Key facts about the Russian truck market in 2017

According RAMR and "AUTOSTAT info" in 2017, the truck market was characterized by the following important features

New medium-duty (MCV) and heavy (HCV) trucks in 2017 was реализовано79,2 million or to 52,8% more than in 2016.

Among leaders was KAMAZ, GAZ, Volvo, Scania and Mercedes-Benz.

The less, despite the leading the shaft, the share of trucks of Russian brands fell to 74% off market 85.5% in 2016, due to the switching of pent-up demand carriers at the products of the leading world brands, mainly the "Big seven".

Top-5 models-leaders were: KAMAZ-43118 (of 5.83 thousand, growth on 25,1%), KAMAZ-65115 (5,85 thousand, +20.7 per cent), natural GAS "Lawn NEXT" (5,37 thousand, +2%), Mercedes-Benz Actros (of 5.08 million, the growth in 2,9 times) and KAMAZ-6520 (4,83 million, +49.1 percent).

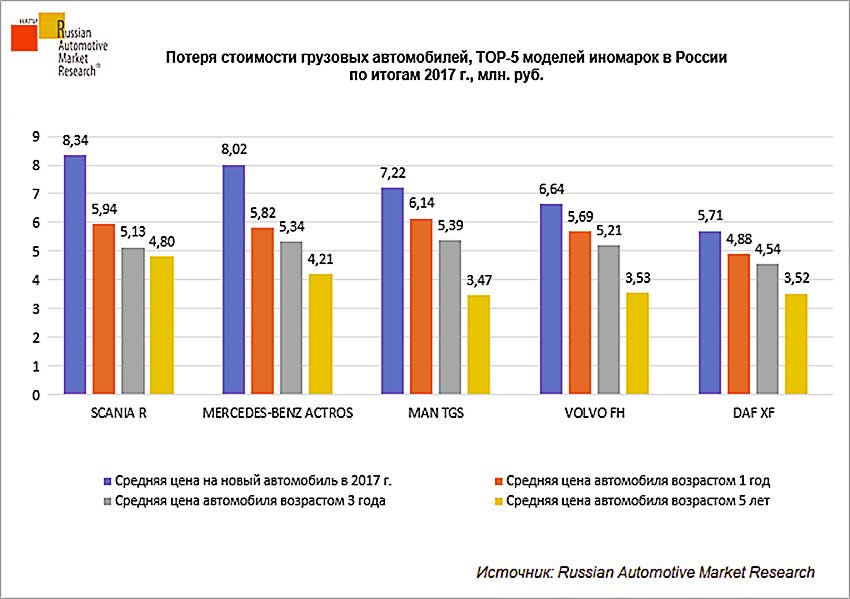

Interestingly, in the Top 5 new freight cars lose most heavily in the price for the first year of ownership models such as Mercedes-Benz Actros and Scania R, respectively, 27% and 29%. Three other models for the same period, losing only 15% of the cost. However, after a few years the situation is still aligned: almost all five-year trucks from this rating, losing nearly half its value. The exception is the DAF XF, which in the age of five, losing only 38% of the cost.

The share of legal entities among truck buyers were on a 89%, and the proportion of individuals accounted for only 11%, and not surprising, since the rare carrier-private owner available is a new truck not mention the main tractor – of their inheritance secondary market.

Top 5 types of bodies – tractor (the same pent-up demand), dump truck, side (mostly with CMU or a lifting Board) or tilt, van (often isothermal) and refrigerator.

Top 5 sales regions: Moscow region (where the largest warehouses of a number of production and logistics companies), Moscow (the largest retail chain and large enough dynamically updated Park municipal vehicles, yeah and, in General, the capital market any vehicles with a solvent for definition), Tatarstan (center of production of KAMAZ and Mercedes with benefits your region), Khanty-Mansi Autonomous Okrug (of the WPK), Saint Petersburg (second largest city).

By the way, how are things with loading "the secondary"? RAMR gives an answer to this question.

On the secondary market in 2017 was resold 271,6 thousand trucks, which is 2% less than in 2016 – pent-up demand has shifted to new trucks for the acquisition of which, by the way, thanks to preferential loans and other state programs it is the most favorable time. The share of legal entities on the secondary truck market, of course, dramatically less than privateers: 30% vs 70%.

Brands-leaders here have become, or rather remained: KAMAZ (Park at beginning 2017 years to 765 thousand), GAS (751 thousand), MAZ (220 thousand), Volvo (84 thousand). The share of trucks of Russian production was 60.5% compared to 61% in 2016.

Top 5 types of bodies second-hand: tractor, dump truck, Board/tent, van, and... crane.

Top 5 regions at the resales: Moscow oblast, Krasnodar Krai, Moscow, Rostov, Tatarstan.

Top 5 truck models with the mileage was: KAMAZ-65115, Volvo FH, GAZ-3307, KAMAZ-5320 and GAZ-3309.

|

|

|