 2018 confidently

Market trailers showed an increase of 22%

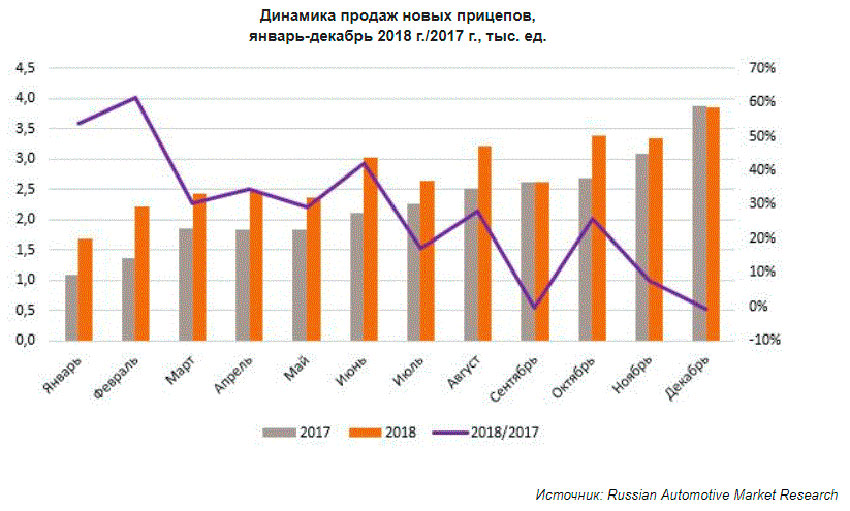

According RAMR Russian market a new trailer in December showed a negative trend of 0.5% (the strongest decline since the beginning of the year) to 3.85 million, while absolute sales were the highest since the beginning of the year, worthy of bestowing the annual results.

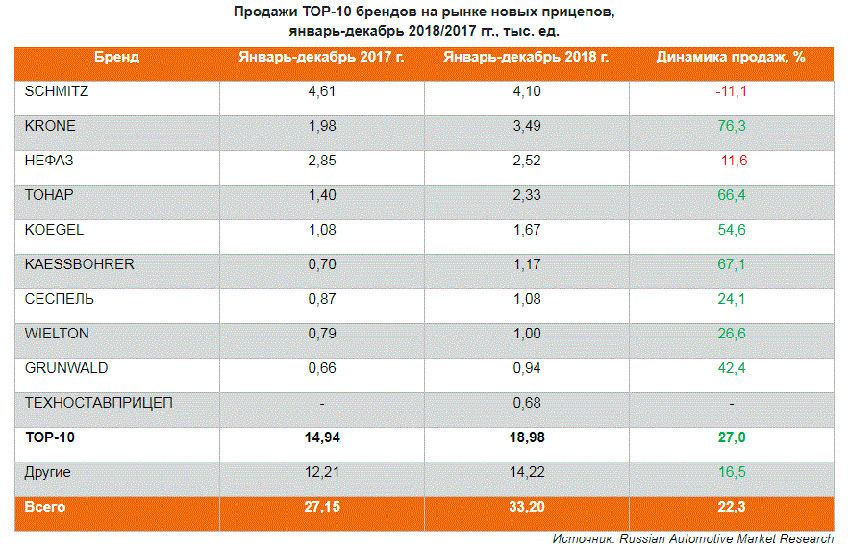

Among the producers in December were leading German brand Schmitz with sales of 0.5 million, albeit with considerable reduction in sales (-25,4%) compared to the same period of 2017. In second place is also German brand KRONE 0.37 million (+32.1 per cent), and the third is a domestic NefAZ with 0.26 million (-13,3 million). On 4-th place – TONAR with 0.26 million (+13%), rounded out the top five SESPEL ' from 0.18 million (+28.6 per cent). The top 10 took in the last month of the year share at 56.1% against 58.9 per cent over the same period last year.

For the full 2018 sales growth of trailers compared with the 2017 year was 22.3%, to 33.2 thousand

Sales leader in the market of new trailer brand Schmitz in 2018 amounted to 4.1 thousand, which is 11.1% less than its result in 2017. But, runner-up German KRONE brand showed the biggest increase in sales at the end of 2018 – by 76.3% to 3.49 million, while year-end could not resist even in the Top 5 brands. The drop in sales was in the domestic brand NefAZ (negative 11.6%) to 2.52 thousand In fourth place also domestic brand TONAR with +66,4% to 2.33 thousand rounded out the Top 5 brands of trailers German Koëgel with +54.6 percent to 1.67 million In the overall Top 10 brands ranked 57,2% market share of new trailers against 55% a year earlier due to the increase of sales of the first "tens" of 27%. Other manufacturers grew in 2018 only 16.5%.

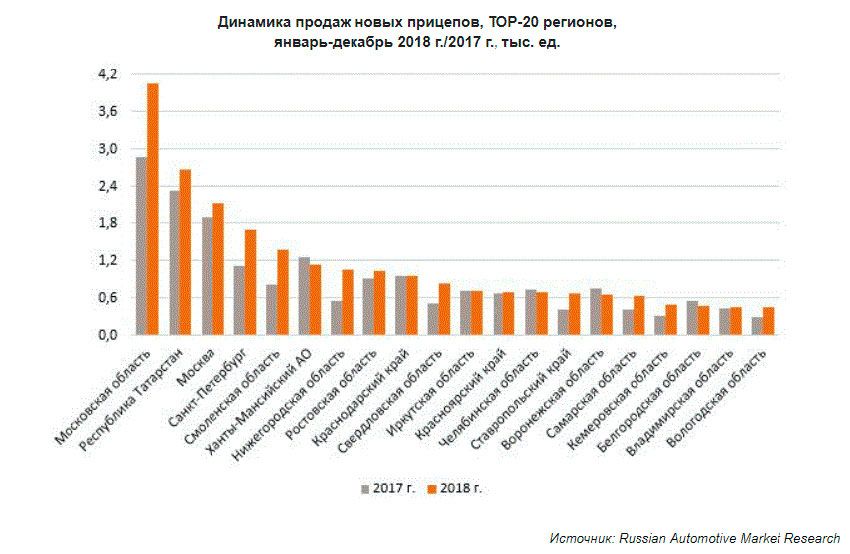

The largest increase (in particular in absolute terms) of the sales were in 2018 in Moscow region, on the second place – the Republic of Tatarstan, and on the third – Moscow. Next come St. Petersburg and Smolensk oblast. Rounded out the Top-20 of the Vologda region, although with relatively good growth. Negative dynamics in the Top 20 regions were observed only in the Khanty-Mansi Autonomous Okrug and in the Voronezh and Belgorod regions.

|

|

|