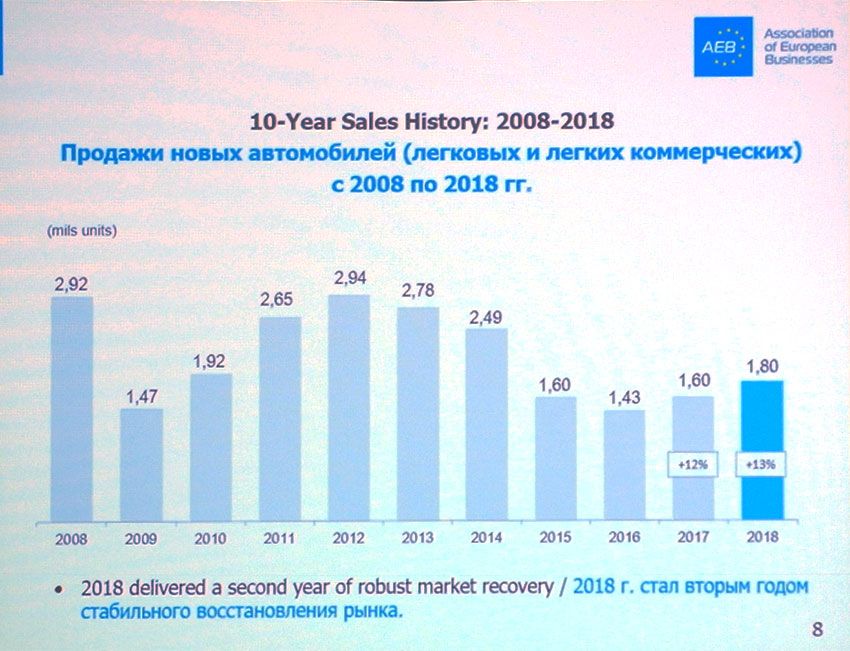

The Russian market of passenger cars and LCVs grew up in 2018, almost 13%

14 January 2019

The AEB noted the success of the Russian market in 2018, but 2019 will need additional acceleration

Today was held the final conference of the AEB at the end of 2018 for the Russian market of passenger cars and light commercial vehicles.

The results, said Chairman of the AEB automobile manufacturers Committee Mr. Joerg Schreiber: "December, with sales up 5.6% (to 175 thousand) better compared to last December (+9,2 thousand cars), summed up the year, noted 12 month period of continuous growth.

Thus, the total Rynek in 2018 has reached the level of 1,801 million, which represented a plus of 12.8% (205 thousand) compared with the previous year.

The prospect for 2019 is not as clear. Increase NDS and possible tightening of US sanctions create significant risks and neopredelennosti on the market, especially in the first quarter. However, based on the assumption of unchanged government policy and constant support for the automotive sector, market participants expect that the fundamental demand will be stable enough to maintain level of sales and output growth during the year. With this in mind, our forecast for 2019, the market of passenger and light commercial vehicles in Russia made with a small improvement, namely 1.87 million, which is 3.6% more than last year."

