The bus market rebounded in 2016

On the market of new buses according to the "AUTOSTAT info" in December 2016 has been a real boom

The market of new buses have soared in the end of 2016 years

On the market of new buses in the data, LLC "AUTOSTAT info" in 2016 year has been a real boom – plus of 91.2% (+824 units) to the same month in 2015 year, amounting to 1728 units and to November sales jumped 60,7%! Of course also, Dec was and the fat month for the buses for all 2016 year.

The segment of domestic brands in the last month of the year showed an increase of 91% (+799 units) to 1677 units and the segment of foreign cars grew by 96,2% (+25 units) to 51 units Part saturated with foreign cars brands all same demonstrated growth and and remained the "background" level, but even with a big minus. Just same to the end of the year really operated 16 bus brands (domestic and foreign) to 14 brands, the company informed. At the same time on the share of domestic brands accounted for 97% of the market against 97.1% a year earlier, and the share of foreign brands were up 3% vs. 2.9%, which however, it was typical for the whole year.

Registration of buses on the Russian market for months 2016 years

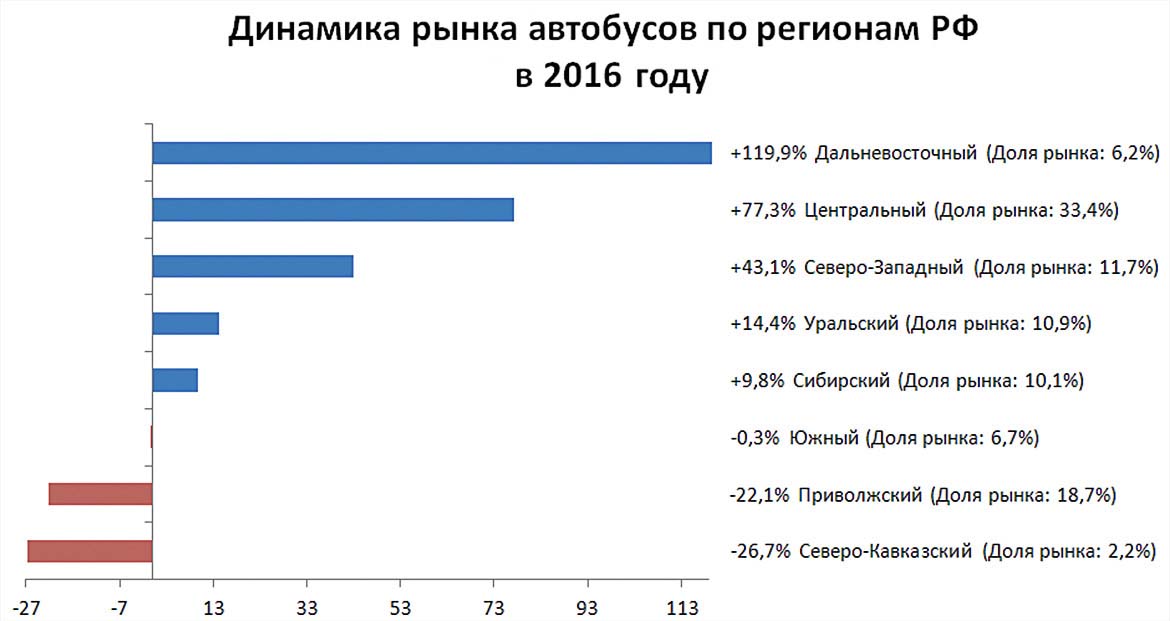

In 2016 year; picture regions remained stable

Most regions on the dynamics of sales in 2016 was in plus, but three and remained the red. So, for the past year the far Eastern Federal district due to the growth in the 2.2 times (market share of 6.2%) of the outsiders moved to the leaders and on the second place was assigned in the Central Federal district with growth and 77.3% (share of 33.4%), respectively, on the third – North‑West Federal district with growth 43,1% (the share is 11.7%). The average establishments – the Ural Federal district (share of 10.9%) and Siberian FD (share of 10.1%) showed an increase, respectively, 14.4% of 9.8%. At southern Federal district (share 6.7 per cent), the decline was minimal, just of -0.3%, and here in the Volga Federal district (share of 18.7%) and have the North Caucasus Federal district (share of 2.2%) is relatively large, respectively, -22,1% and -26,7%.

