Alexander Klimov, photo of the author with BUSWORLD-2018

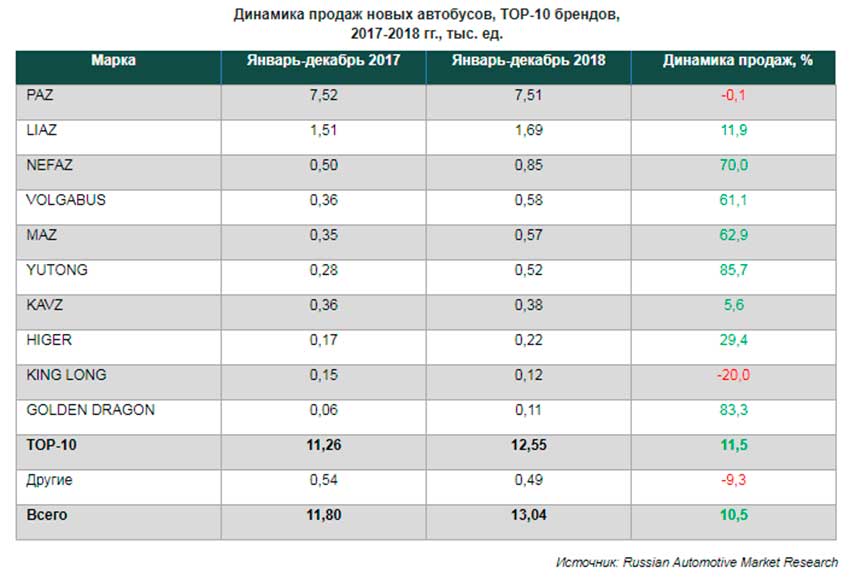

According RAMR in 2018 the Russian new bus market grew by 10.5% to 13,04 thousand due to the extensive public programs of the procurement, including to the soccer world Cup. Although the data of the last quarter was also positive both in terms of physical sales, and in relation to the previous year, despite ending the season.

Share market leader – Pavlovsky bus plant amounted at the end of 2018 57.6 per cent, while sales of new PAZ buses decreased by 0.1% to 7.51 thousand

On the bus BUSWORLD motor show in 2018 showed the most spacious model in the series GAZ VECTOR 8.8 65 seats (23 seats)

Second place in the market for a Model from 1.69 million with a growth of 11.9%, and the third for Nevesom from 0.85 million and a growth of 70%. Was not overawed and coming in 4th place Volgabus with increase of 61.1 per cent to 0.36 thousand

Belarusian MAZ is now considered a foreign car, among whom he became a leader (on the photo the newest articulated bus MAZ-216)

Share market leader – Pavlovsky bus plant amounted at the end of 2018 57.6 per cent, while sales of new PAZ buses decreased by 0.1% to 7.51 thousand Second place in the market for a Model from 1.69 thousand with the growth of 11.9%, and the third for Nevesom from 0.85 million and a growth of 70%. Was not overawed and coming in 4th place Volgabus with increase of 61.1 per cent to 0.36 thousand rounded out the Top 5 brands on the market of new buses, the best brand among foreign cars – Belarusian MAZ from 0.57 thousand cars, which is 62.9% higher than in the same period of 2017.

King Long became the most unlucky Chinese manufacturer in Russia in 2018

Besides brands GROOVE in the considered period, only one brand of Top-10 showed a decline of the Chinese King Long with -20,0% to 0.12 thousand

the Maximum annual increase in the Top 10 showed Yutong with +85.7% to 0.52 per thousand ranked 6th place in the ranking

Buses of other brands outside the Top 10, too, not pulled out – they fell by 9.3 per cent to 0.49 thousand, i.e. the share of the top ten brands accounted for 96,2% vs 95.4% of the previous year.