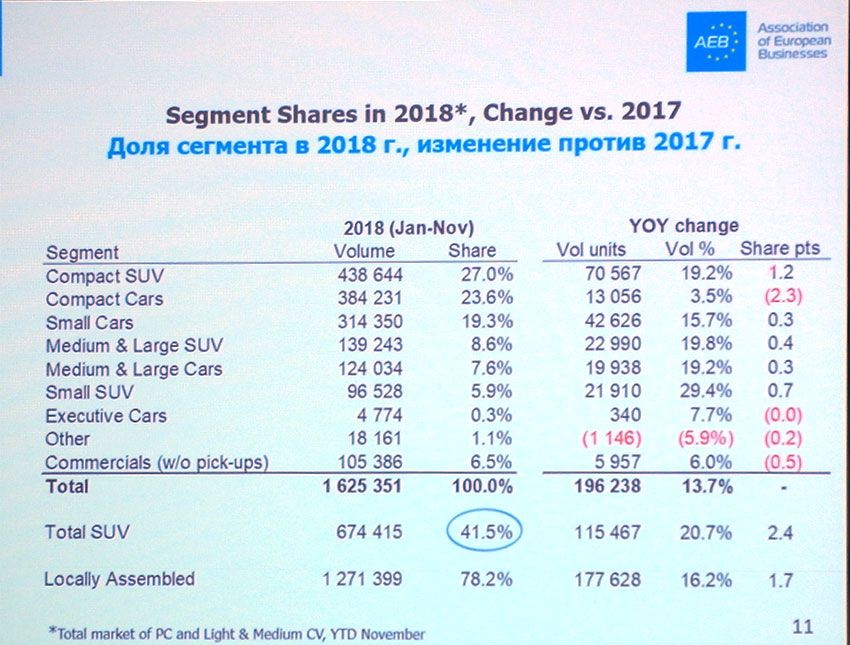

Answering the journalists ' questions, Mr. Schreiber stated that the Russian market continues to rely on cars SUV class, which already took 41%, and in the next 2-3 years the share of this segment can reach 50%, naturally at the expense of reduction of other segments of the market. In addition, about 80% were sold in the Russian market was produced in the Russian Assembly plants.