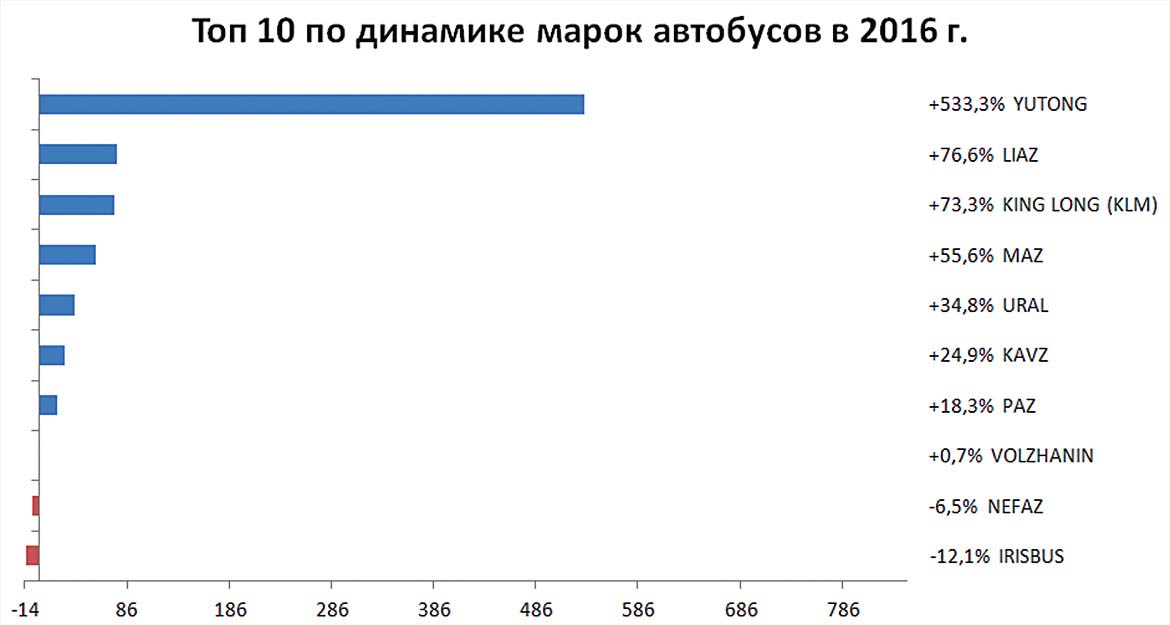

The annual rating of Top‑10 brands at the dynamics headed by Yutong, and the sales — LiAZ

In rating all 2016 the best in dynamics growth and 6.3 times became the Yutong, although just 57 really sold cars. Second place in dynamics in the Features with +76,6% (1845 units). Third place for the King Long (+73,3%, 52 units). At fourth place also on the market MAZ +55,6% (812 units.), the fifth – Ural +34,8% (306 units), followed by KAVZ with +24,9% (366 units), the GROOVE +18,3% (5836 units and their invariable the first place on the market). Leap in the end of the year Volzhanin‑and all the same let him go plus, although small (+0,7%, 275 units). And, here NefAZ in plus not out (-6,5%, 1057 units – 3rd place for sales). Rounded out the Top 10 unexpectedly Irisbus (-12,1%, 51 units). Thus, the Chinese bus brands slowly begin to push off from the bottom, but before the Russian competitors, they still very far away.

In the Top 10 in dynamics models the best growth in 2016 year has shown "good old" MAZ‑103

In 2016 year leader in dynamics became "old" discopolis MAZ‑103 with growth 2,8 times (up to 174 units). On the second place of PAZ‑3204 with +48,1% (961 units.), and on third – PAZ‑3203 with +44,8% (562 units). This is followed by the Central part of Ural‑3255 with +34,8% (306 unit) discopolis LiAZ‑5292 +31,7% (768 units). The leader of sales of PAZ‑3205 (3691 units) with +16,2% only on the 6th place, and city NefAZ‑5299 with+0,7% (603 units) 7 through dynamics 4‑m sales. New LiAZ‑4292 (738 units) so far with zero. PAZ‑4234 went to minus 13,2% (540 units), and shutting Top 10 crew bus NefAZ‑4208 – on 13,7% (295 units).

