RAMR is not optimistic for LCV until 2024

26.03.2019

In 2019 the market for LCVs and pickups will decrease by 1.9%

In the second part of the report of the General Director of Russian Automotive Market Research (RAMR) Tatiana Arabadji RAF-2019held March 19-20, at the special session dedicated to the commercial vehicles (LCV and HCV) and special (trailer) technique was lit 2018 in the segments of light commercial vehicles (LCVs) and pickups, examined the results of 2018 the sales in the markets of new and used LCV, and forecasts to 2019 and for a longer period until 2024. RAMR also compared the development of the market with the index of the last prosperous 2013.

According to T.Arabadji downturn in the LCV market as a more heavy-duty trucks in 2019 just inevitable due to the action of a number of macroeconomic factors related to the slowdown in the economy, the continuing decline of incomes and turnover, respectively, to reduce road transport as such. In addition, in 2019 gosudarstvo sharply reduced the list and the amount of subsidies for the leasing, loans, purchases of motor vehicles, as well as completed a number of programmes to promote the automotive market, for example, "farmer's car", "first car", "updating of fleet of ambulances", etc. played a role, and the increase from 2019 VAT and utilization fee, which stimulated (and the relative reduction of customs duties according to the agreement with WTO) sale in the autumn. However, it also led to the drawdown of the market in early 2019.

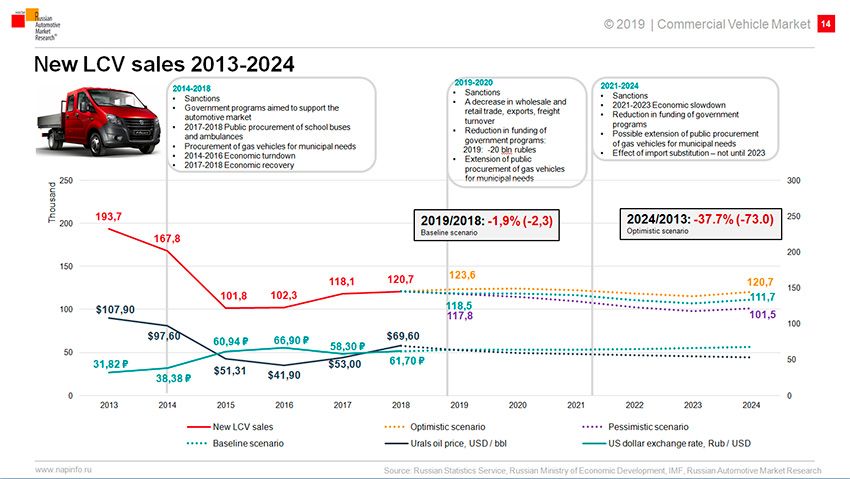

Thus, the decline in the market of new LCV and pickup trucks in 2019 is projected RAMR at the level of 1.9% (in 2018) to 118.5 thousand in the baseline scenario. Accordingly 2024 to 2013-mu can give a collapse on 37,7%, even under the optimistic scenario, the pessimistic but the fall will be all 73% to just over 100 thousand and the trend is even more negative than the market heavier trucks.

