The Russian market of commercial vehicles in 2016

Russian market of commercial vehicles (LCV+MCV+HCV) in 2016 has passed the bottom and started...

At the end of 2016 LCV almost played

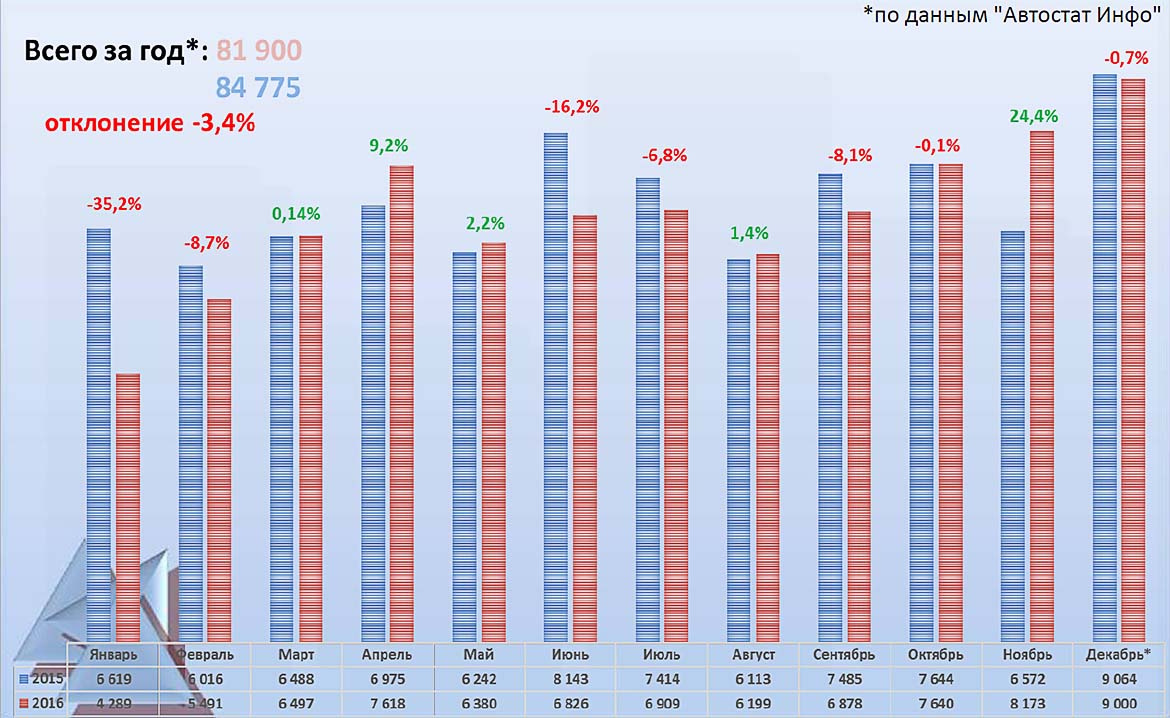

For the full 2016 new LCV market, although did not overcome the overall decline, but due to the rapid December finals caught up to -0.4% (-333 units) to 84 442 units, which had become a serious application for a positive recovery trend. Domestic brand for the 12 months increased sales by 3.4% (+1921 units) to 58 869 that is fundamentally better than a failure 2015. A more significant result for domestic brands has not allowed to pull the UAZ, whose sales in the first half of the year had failed, compounded by the closure of the Kazakhstan market. Hence the annual result Oise remained in the red. But GAS through the model lineup NEXT added to the end of the year of tsmf and the vans went into the lead, almost single-handedly pulling the segment of the domestic LCV a plus.

In the segment of foreign cars LCV by the end of the year, all except the Italians and a couple of Chinese brands went into a plus, although for the year in the red remained and Mercedes-Benz in spite of the Nizhny Novgorod Assembly model of the Sprinter, as well as all the Frenchmen, which began to carry only to the end of the year. The entire year of imported brands more or less actively sought to work on own lending programs, trade-in, fleet sales and comprehensive service. The share of foreign cars on the market for the year 2016 is still reduced from 32.8% to 30.3%.

Registration of LCVs months of 2016.