Moscow took fleet sales

In Moscow in December was implemented 158 machines in 10,5 times higher than in the same month of 2015 year. In their 65 units of LiAZ‑4292, 32 units of the LiAZ‑5292, 30 units of PAZ‑3204 and 14 units of LiAZ‑6213, and 7 units of PAZ‑3205 (an increase in 7 times) and 3 units. Yutong 6119. Other brands and models sold in the same machine. For all 2016 year implementation of the new buses increased nearly 5 times (+394,8%) and amounted to 1524 units the Most popular model was the LiAZ‑5292 (growth to 9.1 compared to 670 units), and also, the new LiAZ‑4292 (277 unit) "accordion" LiAZ‑6213 (126 units). Accordingly, on a brand's share of LiAZ (1088 units) accounted for 70.9% of market versus 53.3% a year earlier. To share Groove (194 units) accounting respectively for 24.1% versus 33.3%, well, and other represented by single machines. So all foreign cars total in 2016 year has sold only 34 units (2.2 percent of the market).

This increase in the implementation of large buses is due to large-scale transfer of municipal routes to private carriers (Avelino and so on.), which has provided fleet procurement urban Lyase. In fact, a single purchase of utilitarian models of the GROOVE for official transport has provided the construction (in including the subway) and road construction company, a single orders imported long-distance liners (mostly Chinese) – mostly sports clubs.

The latest midibus GAS (LiAZ)-4292 fell "to the yard" on the capital's bus market

Peter was held in the"intermediate" all year round

In St. Petersburg December is implemented in 171 machine: 55 units of PAZ‑3203, 45 units of MAZ‑103 and 33 units of PAZ‑3204 and 17 units Volgabus 6271 11 52 units. 701 so on. For all 2016 year sales growth was 58.3%, mainly model PAZ‑3204 (130 units growth 2,4 times).

PAZ‑3204 also offer the gas version

Optimistic results and a good forecast

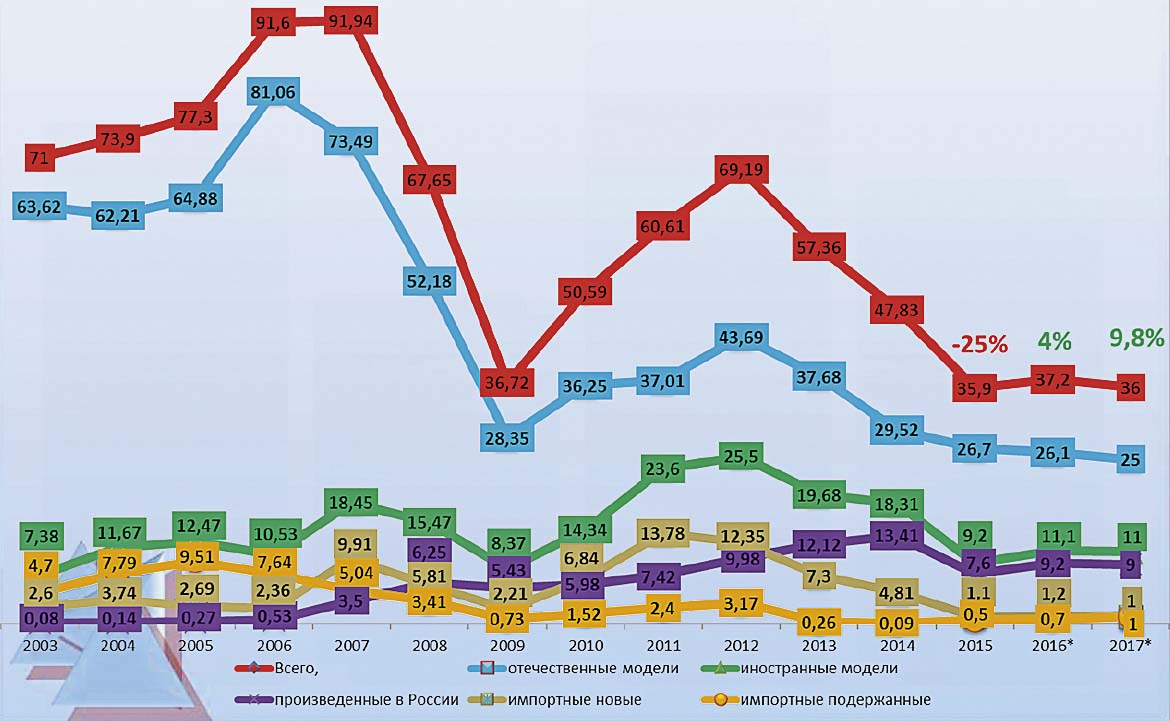

For all 2016 year of the bus segment in General has recovered to 21,4% (+1901 units.) to 10 782 units, with domestic sales of buses grew by 23,8% (+2018 units) to 10 499 units and cars continued decline of 29,3% (-117 units) up to a paltry 283 units that due to a recovery in the second half of the year and especially the already mentioned Dec.

