Financial market capacity LCV and LDT is growing

Increased financial market of new and used LCV and LDT

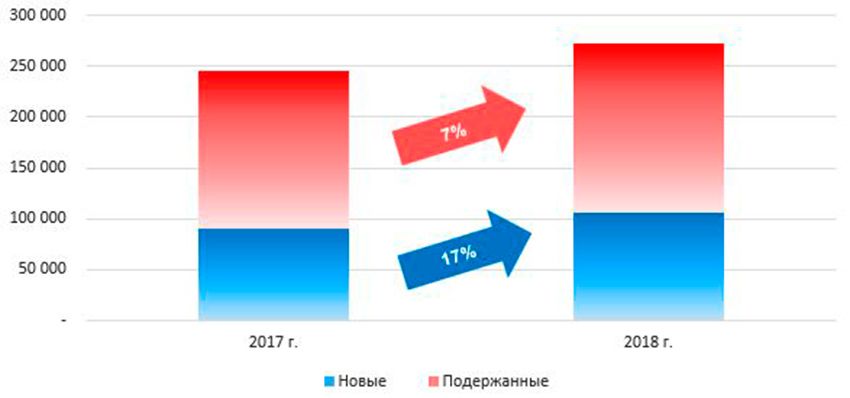

According RAMR financial volume of the market for new light commercial vehicles (LCV and pickups with GVW up to 3.5 tons, plus the so-called LDT with GVW of 3.5–6 tons) in January-August 2018 rose 17% compared to the same period last year, reaching almost ₽106 billion, Respectively, the market capacity supported by the LCV over the same period of this year amounted to ₽of 166.1 billion, which is higher than last year by 7%.

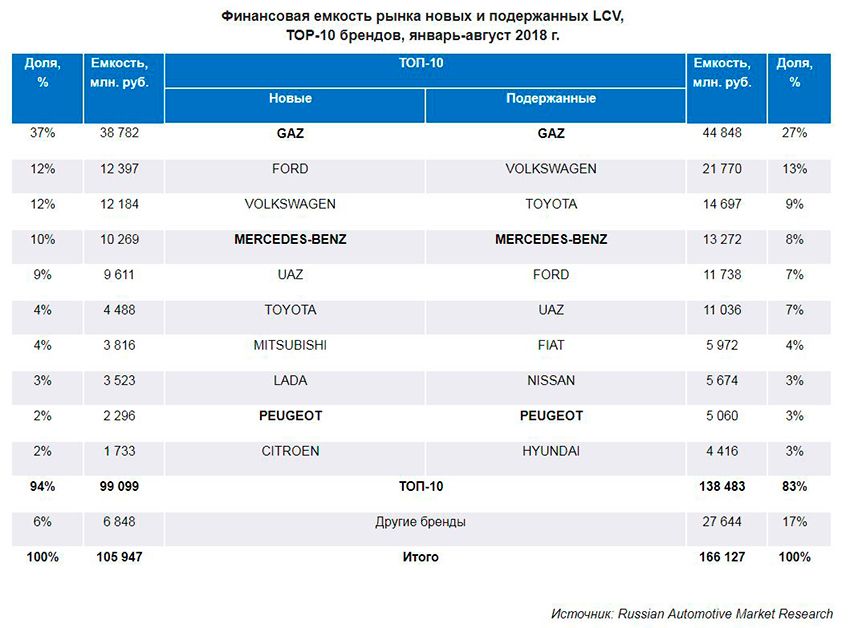

Financial sales GAS, a leader in the market of new LCV+LDT has also been found highest among all the competitors, making ₽to 38.8 billion, Respectively, only to the brand of GAS accounted for 37% of the financial capacity of the Russian market. Second place financial sales new LCV+LDT took Ford with 12.4 billion (12% of the market). Slightly behind him to the Volkswagen brand from ₽12.2 billion (share in the same 12% of the market). Fourth place went to Mercedes-Benz ₽10.3 billion (10% of the market), and the fifth – Oise from 9.6 billion (9% of the market). All Top 10 brands sold in the Russian market of new LCV+LDT at ₽of 99.1 billion, representing 94% of the total market. Financial share of all other brands in the segment amounted to only 6% to 6.85 billion, or

In the segment of used LCV+LDT in terms of financial capacity also leads GAS. Its share amounted to ₽44.9 billion and 27% of the market. The second place is occupied by Volkswagen with 21.7 billion (13% of the market). Third place behind Toyota (thanks to the Hilux pickup trucks and RHD trucks) with ₽14.7 billion and a 9% share. Fourth place for Mercedes-Benz ₽13.3 billion and 8 percent stake. The fifth centre is Ford ₽11.7 billion and a 7% share of the financial market. Top 10 segment of used LCV+LDT is 83% of the market for second-hand, which is ₽of 138.5 billion, the share of other brands represented 17% and 27.6 billion.

In the first eight months of 2018 financial capacity in the Top 10 regions amounted to ₽56.8 billion. or 54% of the total market of new LCV+LDT. The most capacious market, of course, is ₽17.6 billion (share 17%), second place went to the Moscow region with ₽of 11.6 million (11%), and third – St. Petersburg 7.8 billion (7%). The fourth largest financial market in Krasnodar Krai with ₽4.6 billion (4%), and the fifth – Nizhny Novgorod oblast with ₽3.1 billion (3%). Other regions outside the Top 10 won 46% of the market and ₽49.1 billion

Top 10 regional markets for used LCV+LDT in terms of financial capacity accounts for 41% of the national market or ₽68.3 billion In the rating of Moscow also heads the Top 10 regions with indicator ₽14.4 billion (share 9%). Followed by: the Moscow region with ₽13 billion (8%), Saint Petersburg ₽8.8 billion (5%), Krasnodar Krai with ₽8.6 billion (5%) and Primorsky Krai from 4.63 billion (3%). The share of the regions outside the Top 10 is not less than 59% and ₽97.8 billion

These numbers underscore market position in a country where the leading economic regions of the donor and the automotive market are in a better financial position, preferring a new light (and all other) commercial vehicles used, which they actively resell in the poorer regions.

|

|

|