Cars could pull the market MCV+HCV plus

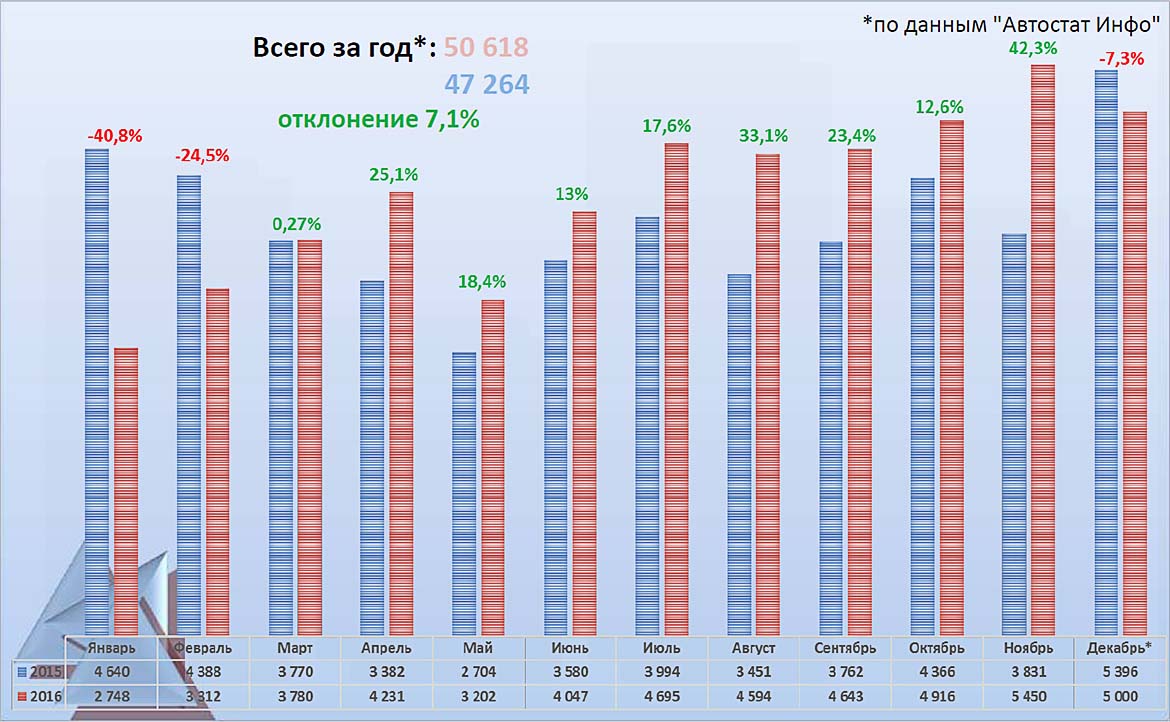

For the full year of 2016, the segment of medium and heavy (MCV+HCV) trucks showed growth due to the successful December at a double-digit figure of 11.1% (+5254 units.) to 52 518 units by 2015, which was just the market just collapsed (-36,9%). So that truck segment has clearly left a positive trend.

The role of the freight cars in the market recovery became undeniable at the end of the year. So, if, the domestic brands in December slowed to 9% (347 units to 4203 units) against 24.5% in November, the cars have shown to 75.1%, against 77.1 per cent in November (1157 units to 2697 units). For a year the Russian producers came to +14,8% (+4518 units) to 35 088 units, but the foreign cars at the expense of December sales came in plus 4.4% (+736 units) to 17 430 units, Respectively, the share of cars in December rose to 39.1% as compared to 28.5% for the same month 2015. For the full year of 2016, the share of foreign cars, however, still dropped to 33.2% versus 35,3% in 2015. the Share of domestic producers, respectively, 64.7 vs 66,8%.

Registration of trucks by months of 2016.