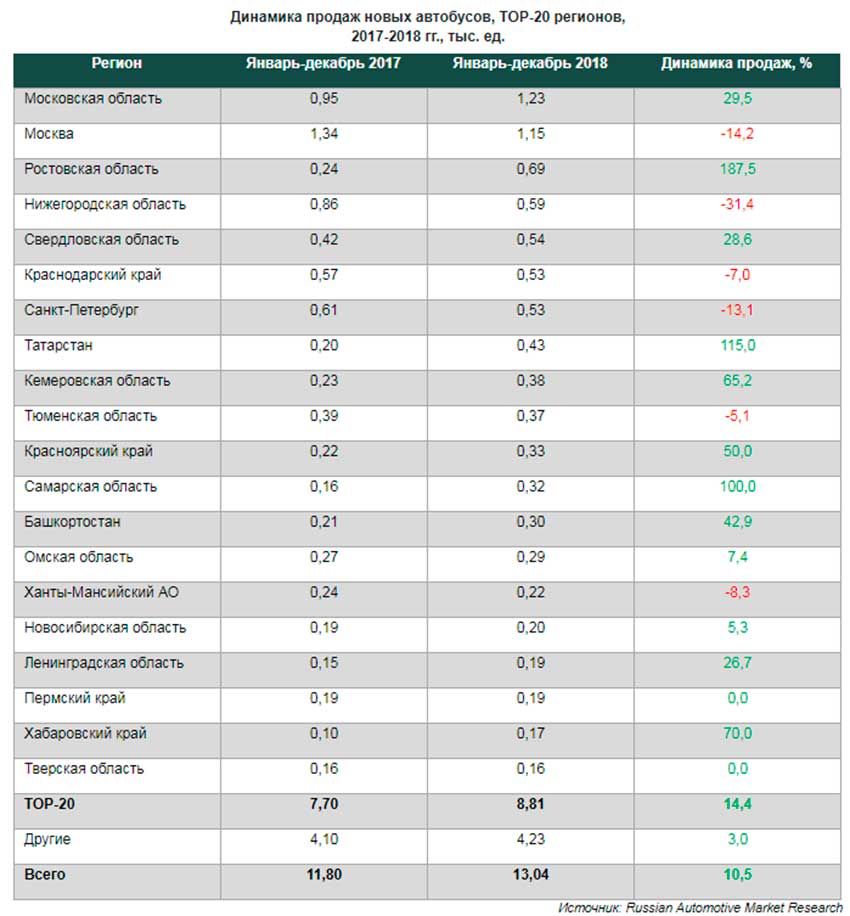

Among the regions for the procurement of new buses was in the lead Moscow oblast from 1.23 thousand and increase by 29.5%. Further, Moscow has purchased only 1,15 thousand of buses of all classes, which is 14.2% less than 2017. In third place was Rostov oblast, thanks to world Cup shell out 0,69 thousand buses (growth of 187,5%). Reaching 4th Nizhny Novgorod oblast, by contrast, experienced a decline by 31.4% to reach 0.59 thousand cars. Top 5 regions locked Sverdlovsk oblast from 0.54 million (+115%).

Among the regions for the procurement of new buses was in the lead Moscow oblast from 1.23 thousand and increase by 29.5%. Further, Moscow has purchased only 1,15 thousand of buses of all classes, which is 14.2% less than 2017. In third place was Rostov oblast, thanks to world Cup shell out 0,69 thousand buses (growth of 187,5%). Reaching 4th Nizhny Novgorod oblast, by contrast, experienced a decline by 31.4% to reach 0.59 thousand cars. Top 5 regions locked Sverdlovsk oblast from 0.54 million (+115%).

The Top 20 regions amounted to 8.1 thousand, or 67.6 per cent, i.e. over one third. All other brands grew 3% to 4.23 thousand

The Top 20 regions amounted to 8.1 thousand, or 67.6 per cent, i.e. over one third. All other brands grew 3% to 4.23 thousand

The bus industry is flashed at last year's BUSWORLD 2018