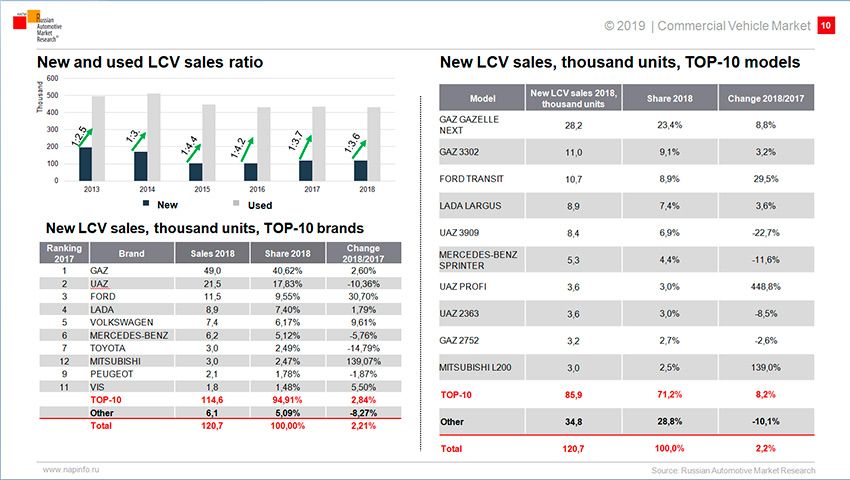

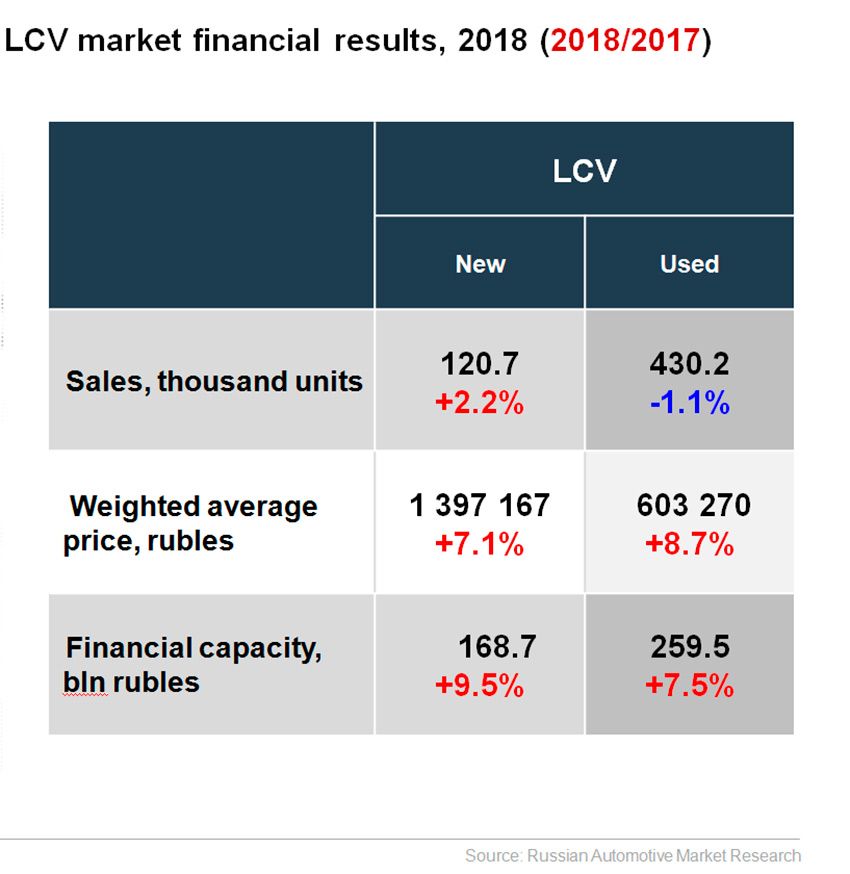

Incidentally, the ratio of sales of new LCVs to used cars in 2018 decreased to 1:3,6 to 1:3,7 informed

