RAMR predicted truck market stagnation until 2024

21.03.2019

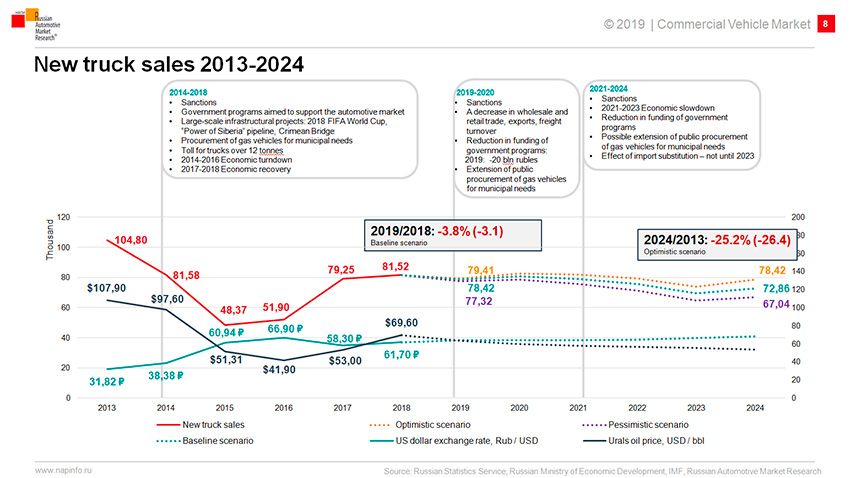

In 2019 the market for trucks would fall by 3.8%

The report of the General Director of Russian Automotive Market Research (RAMR) Tatiana Arabadji RAF-2019held March 19-20, at the special session dedicated to the commercial vehicles (HCV and LCV), and special (trailer) equipment, carefully covered the results of 2018 the sales of new and used trucks, as well as considered the production of trucks of all categories. Were the forecasts of sales and production of trucks for 2019 and also for a longer period until 2024. Moreover, the estimated RAMR figures compared with the index of the last prosperous 2013.

According to T. Arabadji the market downturn of trucks (MCV and HCV) in 2019 is simply inevitable, as this "contribute" all macroeconomic factors, including slowing growth conclusion in 2018, major construction projects (Crimean bridge and world Cup 2018) at absence of the same scale national projects in 2019 and subsequent years, respectively, the decline in construction as such, industrial production and hence, the volume of cargo transportations. In addition, in 2019 drastically reduced the amount of state subsidies for the leasing, loans, purchases of motor vehicles and minimized the number of other programmes to promote the automotive market (completed program "farm vehicle", "new truck", etc.). A large enough shock of the 2019 was the increase in VAT and utilization fee, which may well outweigh the reduction of import duties in the autumn of last year (according to the WTO agreement). By the way, the threat of rising prices due to the new VAT supported sales last year, completely by choosing a pent-up demand and reducing the potential market for new trucks, at least in the first half of this year.

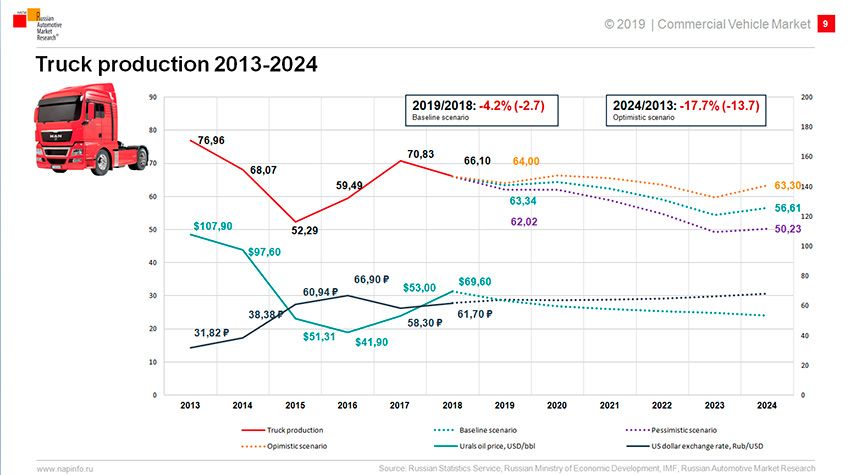

Thus, the decline in the market for new trucks in 2019 is projected RAMR at the level of 3.8% (in 2018) to 78,42 thousand in the baseline scenario. And, here 2024 by 2013 gives not decline, and the quality of the collapse of 25.2%, i.e. a quarter and a long-term, even more radical trend on the Russian market of new trucks.