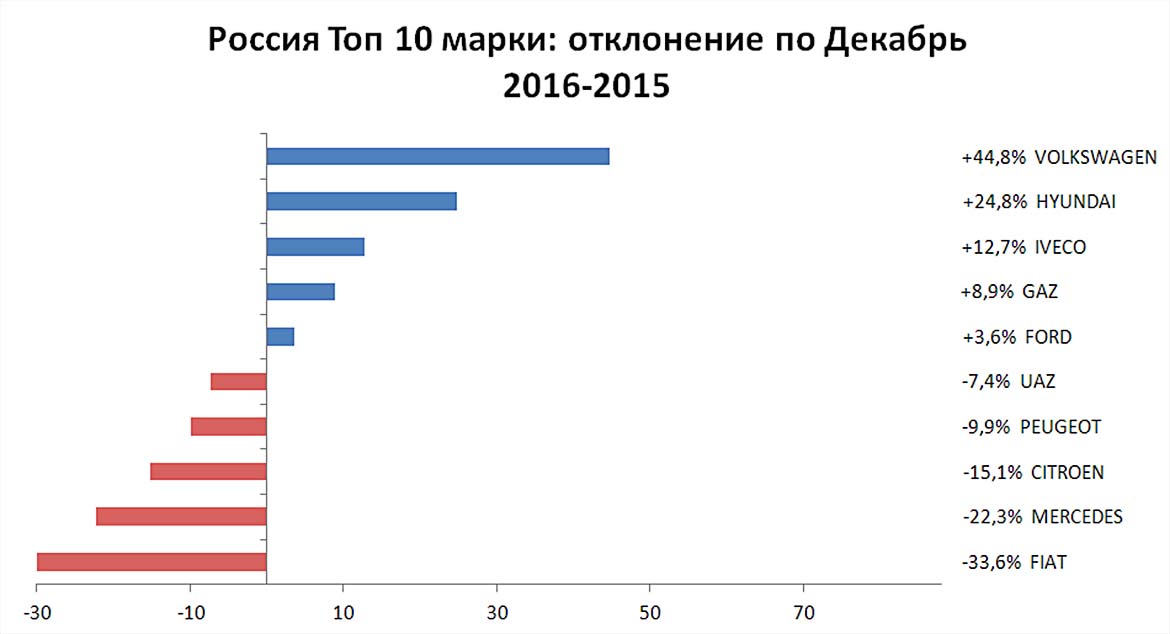

In the Top 10 for 2016 brands LCV shared growth fifty-fifty

The Top 10 LCV brands in the 12 months 2016, all five leaders of growth remained unchanged from November. So, the first Hierarch of the rating of Volkswagen showed +44,8% (5255 units. and the usual 4-th place on the market). Second was Hyundai with +24,8% (1469 units), and the third – IVECO with of +12.7% (1186 series units Daily). Fourth place also with Gas +8.9 percent (40 955 units and a huge advantage in sales), and the five was closed by Ford +3,6% (4923 units and 5th place on the market). Bottom five all from Oise with -7,4% (17 889 units) – 2nd in the market and 6th dynamics, to the failed Fiat c -33,6% (2010 ed.) is in the red. Third, sales of Mercedes-Benz (6552 PCs) with -22,3% dynamics did not break out from 9th place.

Top 10 LCV brands

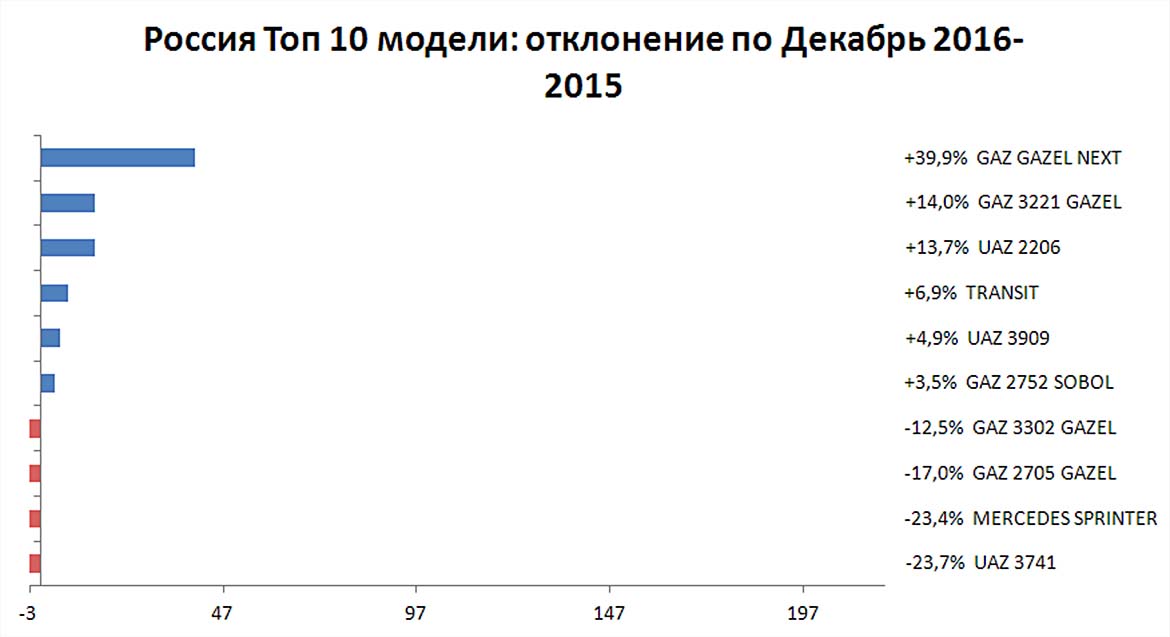

GAZelle NEXT finished the year in the lead

For the 12 months of 2016 ranked in the Top 10 LCV brands in the dynamics of the leader remained GAZelle NEXT with +39,9% (18 of 148 units. but old family "Gazelle BUSINESS" sales totals in 18 243 units, of the championship she has not yet conceded). In second place was the minibus "GAZelle BUSINESS" GAZ-3221 with +14% (4094 items) ottenuti third minibus "loaf" UAZ-2206, with its +13,7% (2572 units). Further, the advantage are: Ford Transit +6,9% (4915 units), UAZ-3909 with +4,9% (4252 units) and GAZ-2752 "Sobol" with a +3.5% (2982 units). Other models at the end of 2016 and remains on the downside, well, the last result showed the lead of the previous year van UAZ-3741 with -23,7% (1165 units). The second place on sales (10 of 426 units) is firmly reserved for GAZ-3302 and 7th position on the dynamics of -12.5 percent. a third for sales of Mercedes-Benz Sprinter (4967 units) only 9-th place according to the dynamics with -23,4%.