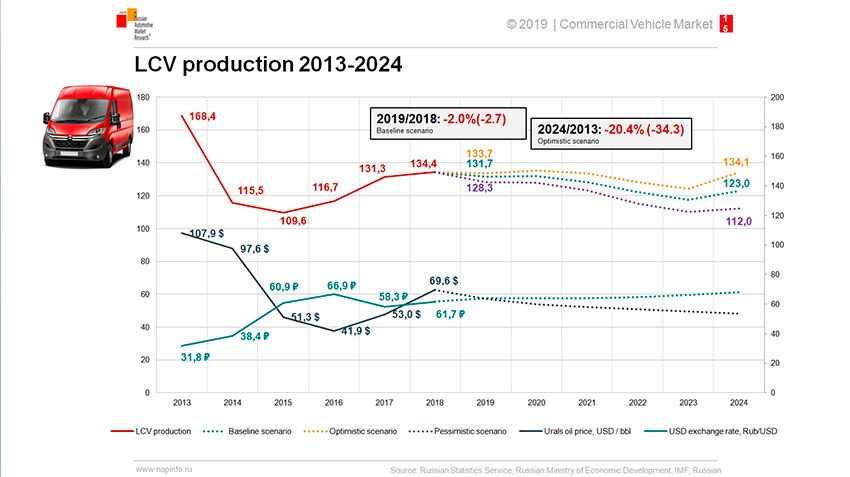

The decline in LCV production in 2019 will be at 2%, but 2024 by 2013 gives the failure by 20.4% and 34,3% according to the pessimistic scenario

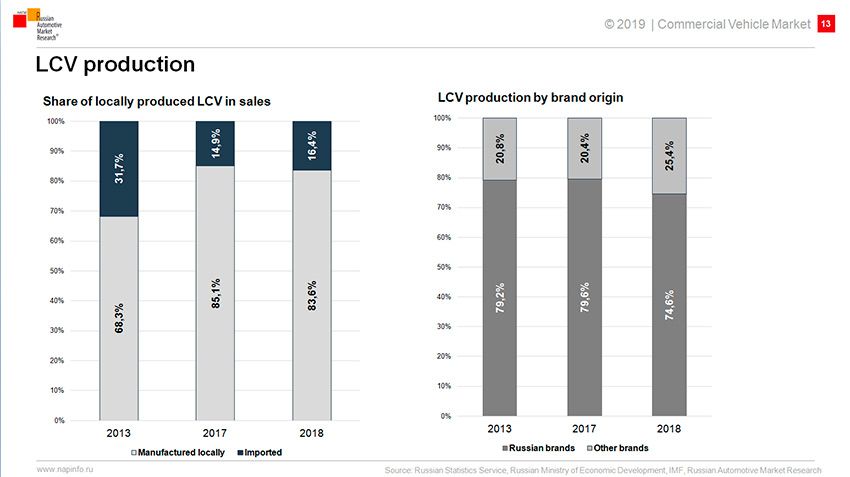

The ratio of new LCV sales domestic imported looks like a 3:1 (74.6% of domestic production, against 79.6 percent in 2017). The share of Russian brands in the production was 78.4% vs 76.6% a year earlier – in fact, solely due to state support programs of leasing and crediting.

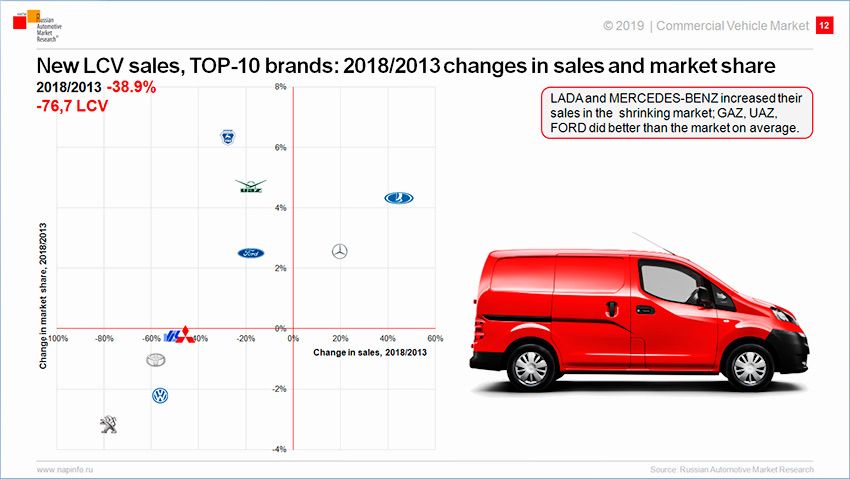

It is interesting that even amid the crisis, some brands were able to significantly increase its share of the LCV market and this has particularly been the LADA and the Mercedes-Benz