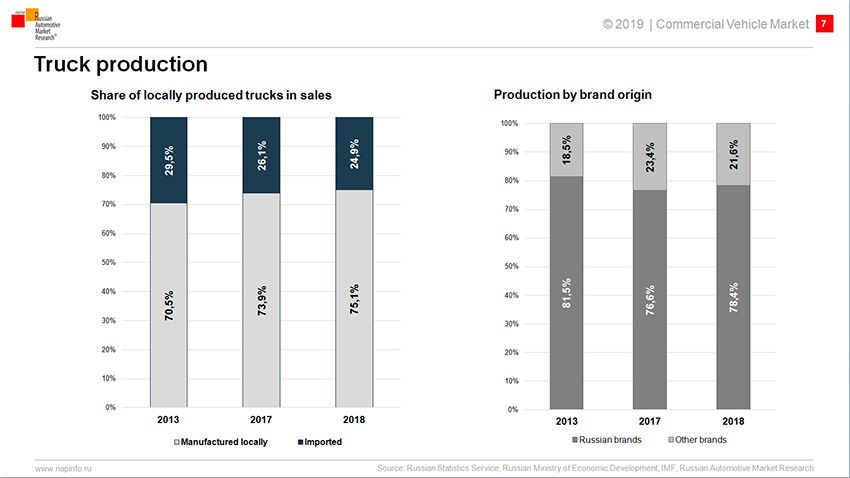

Incidentally, the ratio of sales of new trucks to used cars in 2018 decreased to 1:3.2 vs. 1:3,5 the company informed. The ratio of sales of new domestic trucks imported looks like a 3:1 (75.1% of domestic production, against 73.9 per cent in 2017). The share of Russian brands in the production was 78.4% vs 76.6% a year earlier – in fact, solely due to state support programs of leasing and crediting.

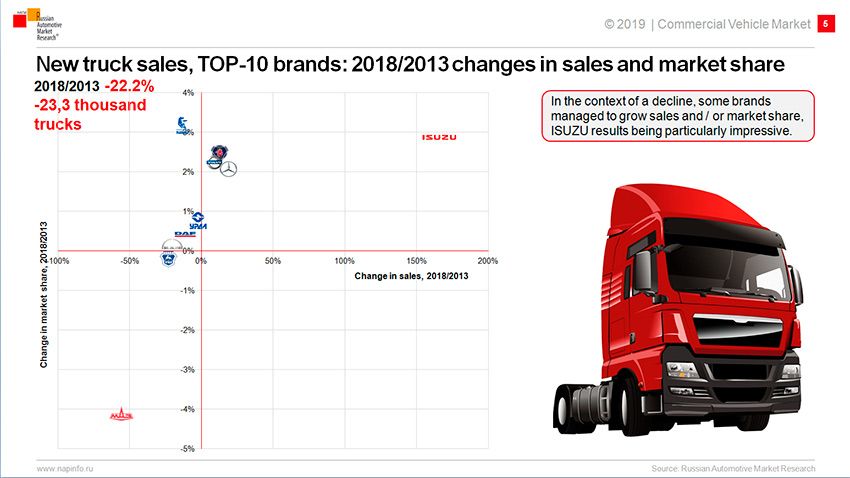

It is interesting that even amid the crisis, some truck brands were able to significantly increase its market share and especially succeeded ISUZU.