Top 10 LCV models

All Moscow came to the end of 2016 plus. So, in the capital market December ended with a growth of almost 2.5 times to 1517 units. All of 2016, this also was in positive territory by 6% (12 390 units). The cars climbed 4% to 7826 units, and domestic brands – by 9.5% to 4564 units. the Most popular model in December (244 units) and for the entire year (2411 units) in Moscow has appeared "the GAZelle" with an increase of 2.4 times and 66%, respectively. Its market share of 16.1%.

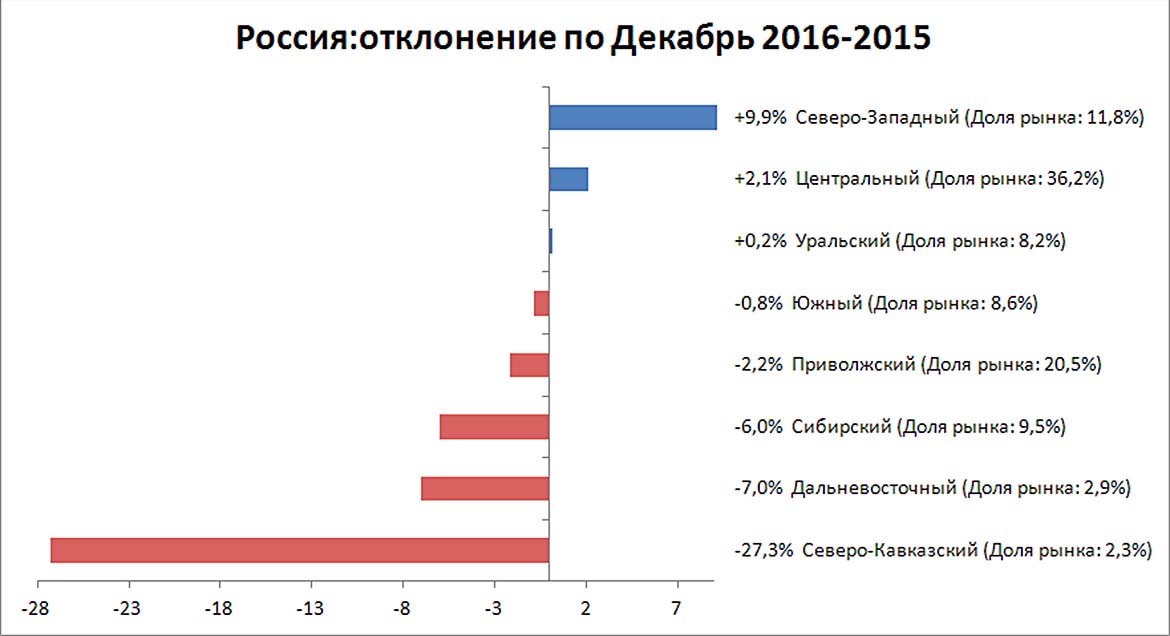

Regions rose due center

Rating of regions by dynamics of LCV for 2016 showed an increase only in the North-West Federal district with a +9.9 per cent (the share is 11.8%) and staged a finishing spurt of the Central Federal district with of +2.1% (share of 36.2%). Other regions of the minus could not get out. So, in the Volga Federal district showed -2,2% (share of 20.5%). And, the most recent result for the year and remained in the North Caucasus Federal district with -27,3% (share of 2.3%), which began to rise only in the last quarter.

Dynamics of sales of LCV by region

"Plato" walked a skating rink by region, but most of all went to the North Caucasus Federal district