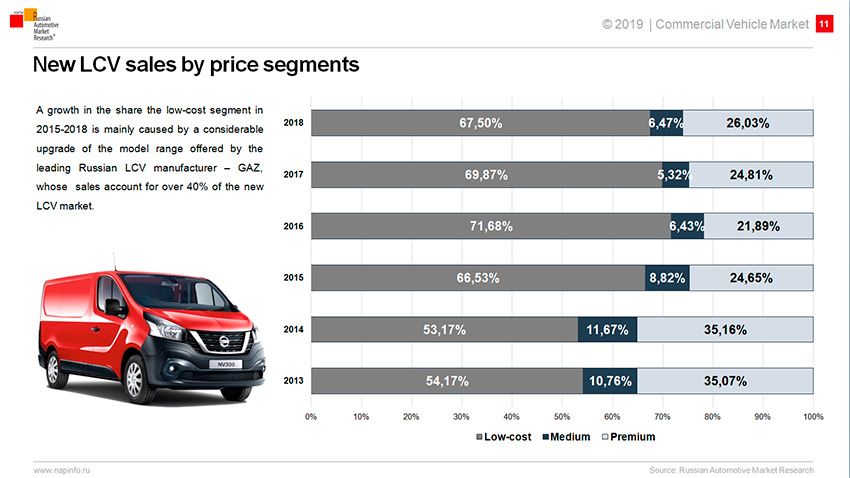

The lion's share of the LCV market (67,%) account for the budget segment (all domestic models), another 6.5% on the average price segment (Korean Hyundai, etc.) and 26% on the premium segment of the European brands

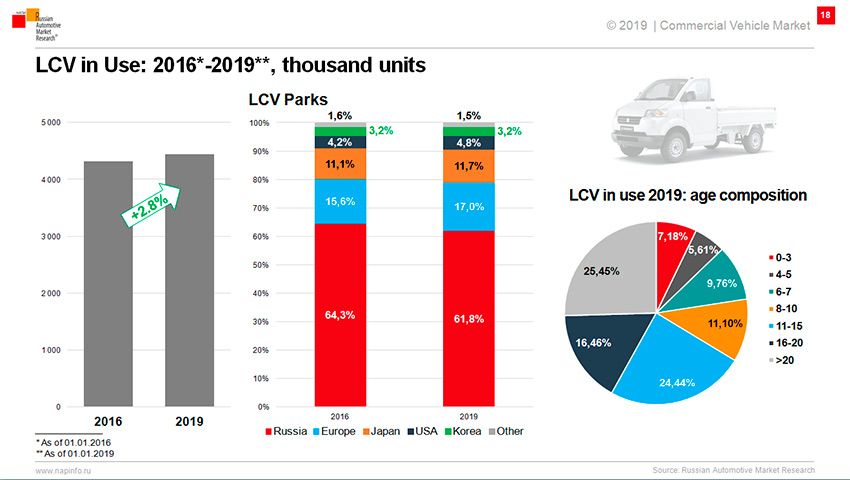

Data RAMR in the Park of LCVs and pickups the following: in 2016-2019 fleet growth will be 2.8%. The lion's share of the Park in 2019 will have on local brands – the 61.8%, European – 17%, Japan – 11.7% of American – 4,8% for Korean – 3,2%. The Chinese have entered other 1,5% of the Park. In 2019, the share of LCVs and pickups in the Park over the age of 20 years will be not less than 25.5 percent, which also indicates the great potential for the market of new LCV, but growth can only give the actual growth, so without government programs to stimulate demand and production and this segment will not move.