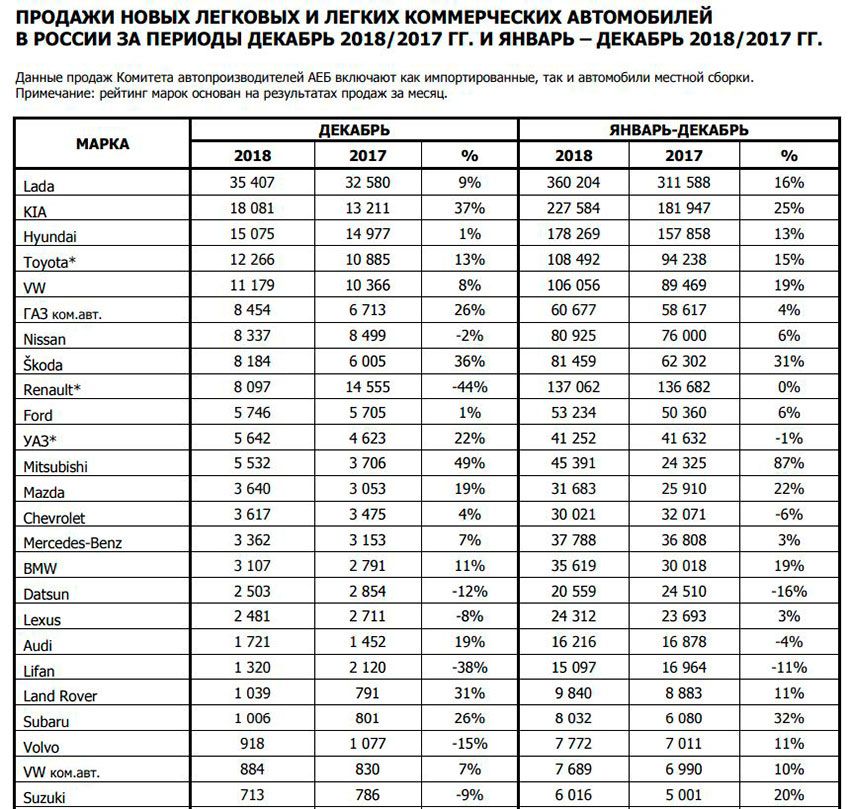

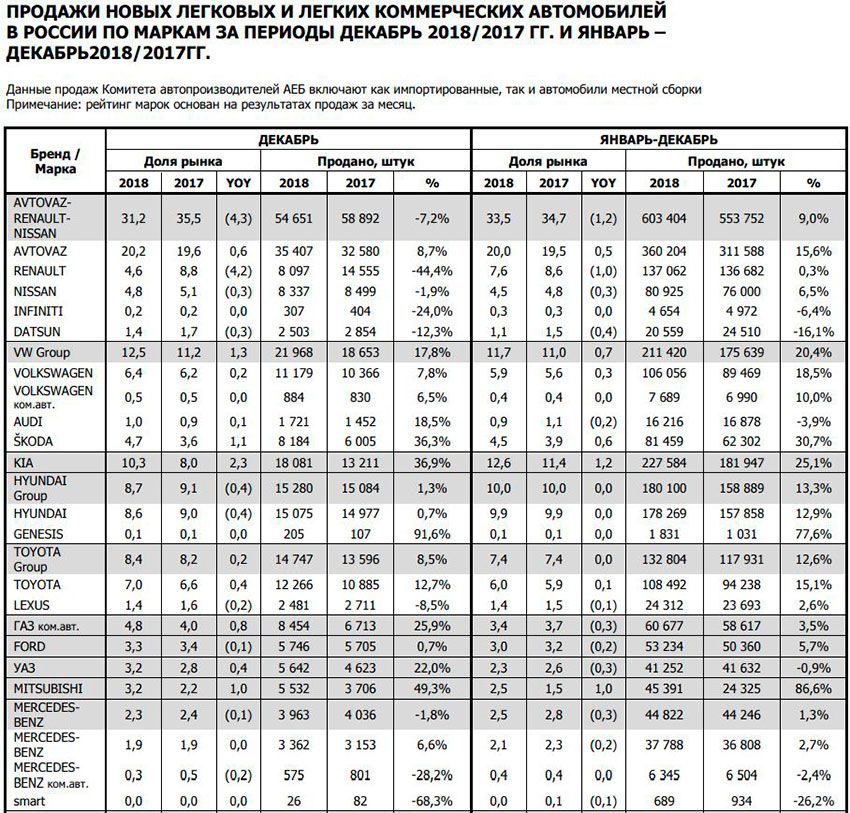

Top 10 brands retooled by the end of 2018

The leader of sales all year remains LADA with 360 204 units (+16%, which is above market), but in December it pokazala an increase of only 9% (although it is also above the market) 35 to 407 units. the "Silver" place firmly and consistently takes KIA with 227 584 units (+25%) and 18 081 units (+37%) in December. The conventional "bronze" keeps Hyundai, respectively, with 178 of 269 units (+13%) and 15 075 units (+1%). Next, on the 4 th place Renault with a zero increment up to 137 062 units and only 9-th place in December with 8097 units (-44% – a record not even in the Top 10, and in the Top 20), and 5-m – with a very large gap Toyota from 108 492 units. (+15%), and even 4-I December 12 266 units (+13%) due to the new models Pokolenie. Year Volkswagen 056 106 units (+19%) was 6th, but in December climbed to 5th place with 11 179 units (+8%). On 7-seat – Skoda with 81 459 units (+31%), and in December, she's only 8-I 8184 units, despite an increase of 36%. Just a little behind her for the year Nissan 80 925 units (+6%) and 7th place in December from 8337 units (-2%). Further, the 9th year GAZ LCV – 60 677 (+4%), but 6th in December due to the leap by 26% to 8454 units rounded out the Top-10 and Ford for the year with 53 234 units (+6%) and December with 5746 units (+1%).

Within the Top 20 final spurt made, such as UAZ with +22% to 5642 units vs -1% for the year (41 of 252 units). More than worthy looks best in the Top 20 in the growth result Mitsubishi with +87% year-to 391 units 45 and +49% in December to 5532 units In the red in the Top 20 and year (18th) and in December (the 17th) was the Datsun, respectively, -16% to 20 559 units and -12% to 2503 units, and closed twenty Lifan -11% up to 15 097 units and -38% to 1320 units, While Lifan is the latest in the market brand with five-digit sales figure and even break the bar in 15 thousand cars a year.

By the way, the highest rate of growth across the market in 2018 Chrysler – 8.2 times up to 74 units, and in December, the HTM is 11.5 to 23 time units. Among the major losers more than six months listed Ravon (pereshedshie from GM in the hands of the Uzbek government), which may not have sold a single car and lost 66% of sales (up to 5184 units).

