The bus market in 2017 showed ragged dynamics

The market of new buses in 2017 showed growth 10.6% of

The sales of buses on the Russian market for data RAMR made up 11.87 thousand

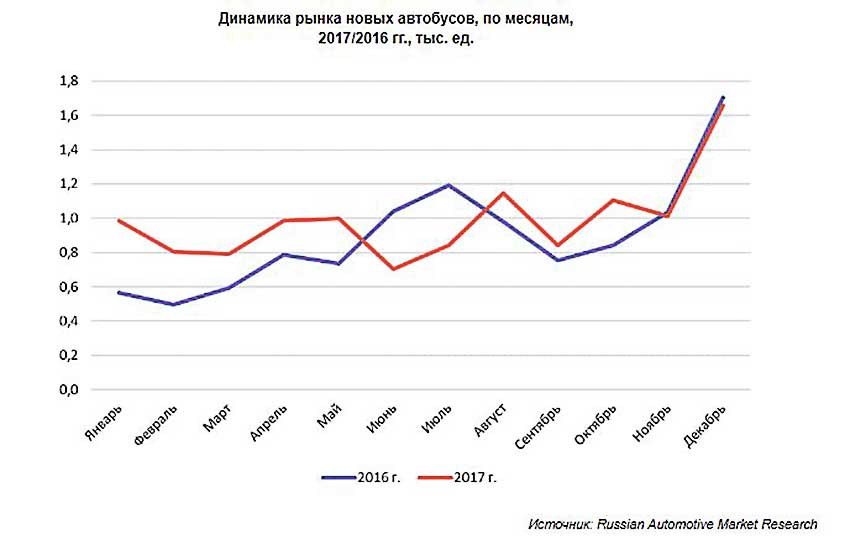

For years the bus market has demonstrated sufficiently "ragged" sales dynamics. So, if January may dynamics were better 2016 year (especially in January, which was 74,8% better – the highest figure in the whole year), then the dynamics started to decline in June-July followed by a sharp decline (symmetric lifting summer 2016), then sales up

as their rate of growth, but end of the year, though, and turned out to be quite fruitful – December demand

as in 2016, significantly exceeded 1.6 million, but dynamics, beginning with November again went into a minus, respectively, on a 2.2 and 2.7 percent.

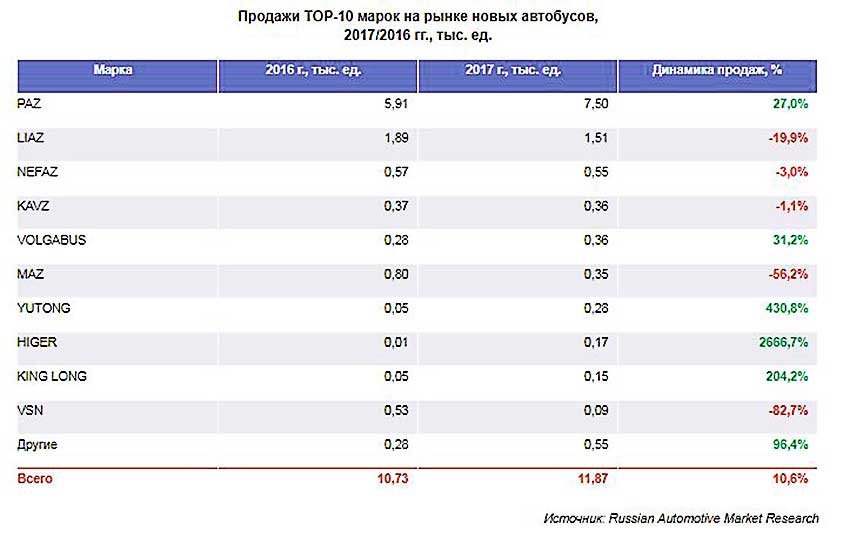

In contrast to the truck market in 2017 the Russian market of buses there was a breakthrough of Chinese brands, which increased sales of their products more than 6 times. In including

because of this, the share of buses of the Russian brands has decreased by 2% and dropped to 88% market share. The decrease in sales was recorded for bus brands LIAZ (-19,9% to 1,51 thousand), NEFAZ (-3% to 0,55 million), KAVZ (-1,1% to 0,36 million), MAZ (-56,2% to 0,35 million) and VSN (-82,7% up to 0,09 million).