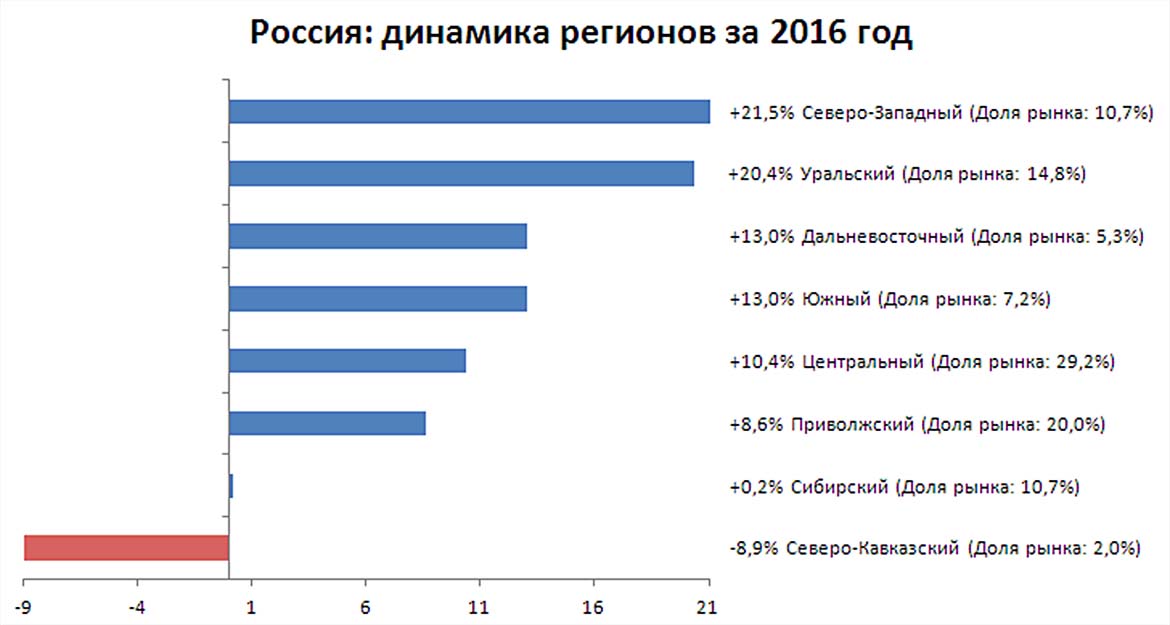

For the entire 2016 painting among the regions is quite positive, but the leaders of growth still left the North-West Federal district with a +22,7% (share of 10.6%). Among the heavyweights still in the plus: Urals FD (the share of 14.5%) showed +16,7%, Volga FD (share of 20.1%) plus of 7.8% and Central FD finally got out of minus with a +4.7 per cent (share of 29.1%). The only region in the red remains of the North-Caucasian FD with -9% (share of 2%) which did not recover from the introduction of the "Plato" is not so much due to the increase in transportation costs, but because of the forced exit to the light grey traffic.

Dynamics of sales MCV+HCV by regions of the Russian Federation

Moscow has caught up by leaps and bounds, but did not go to the plus

Capital cargo market, though, and leapt in December to 2.45% to 650 units, but for the whole year were in the red (-2,4% to 4418 units). For 2016 cars, respectively, decreased by 3.8% to 2205 units, and domestic producers – 0.9% to 2213 units So their share of the capital market was virtually equal: a 49.9 and 50.1%, respectively, against 50.7 and 49.3% over the last year.

Peter slowed down at the end of the year

Accordingly, in St.-Petersburg trucks for 2016 showed +62,9% to 2,591 units of the Russian brand grew by 70% to 1,367 units, and cars – by 55.5% to 1224 units.

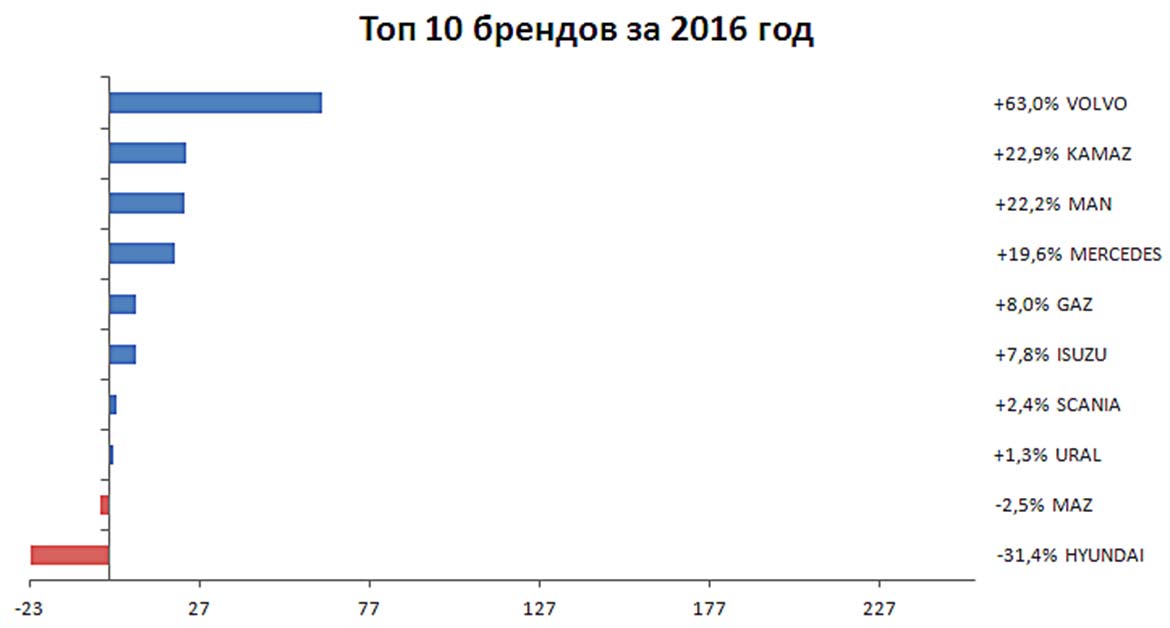

"Big seven" came out in 2016 growth

The "big seven", traditionally consisting of European brands, including DAF, IVECO, MAN, Mercedes-Benz, Renault Truck, Scania and Volvo Truck is due to the shock of November (growth in 2,3 times) and December (2.1% to 1808 units) to recover on year by 24.8% (to 8150 units) that are even allowed to pull out of the entire segment minus freight cars! Thus, the growth in "seven" in 2016, showed six brands: IVECO with 75.3 per cent (745 units), Volvo from 63% (1672 units), DAF from 57.1% (938 units), MAN from 22.2% (2184 PCs) and Mercedes-Benz from 19.6% (2057 units) and even Scania Sogda to pull in plus 2.4% (2510 items). The only minus is left Renault with -57,2% (62 units), which in 2017 will clearly restart.