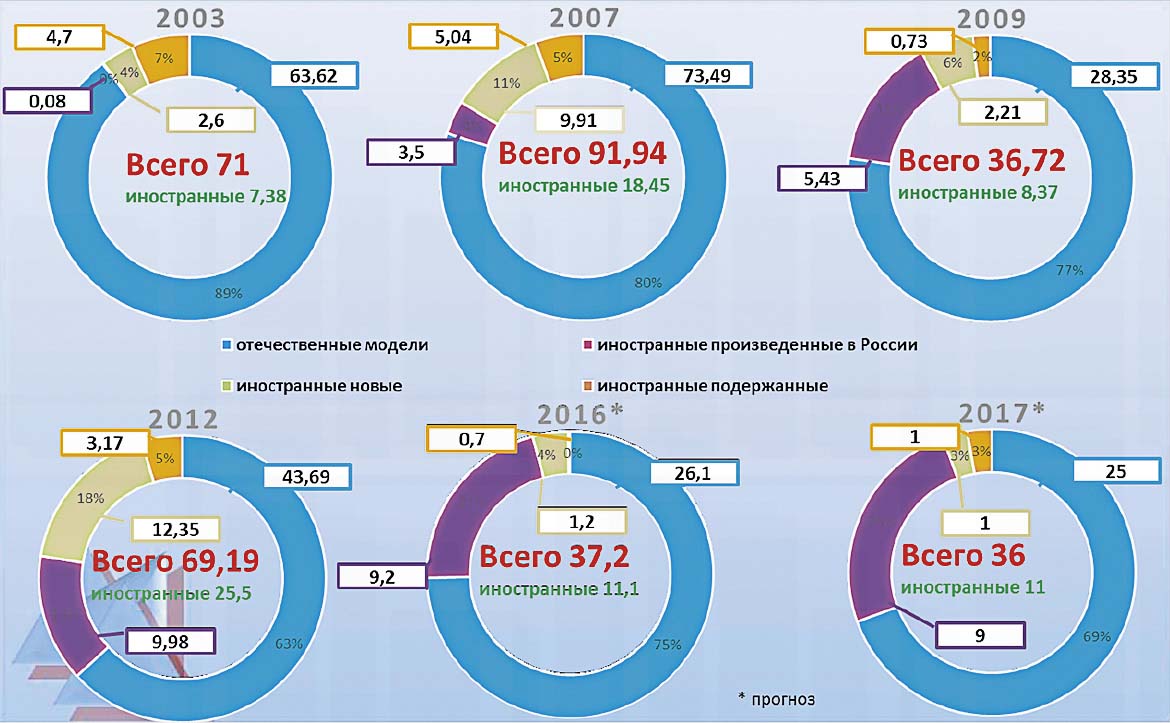

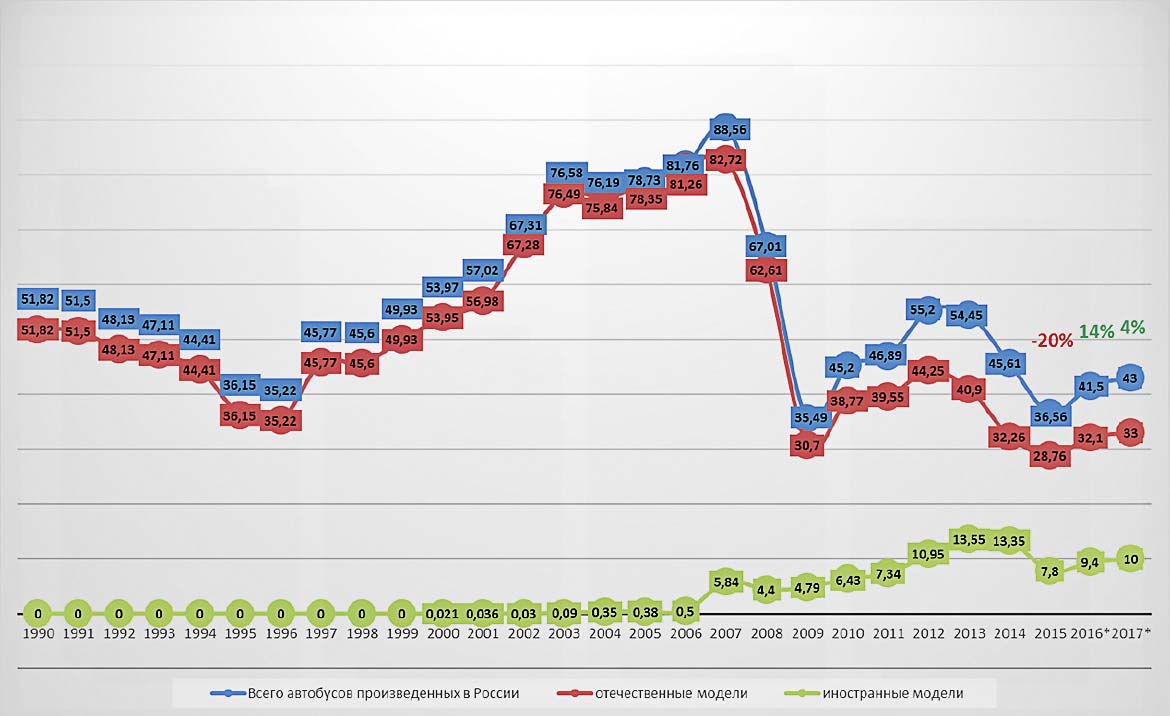

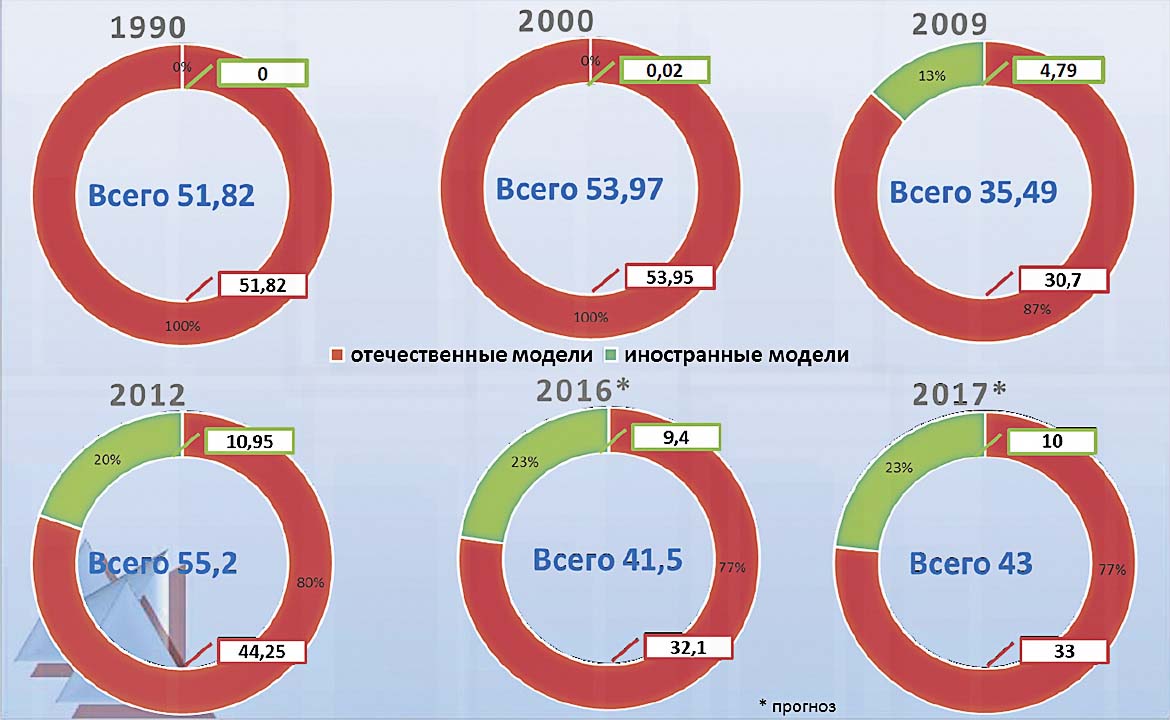

The bus market in Russia 2003-2017

The structure of the bus market in Russia from 2003 to 2017 year

The production of buses in Russia grew by 14% to to 41.5 thousand of which 32,1 thousand domestic and 9,4 thousand of foreign brands. Forecast for 2017 year – a growth of 4% to 43 thousand which 33 thousand domestic and 10 thousand of foreign brands. The sales of buses in 2017 year may be increased on 9,8%.