Share AVTOVAZ on Rinke in 2018, 20% vs 19.5%, but the market in General, it's not so clear the result takes place as if "downsizing" - turbocharged version with a transfer of an impoverished population with more expensive brands budget LADAto the same is largely implemented through preferential loans and leasing, subsidized by the state.

Top 5 models 2018

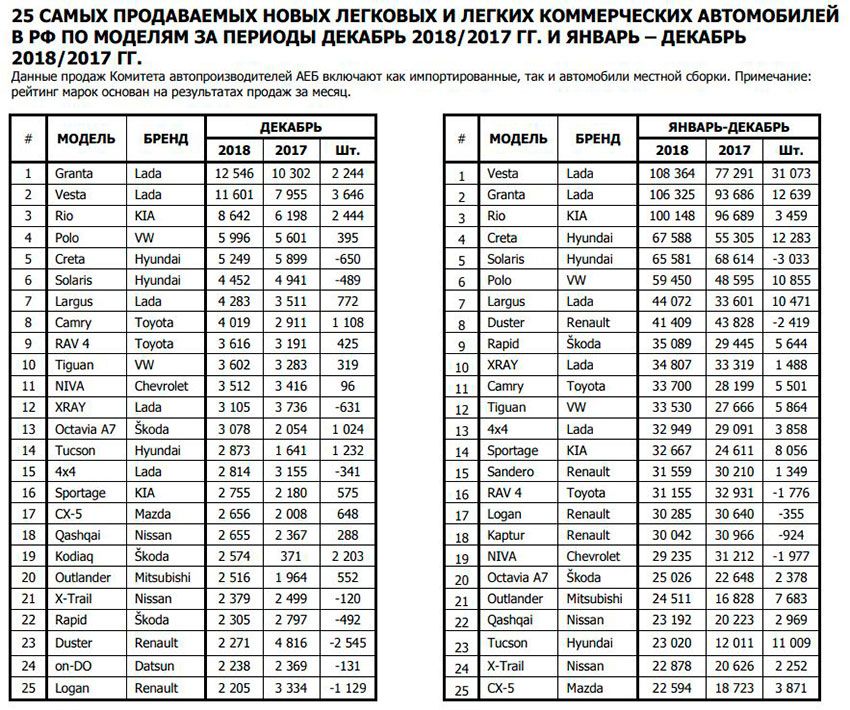

A bestseller only in 2018 became LADA Vestareinforced version in the station wagon SW and SW Cross helped her to increase sales by 40.2% to 108 364 units But in December, the restyled series LADA Granta (absorbed a series of Kalina) was again the leader of the month from 12 546 units (+12.8 percent) and the second year with 106 of 325 units (+13.5 percent). Third place consistently for KIA Rio with 100 148 units (+3.6%), and 8642 units (+39,4%) in December. Fourth place for year Hyundai Creta 67 588 units (+22,2%), and in December – VW Polo 5996 units (+7.1 percent). The top five was closed on the year – the Hyundai Solaris with 65 581 units (-4,4%) and in December, Creta with 5,249 units (-11%).

Expected development of the market in 2019:

Uncertainty arose already from the start – it is unclear how demand will be influenced by the increase in the VAT increase to 20%. On one hand, this factor is already worked by the market in the last quarter of last year, becoming one of the main incentives for the conservation of sufficiently high growth market, on the other hand it is no good the market is promising in the first half of 2019. Further, it is unclear what the government's policy in relation to brands and the market in terms of growth recycling collection and support measures. Here, Mr. Schreiber expressed doubt as to the validity of such a high recycling fees and ultra hard certification procedures of imported cars under the system GLONASS, which should be subjected to crash tests (including side impact and rollover) three copies of each of the model and modification, making it virtually impossible to implement in the country Dorogi short-run car – maker will be forced to reallocate a hefty price of the destroyed car (sometimes in the tens of millions of rubles) on the rest of the sold, while the volume of their sales may not exceed a few tens or even units, which of course makes them totally uncompetitive. This is the question, how will develop the Russian market.