a Leader in dynamics for all of 2016 in the Top 10 was Volvo

In the Top 10 for all of 2016, the leaders still managed to keep the Volvo, but the actual sales (21 of 357 units), of course, was not equal to the KAMAZ, which showed in the result of the 2nd dynamic (+22,9%). Third place was also held by MAN with minimal interruption from KAMAZ. Fourth place for Mercedes-Benz, and the five could close the GAS +8% (8810 units – 2nd place in sales). Next has retained its 6 th place with Isuzu +7,8% (2586 units). And Scania trucks with Ural (+1,3%, 2075 units) are also in negative and somewhat improved their final position. However, the two closing the Top 10 of the brand did not come out of minus. It is the eve of -2.5% (2553 units) and Hyundai with -31,4% (1403 units).

Top 10 brands MCV+HCV for 2016

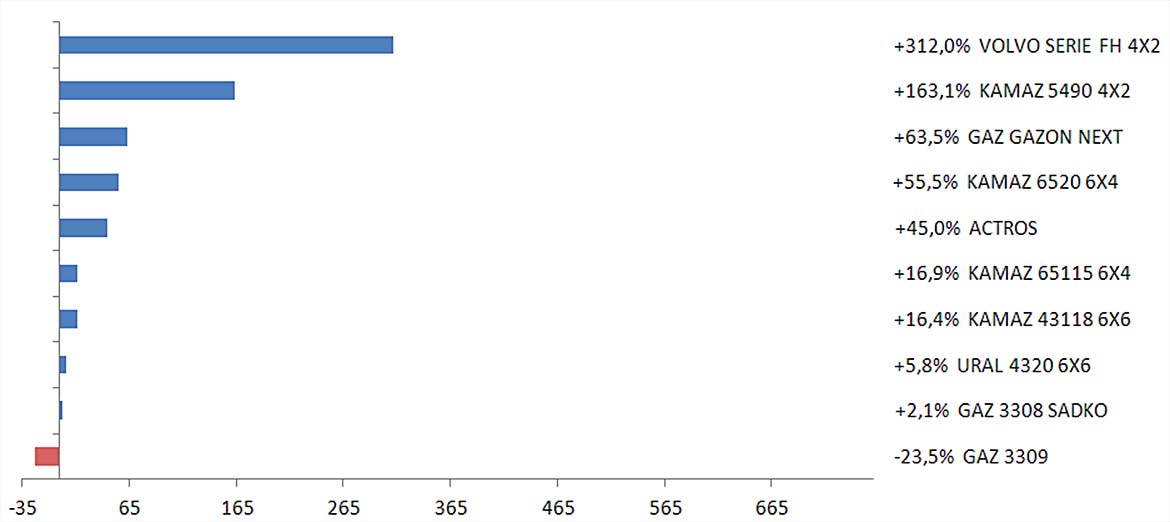

Top 10 models MCV+HCV favorites not changed

For the full 2016 Top 10 on the dynamics of truck models with an increase of 4.1 times the leaders kept Volvo FH 4x2 (1067 units.), in second place – tractor KAMAZ-5490 with an increase of 2.6 times (2257 items), and the third the Lawn NEXT c +63,5% (5269 units). Further entrenched heavy KAMAZ-6520 with +55,5% (3236 units) and Mercedes-Benz Actros s +45% (1741 ed.). Plus at the end of the year also showed that the KAMAZ-65115 with +16,9% (4846 units), KAMAZ-43118 with +16,4% (4662 units), Ural-4320 (including NEXT generation) with +5,8% (1087 units) and GAZ-3308 "Sadko" with a +2.1 percent (1410 units). Rounded out the Top-10, gradually coming into circulation of GAZ-3309 with -23,5% (1630 units).

Top 10 MCV+HCV for 2016

Capital fell in the Lawn NEXT, but also holds KAMAZ

In Moscow for 2016 remained the leader of the KAMAZ-6520 (499 units, a 3.1-fold increase), and the Lawn NEXT (448 units, a growth of 2.4 times) became the second, and the three locked KAMAZ-65115 (285 units -44,7%), being in the lead in the Park from 7.11 million (share 5%).