Prices on new and used light commercial vehicles in 2018, growing at a faster pace

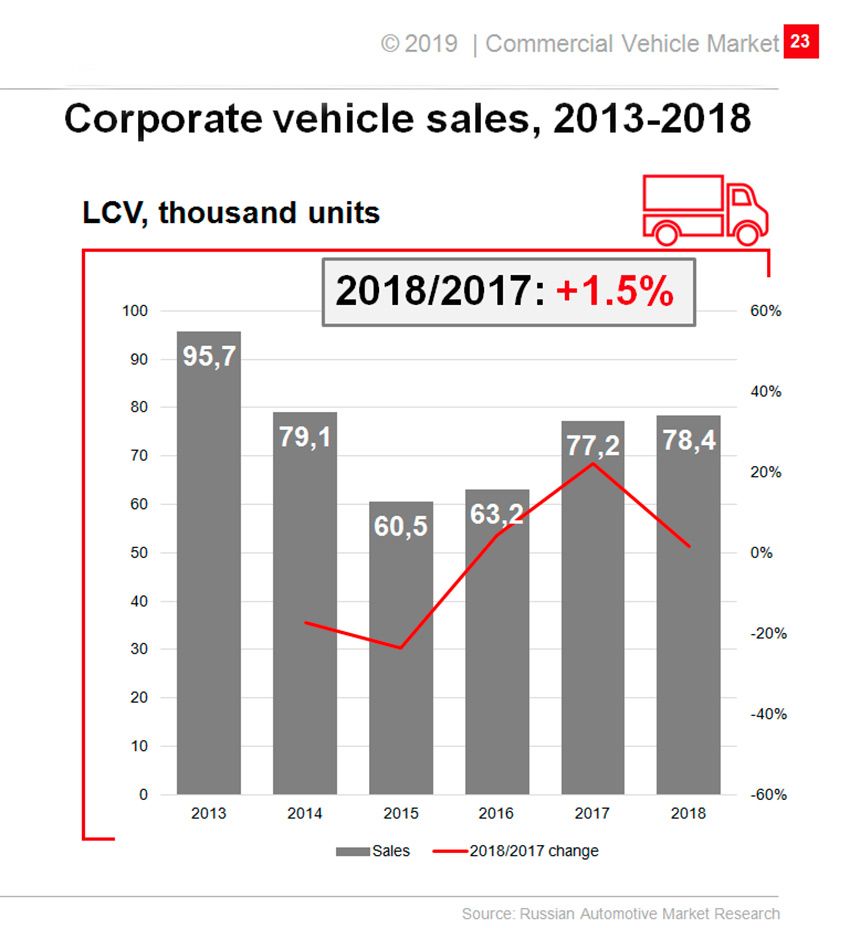

Corporate sales of LCV in 2018 increased slightly (+1,5%) to 78.4 per thousand

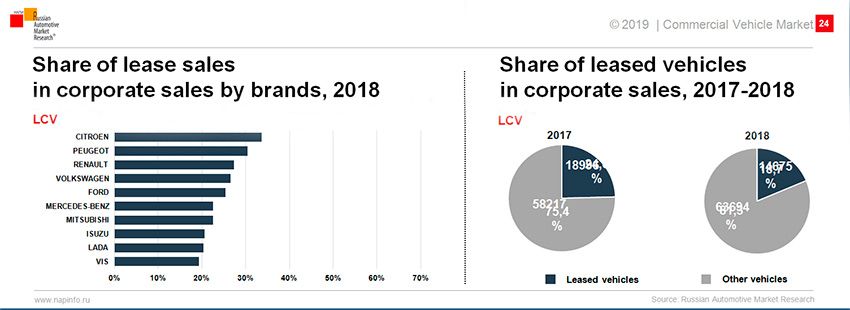

Leasing the best sold LCV Citroen and Peugeot (both more than 30% of all sales) and the share of leasing specific sales declined by 6.1%

In the third part you will learn about the report on the market of commercial vehicles of the company DaimlerKAMAZ. Follow the news on the portal www.rim3.ru<.

|

|

|