ASM-holding summarizes 2018 and provides forecasts to 2019

In 2018 rose all market segments except commercial vehicles LCV

Overall, the situation in the market of commercial vehicles according to ASM-holding, presented at a final conference rim3.ru/avtonovosti/novinki/rossiyskiy-avtoprom/ "the outcome of the automotive industry in Russia in 2018 and the prospect of the development industry to 2019", in 2018, good enough, in addition to the LCV segment.

Production of commercial vehicles

the Preliminary result of 2018 for the production of trucks (including light trucks) were at the level to 159.5 million (-0,5%), notably lower projected growth of 4.2% to 167 thousand

LCV of them in fact amounted to 128,3 million (+3.9 percent), which is higher than expected 125 million (+1,2%).

In the bus segment (including LCV-vans) for which the forecast was +3.3% to 44 thousand – in fact, the growth was +3.1% to 43,9 thousand

commercial vehicles

For registrations in 2018 pre-market cars (without LCV) will be 81 million (+3,3%) with a steady growth since September, and the forecast for 2019 is 83 thousand (growth by 2.5%).

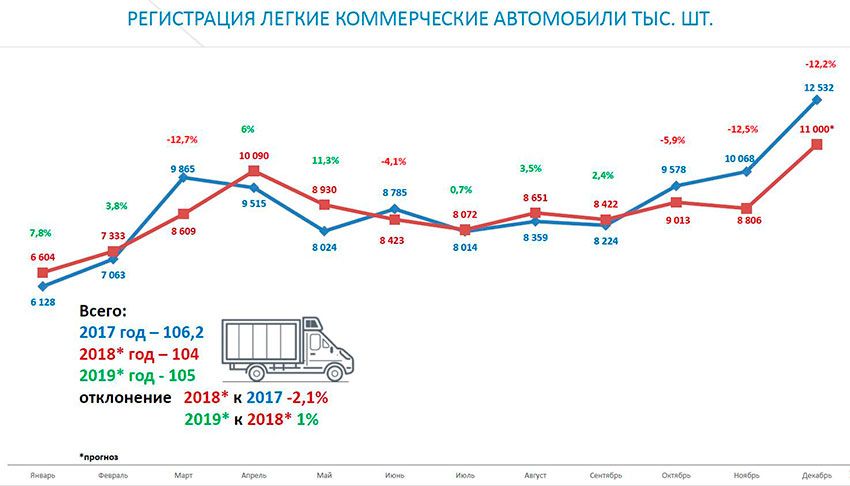

Registrations of LCVs by 2018 was worse than the 2017 2.1% to 104 thousand Practically, this segment stagnated from may to November, and only the expected jump in sales in December may be somewhat correct the situation. The weather forecast is for LCV in 2019 is 105 thousand (growth by 1%).

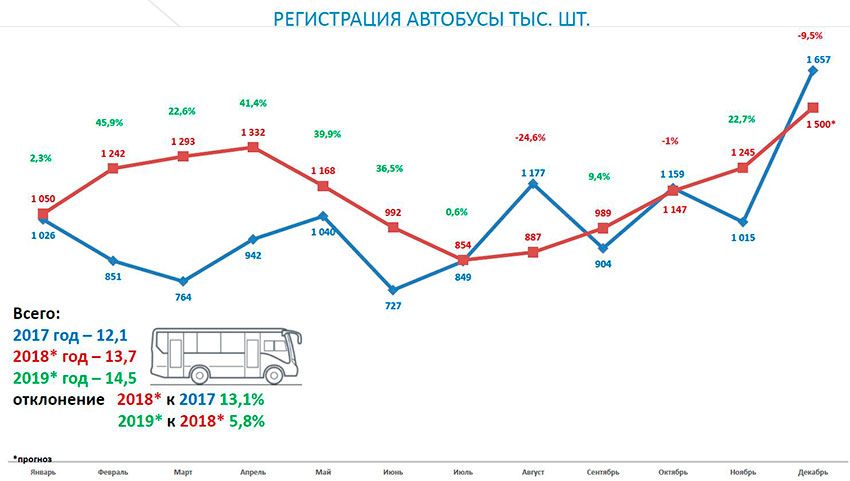

Buses registration 2018 pre-13.7 million (+13.1 per cent) due to relatively stable growth in the second half of the year, and in 2019 the forecast is +5.8% to 14.5 thousand.