Resurrected the LCV market of gostelow can lose

The LCV market positively reacted to the main indicators like the growth of a barrel, the ruble and the improved macroeconomic forecasts for Russia's GDP in 2017. However, the effect of the programs for state support of industry is renewed only for the first quarter and there is a danger that the relatively more successful LCV segment will lose them one of the first. Thus, for example, the impact of the programme to replace the fleet of ambulances, is undeniable, especially for brands with the Russian Assembly as GAZ, UAZ and Ford.

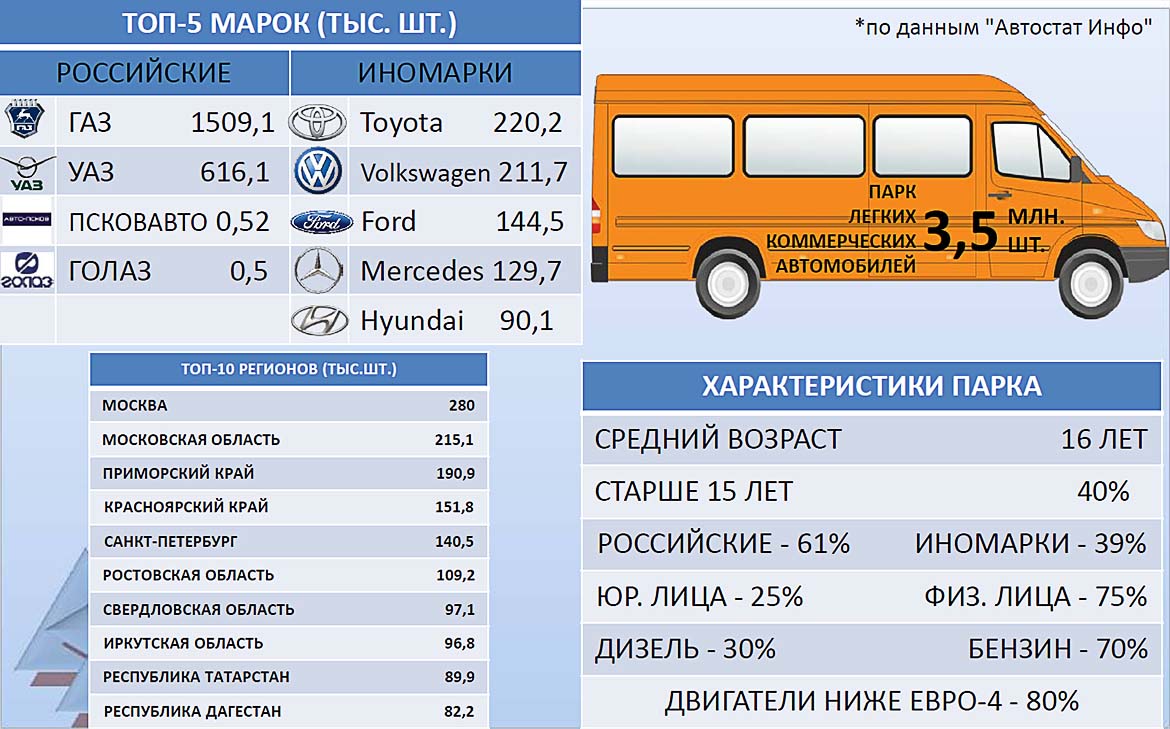

Park LCV at the beginning of 2016

Trucks drop in 2017 has not threatened

A positive trend of recovery of the cargo market (MCV+HCV) throughout 2016 (except may), particularly intensified in the final month of the year, which was quite dynamic that has consumed plus in all segments, including cars. In 2017, the market of trucks MCV+HCV, in the absence of "black swans", i.e., major force majeure events, could increase by twice the percentage than in 2016. However, this prospect may or may not happen, if the Russian government chooses to extend a government program to support consumers, including the procurement of gas utility equipment, outside of the first quarter, although the increase in payments of "Plato" are now delayed to a later date, and their rise will be disposable (carriers mind very active). There is hope and the beginning of the programme impact in stimulating exports about compensation for transportation to the border and the adaptation of national models to export markets. Rapid growth is cars, shows that the client prefers your money and a quality product.