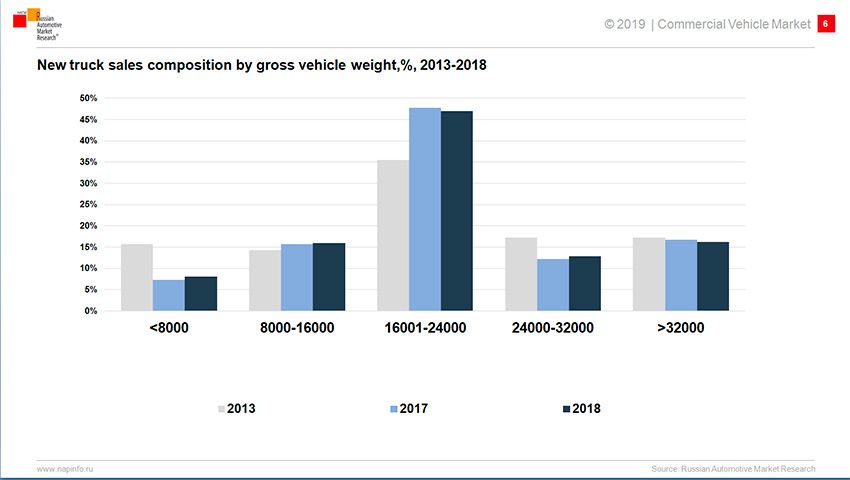

to complete the mass production of trucks were distributed as follows: lion's share (over 47%) occurred in the category of 16-24 t, although there was some decline, but other categories revolved around the strap of 15%. Moreover, the drop in the last two years, have experienced segments total weight up to 8 tons and 24-32 Somewhat only increased the segment of 8-16 t

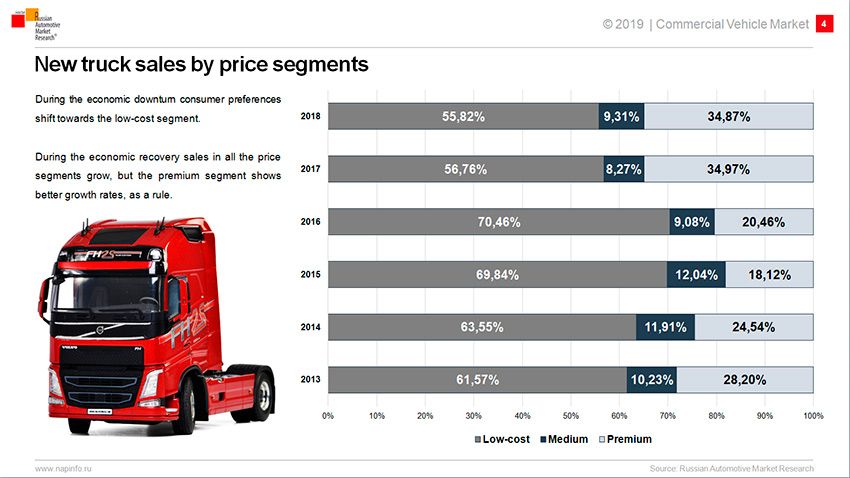

By price segments of the market were distributed as follows: budget (low-cost), mainly domestic and Chinese brands took 55.8% of the market (slightly less than in 2017), the mainstream (for example, Isuzu, Ford Cargo Hyundai Truck) and 9.3% (growth by 2017), and premium (read: Most of the European seven) is 34.9% (minimal decline).

Accordingly, the production of trucks follows in the footsteps of their market, i.e., even in the optimistic scenario is stagnating, and in base or, the more pessimistic – falls with different degrees of intensity, and this downward trend is realized, even while maintaining for the entire forecast period more or less stable prices of Russian Urals oil and, accordingly, the exchange rate of the ruble to the dollar. From this it follows that the volume of production, which will nedopustit the domestic auto industry – will be immediately compensated by imports.