Park commercial vehicles

Among the Top 3 models on the mass in the Park of trucks including: gasoline medium-duty trucks GAZ-3307 and GAZ-53, as well as heavy truck KAMAZ-55111

the Park of trucks in 2018 is 3 million 341.1 thousand Including Park Top 5 brands of trucks (MCV+HCV) includes: KAMAZ 816,6 million, GAS – 774,7 thousand, ZIL – 419,1 thousand, MAZ – of 231.6 thousand and Ural – 131.3 thousand

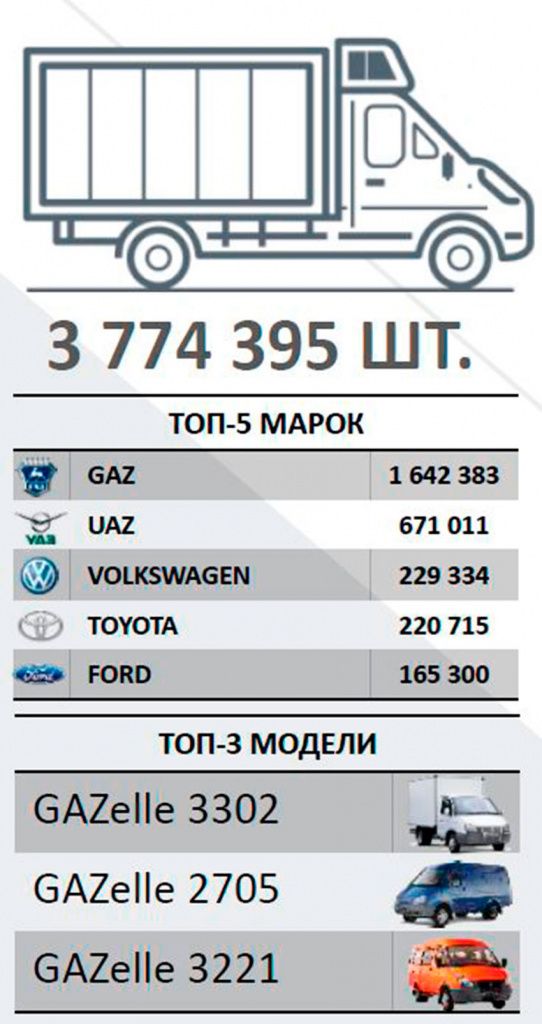

In the Park LCV Top 3 are, of course, the "GAZelle" GAZ-3302 (on-Board and chassis with add-ons), GAZ-2705 (tsmf) and GAZ-3221 (minibus, including minibuses and ambulances)

The Park of light commercial vehicles in 2018 is 3 million 774,4 thousand including Park Top 5 LCV brands include: GAS with 1 mln 642,4 thousand, UAZ – 671 thousand, Volkswagen – 229,3 million and Ford – was 165.3 thousand

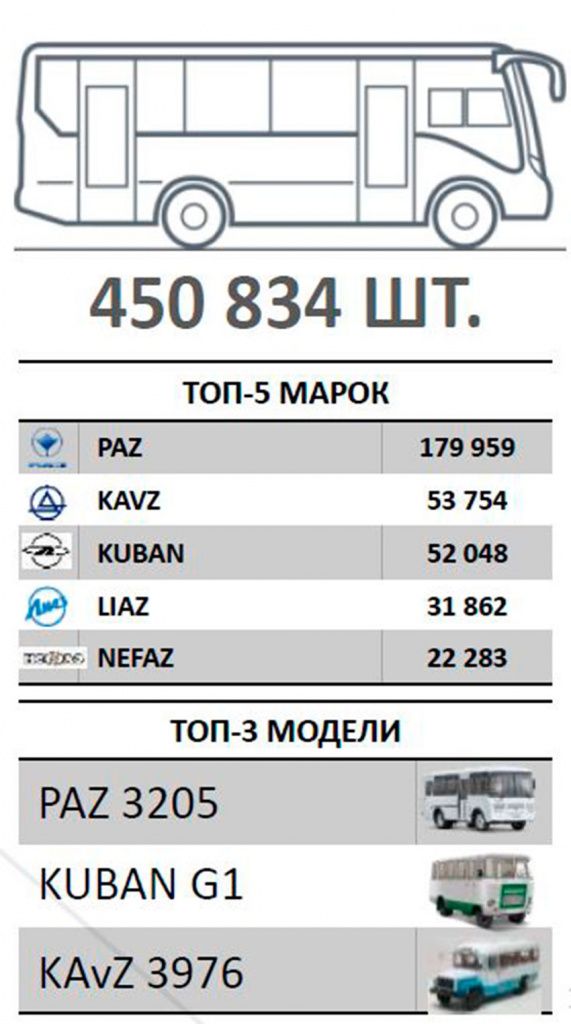

In the Top 3 buses came in, the GROOVE-3205, Kuban-G1 and KAVZ-3976, etcE. machine small capacity on chassis srednetonnazhnye GAS

The fleet of buses in 2018 amounted to 450,8 thousand In the Park, among the Top 5 brands of buses include: a GROOVE 180 thousand, KAVZ – 53.8 thousand, "Kuban" – 52,1 thousand, LiAZ and NefAZ were 31.9 thousand – 22.3 thousand.