Park MCV+HCV at the beginning of 2016

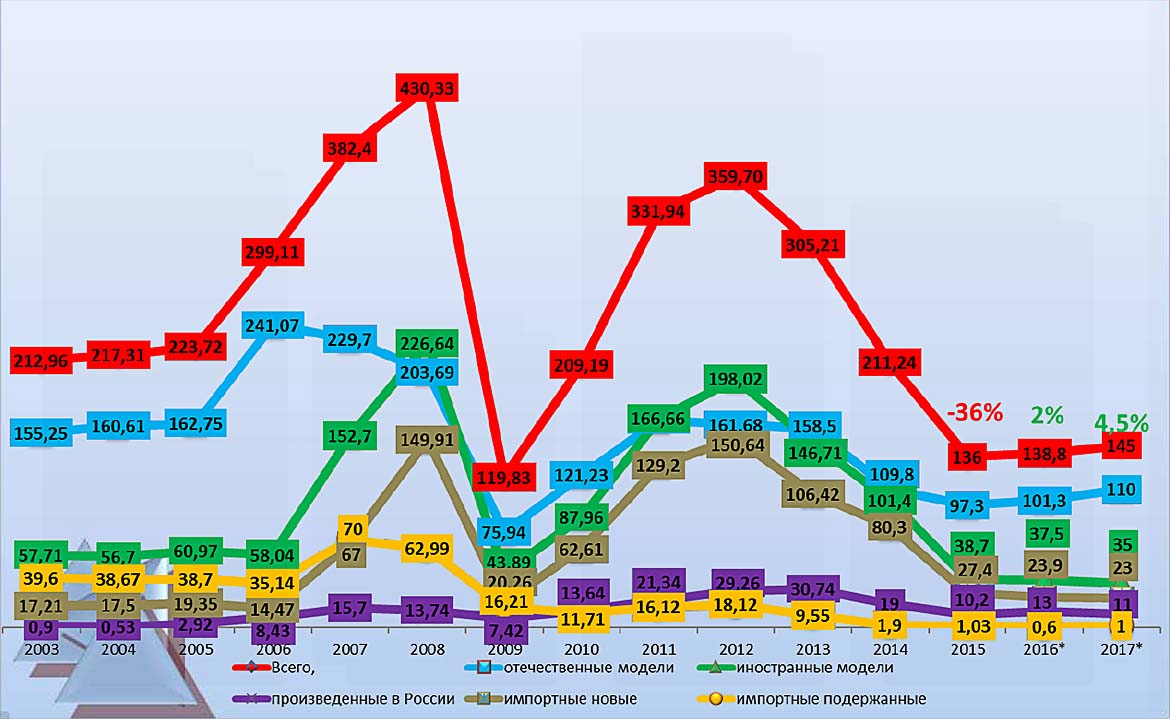

Truck market in Russia 2003-2017

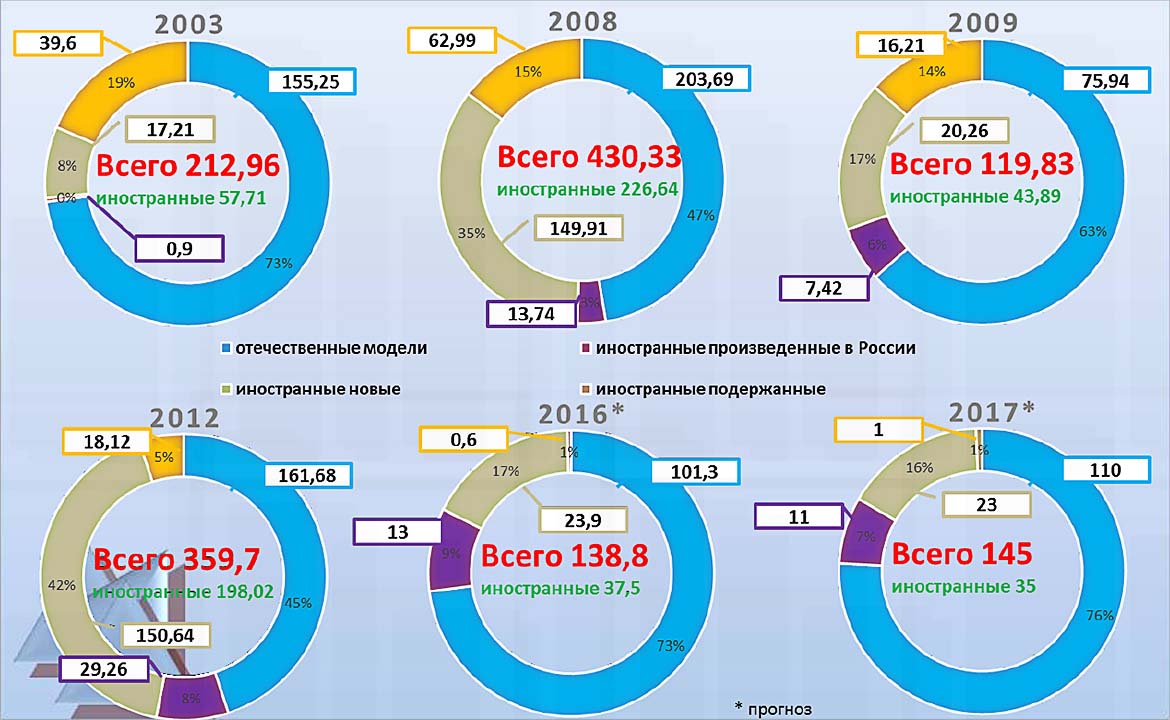

The structure of the market of trucks in Russia from 2003 to 2017

.

|

|

|