The production of buses in Russia in 1990-2017 (data of ASM‑holding)

A fundamental role in the resumption of the positive trend in the bus market, including the regions, of course, played a stimulating program, especially import substitution (without the quotes) ban on the acquisition by state agencies of imported buses. Here same should include a large-scale program of updating of Park of wheeled vehicles (for 22.5 billion rubles), the benefits of the acquisition of new rolling stock buses in the framework of the program of gasification (at 3.3 billion), preferential leasing CCC (5 billion), concessional loans (11,3 billion), subsidies for the purchase of city electric transport (1 billion), and also, the block of industrial subsidies (of 80.4 billion), a benefit due of interest on investment loans (7,2 billion) export support (at 3.3 billion). And, although, directly on the bus segment accounted for only a portion of these benefits, but to overestimate their value impossible, especially for the regions. In addition, this segment of the market all the might of its budget was supported by the capital for large-scale program of updating of Park.

Structure of production of buses in Russia with 1990 2017 year (ASM‑holding)

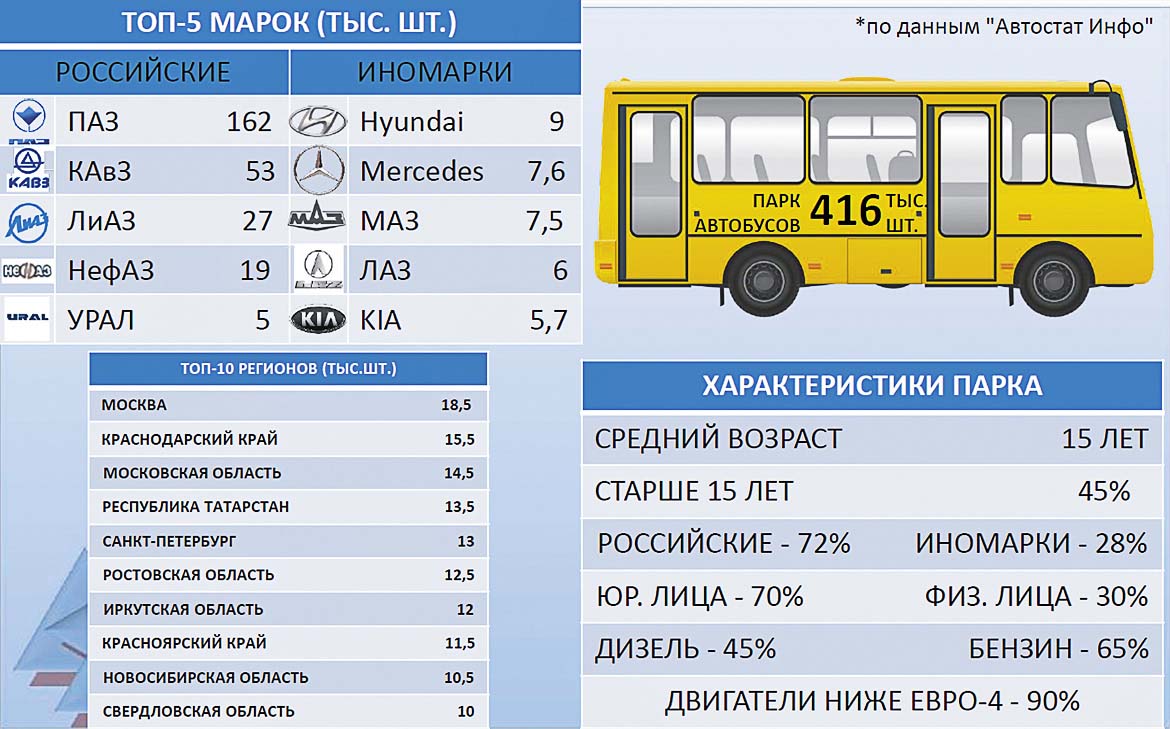

Objectively the market has room to grow, because over 90% of bus fleet equipped with engines below the Euro‑4 and cars older than 15 years it is over 45%. Average same age of buses in the Park is located 15 years.

Buses to the beginning of 2016 was

The year 2016 was crowned the first Russian exhibition BusWorld, held in"Crocus‑Expo"

.

|

|

|