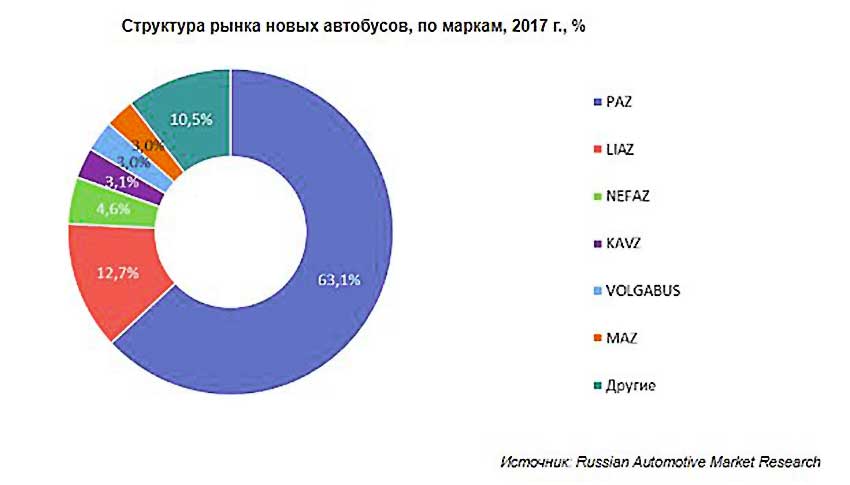

Domestic GROOVE showed an increase of 27% (7.5 thousand) from shares 63,1% of the market and also VOLGABUS – on 31,2% (to 0.36 million) with market share at 4.6 percent.

The basis for the production of Pavlovsk bus plant to still is manufactured with 1989 years small bus PAZ-3205 – "king of the Russian off-road" (pictured restyled model 2015)

Quite rapidly gaining popularity of the newest models of the "Russian buses" –

GAZ Vector NEXT and GAZ Cursor

Updated lineup firm VOLGABUS is progressing very effectively.

(photo of a new suburban model "Marathon")

Other domestic manufacturers also do not stand location, for example, NefAZ showed COMTRANS-2017 airport Shuttle to 110 seats that when the price to ₽ 10 million is to organize provincial airports

On the supply of 300 buses NefAZ-6282 in 2017, a contract was signed with the Metropolitan

GUP "Mosgortrans"

Answer by GAZ Group in the emerging segment of buses was the model LIAZ-6274

the second generation

Among the Top 10 brands on the Russian market of buses the most significant sales growth was shown by Chinese HIGER (an increase in 27 times), YUTONG (an increase in 5.3 times) and KING LONG (growth in 3 times).

A good example of the crossing of the Scandinavian Sino – joint liner Scania Touring on chassis Higer

Flagship vysokoparnym Yutong T122HDH can compete with the European counterparts, but in Russia is still more popular budget model

For Example Yutong 6122 H9

Liner KingLong and the price is cheap and looks good

These European beauties 5-star class as Neoplan Cytiliner of the year year are sold on the Russian market literally by the piece

Have short-haul airliner, the MAN Lion ' s Coach 07 chances for more mass demand much more, although it is not can resist the low cost Chinese counterparts

In recent years, even in cities are becoming more widespread urban buses of small class – setbusy (for example, photo model on the basis of LCV Iveco Daily 70C15)

Or another analog on the same chassis Iveco – FoxBus

Increasingly develops the segment of citybus and AZ GAS

(photo production model GAZelle NEXT Citiline A63 and A65 perspective)

|

|

|