Hence it can be concluded that the production of GAS (including the removed quarter of a century ago trucks) virtually dominates in the Park of commercial vehicles of Russia. Still a large proportion not only morally, but also physically worn ZIL (their mass production has been minimized in the distant 1994).

Conclusions ASM-holding in relation to the prospects of the domestic automobile industry while maintaining the current "disastrous for the national automotive industry" trends very pessimistic. So, it is stated that the specific contribution of automotive sector to GDP has decreased over the last 15 years by 47% and its share in gross value added of now does not exceed 0,35%. Because the contribution of industry in GDP is significantly below 1%, it is practically no longer an independent industry in the country. The number of jobs in the automotive industry for 9 years decreased by 113 thousand people or 29% and in the automotive industry, in General, almost half a million! The loss of qualified personnel is that not implemented the development of new domestic products, but mostly is assembling foreign goods imported from the same components. And although technically for the last 9 years, the production of added value per employee increased by 6 times, the social burden on the budget of the state of the dismissed workers has increased significantly. The volume of state support of the industry is constantly growing. Over the last 9 years has grown to 324 times. During this period the value added of the sector increased by 4.2 times

Every ruble of added value of industry in 2017 includes 56 kopecks of state support, which until 2009 was missing at all. In 2009, the figure was less than 1 kopeks on the ruble in production volumes. Serious and, most importantly, the continuous increase in government support is observed, starting in 2014, while in 2016-2017 more than 54% of gross value added accounted for by the automotive industry. However, the effectiveness and principles of implementation of state support is questionable.

Because of anti-Russian sanctions are having significant risks of a sudden stop of the enterprises of the industry (including relatively less dependent on the import of GAZ Group and SOLLERS), which can lead to substantial losses for the state budget. Low sanctions the sustainability of the industry weakens the sovereignty of the state.

However, the current development strategy of automotive industry up to 2025 contains almost no analysis of the risks of application of sanctions, and most importantly, meropryaty to neutralize them.

The results of the applied methods for the localization of "industrial Assembly-1" (Ordinance No. 166) and "industrial Assembly-2" (order No. 566) was very doubtful.

So, was set unrealistically low, the growth target localization by 30% for 7 years of work programs promsborki.

For comparison, in China and India in just 3 years had reached the level of localization in 75% (this must be not only political will, but sustainable and self-sufficient financial system – auth.). In connection with the arrival of new "players" in the market, our country has actually lost its own automotive industry (unfortunately, not even the encroaching, at least to a low level of competitiveness of import – ed.). Was lost skilled personnel (though focused solely on the old technology of designing and manufacturing obsolete products – ed.) in connection with the transition to branded integrated with a minimum level of added value in Russia.

The variety of brands and small volumes of production of most of them, does not allow the localization of production. Hence, the production capacity for the whole of Russia amount to more than 3.6 million, but is loaded only on 40-50% (but the consumers had and still have a decent selection of the most diverse in purpose, quality and price of automotive products that, at least, reduced in recent years, the mortality rate of accidents and the volume of harmful emissions in cities, and forced domestic automakers (read: VAZ, GAZ and UAZ) actively introduce modern passive safety systems and purification of harmful engine emissions –ed.).

Export-import of products of the Russian automotive industry is $4 billion for export and $80 billion on the imports, which gives the enormous figure of 20-fold excess of imports over exports.

Among the constructive recommendations of ASM-holding reform of the industry has clear wishes of the shift control system and statistical reporting of the industry, the use of clear criteria as the contribution of industry to GDP and a more accurate accounting of the actual (not nominal terms) of the degree of localization of cars and the transition to more stringent from the point of view of protection of national market and national industry laws, including closing loopholes for non-localized import machinery through the customs Union countries, to take concrete programme of action in terms of sanctions, designed for 5-10 years., to improve and strengthen tax control to heighten the fight against corruption; to establish clear lines of automobile and auto component industries (what companies to them are, and which are not), to set limits on their responsibility skills; usovershenstvovat measures of state support of the industry on key parameters, such as: with the position of the state: contribution to GDP, jobs, exports, imports, etc. In addition, it is Necessary to move from sales incentives to stimulate production and ensure competitive production factors.

PS Frankly, given the actual lack of competitiveness of domestic enterprises of automobile industry, these figures need to tie volumes of oil and gas exports, just covering the import. Here, then, and it will be clear that the real deindustrialization of the country, which began in the 1990s and is still ongoing, primarily benefit the Russian elite, and saddled the TEK and simplify your business to a simple formula: export raw materials and all finished imported for oil(gas)dollars, of course, leaving a significant part of the rent and trade margins in their pocket. Therefore, sadly but true revival (at the level of global competition) any manufacturing industries in Russia at the moment, at a constant orientation on the raw materials economy to say, of course, possible, but as they say "Vaska listens, Yes eats".

.

|

|

|