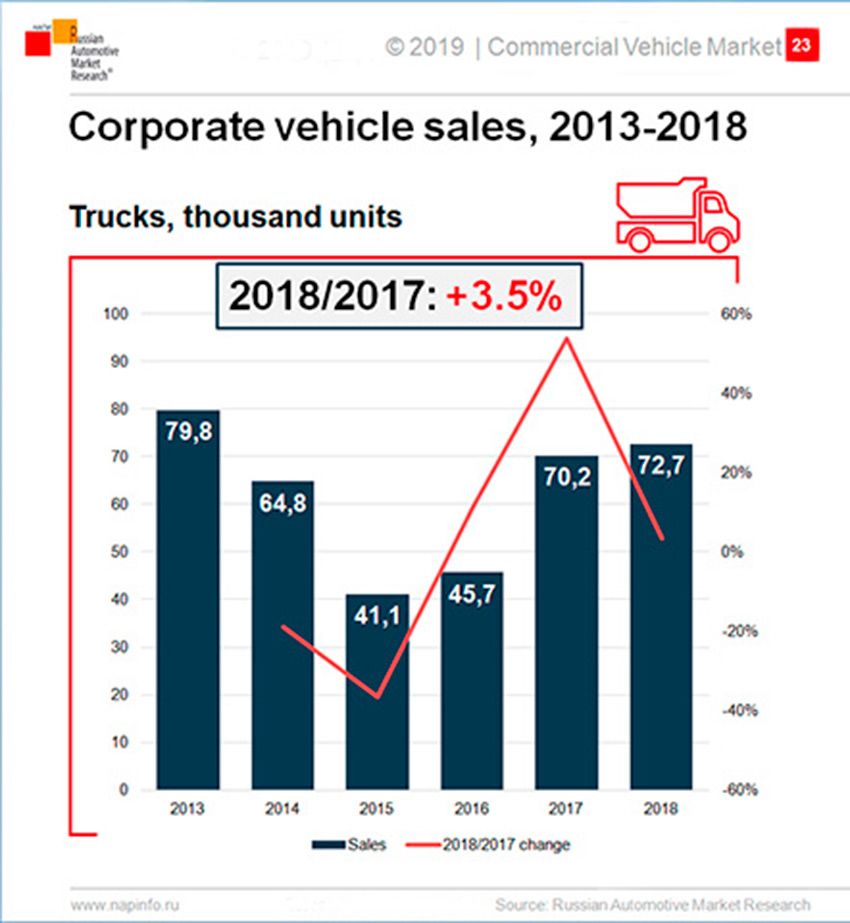

Corporate sales of trucks rose in 2018, 3.5%, however, with a sharp drop in their share of the.

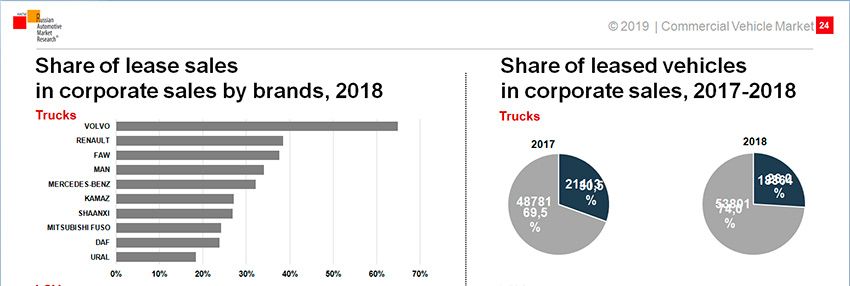

The share of leasing sales truck brands in 2018 are high enough. Thus in General, the market share new truck sold the lease in 2018 fell from 30.5% to 26% (18.9 thousand).

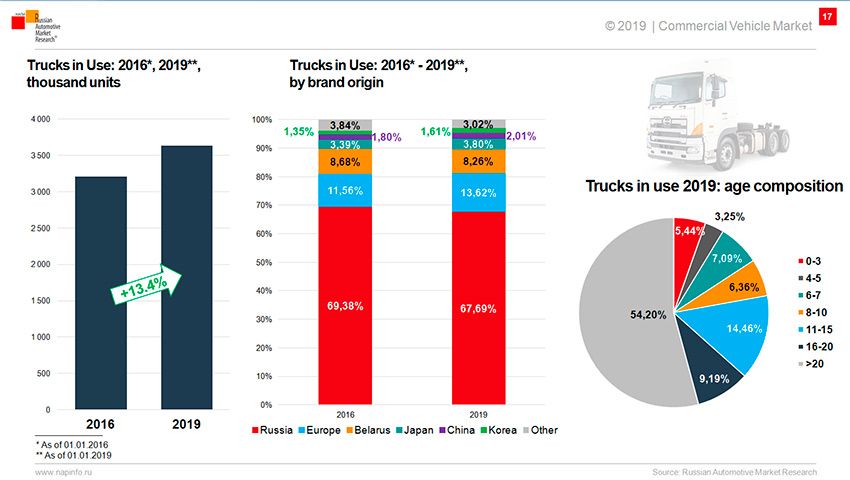

Unique data RAMR provided in the Park truck. So in 2016-2019 fleet growth will amount to 13.4%. The lion's share of the Park are domestic brand of 67.7%, in the European – 13,6%, in Belarus – 8.3% and 3,8% – in Japanese. The Chinese occupied only 2.1% of the Park, and the Koreans and 1.6%. In 2019, the share of trucks in the Park over the age of 20 years will be at least 54,2% that formally speaks of the enormous potential market for new trucks, but in fact everything depends on the macroeconomics and without government programs to stimulate demand and production, no serious progress will not happen.

In the second part of the review, you will learn about a similar situation on the market of light commercial vehicles. Follow the news on the portal www.rim3.ru.

|

|

|