The Americans fell back in love with large vans

Market segments commercial vans in the U.S. in 2016, had a choppy

Sales on the American market full-size vans (Large Commercial Vans segment) markedly grew 2016 year

Phony full-size (Large Vans) has risen over the 2016 year 15.4% to 377 971 units, became the highest in the last decade. However, in 2017 year, special innovations not expected, so that sales volume is likely to continue to grow moderately, in particular the expense of the share of the segment of compact vans (Small Commercial Vans segment), at least with the relatively stable fuel prices.

Key figures for the 2016 year:

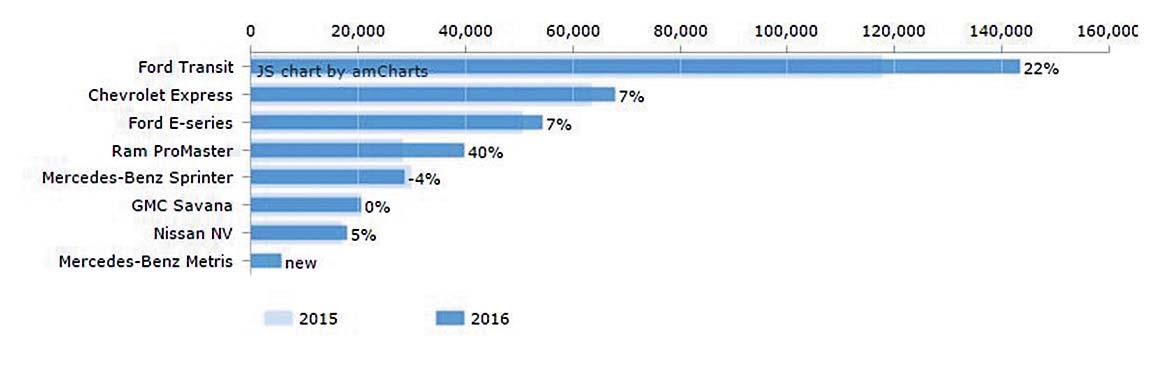

theSales of Ford Transit increased by 22%, again reinforcing the leading position of the model, which became the "king" of a new era of commercial vans in USA that now it is twice superior in sales which occupies the second position in the ranking of sales of the Chevrolet Express.

Just behind the Chevrolet Express has a Ford E‑serie – another wagon of the previous generation, but he probably did not disappear in the near future because of its low price, availability of a wide family of various configurations and steadfast commitment to his fans.

Sales of the RAM Promaster van rose 40% allows him to qualify for the fourth place with Mercedes‑Benz Sprinter.

Van GMC Savana jumped unexpectedly in the last quarter, when sales grew by 59% of than the same period of 2015 year, allowed him to stay ahead is too slow growing Nissan NV.

Sales of new mid-size models Mercedes‑Benz Metris (version MB Vito for the American market) too quickly stabilized at the level slightly below 2000 per quarter too far from hope Daimler AG and raises serious doubts about the appropriateness of bringing to market two models of commercial vans of Mercedes-Benz close dimensions.

The biggest loser among full-size vans Nissan NV – not find your permanent customer

Graph of sales of full-size vans in USA in 2016 year

The segment of compact vans (Small Commercial Vans segment) declined in 2016 year

The segment of compact vans decreased by 10.4% to 84 408 units in the first time since 2009 years, the first place was due to a sharp decline in sales of the bestseller Ford Transit Connect, triggered by the decline in prices for fuel refocusing the customers on the already familiar full-size commercial vans and pickups. In the absence of in 2017 year of fundamental innovations in this segment, its further destiny will depend on a mass of customers ' expectations about the dynamics of prices for fuel the near future.

Key figures for the 2016 year:

theThe undisputed leader of sales in the segment is the Ford Transit Connect, which fell on 17 percent compared to 2016 year, although still superior to second-place Nissan NV200 almost like three times.

Van RAM ProMaster City, which is ahead of Nissan 100 units in the second quarter, all the same way behind in the second half of the year, showing sales in IV quarter 30% lower than for the same 2015 year.

Sales of the Chevrolet City Express (a version of Nissan NV200 under the native American brand), sales of which in 2015 year were almost level with the Ram ProMaster City, literally collapsed in the second half of 2016 years (63%), in bringing its total sales for the year amounted to less than half of what showed his main competitor Ram.

The "fruit" badge-engineering Chevrolet City Express great lost to its Japanese cousin Nissan NV200

Schedule of sales of compact vans in USA in 2016 year

Schedule of sales of compact vans in USA in 2016 year

|

|

|