Output AEB: the market will impoverish in terms of diversity of models, as an increasing number of people on the market brands will sell only 2-3 bedrooms and only one model (mostly it will be SUV). In addition the unpredictability of the market adds the volatility of the ruble based on not only oil, but to an even greater extent, already from the next package of anti-Russian sanctions adopted by Western countries under US pressure.

So that the beginning of 2019 will be very difficult, including because of the high base last year, so without the proper support system from the state can not do. More chances of a recovery in sales the AEB is seen in the second half of the year as underlying demand should outweigh the amount of uncertainty.

the Main activities of the automobile Manufacturers Committee of the AEB in 2019

At the request of Mr. Schreiber, the automobile Manufacturers Committee considers necessary to preserve the measures of state support of the industry, although still they remain unclear, the Effectiveness of these measures can be guaranteed by the direct participation of industry representatives in their development.

Disturbing factor also acts as a possible increase in the recycling fee, in this connection, the Committee strongly appeals to the Government of Russia with a wish to announce the upcoming "reforms" in advance, as the nervousness due to uncertainty in either the quality or the profitability of the business improves. One more problem requiring urgent solution is the double payment of the recycling fee for vehicles produced or importowanie in Russia to markets of other member countries of the EEU.

For automakers it is also regulatory uncertainty, the local proizvodstvaincluding conditions of detention Speke, which complicates the process of making and implementing critical decisions on investments.

In addition, the Committee considers that despite the definite policy of the Russian Government on further promotion of domestic production and preservation of favorable conditions for domestic producers by protecting the market from ready-made imported models, fair and equitable conditions should be provided for both types of products, as collected in Russia and imported models are suitable for different segments, and the risk of "internal cannibalism" at the segments and amounts excluded.

About e-title that must be entered November 1, 2019, in the Committee's view still needs to be done quite a lot of work and resolved all the contentious issues between stakeholders, specifically between public authorities, operators, distributors and dealers. This requirement is key to ensure the smooth continuation of sales in the market.

To this time to the Law "On protection of consumer rights" is not included AEB proposed changes (replacement machines under warranty and the sources zapchastey)that leads to additional costs and risks on the part of distributors and dealers.

The automobile manufacturers Committee supports the Government's measures to increase the export potential localized productii. Avtoproyzvodytely from Russia are interested in entering the foreign markets, but without serious support from the state finances and the more active work of Russian trade missions abroad not to do.

One of the main positive aspects of last year, automobile Manufacturers Committee, called the signing of Memorandum of understanding between the AEB and the ROAD in October 2018. The purpose of the Memorandum is the establishment of a fair, open and fair rules of competitive interaction in the market of sales of cars of the Russian Federation. The Memorandum brings together in a single document good practices of manufacturers / retailers and official dealers. By the end of 2018 more than 50% of the members of the Committee acceded to the Memorandum.

Among other tasks: support yuridicheskih iniziative according to the insurance conducive usilenii the security vladeltsev quality car repair authorized dealers.

The plans of the automobile Manufacturers Committee in respect New Tecnologies – podderzhke prodvijenie Lubich osili, napravlennyh with the development rinka innovative vehicles, including elektricheskih, gibridnykh, avtonomnykhand vehicles on alternative fuels.

By the way, on the issue of low representation of leading brands at the Moscow International avtosalone in August 2018, Mr. Schreiber replied that it was on the one hand caused by a relatively "small" (!) volume of the Russian market ("only" fifth in Europe), and on the other hand "extinction" dealers as such due to the transition to a more efficient online trading cars (frankly about the decline of the auto repeat for a century, and they all deistvuyut – just automakers never beneficial to compare in a forehead its products from competitors, but now to justify the invented excuse about online car dealer ed.).

Alternatively, the "boring" official avtosalonu proposed interactive Festival of Motoring in Sochi from 18 to 21 July at the circuit of Sochi (which is a Russian stage "Formula 1"), which the AEB in cooperation with Messe Frankfurt, in collaboration with Goodwood, developed and offered to member companies of the Committee for the new interactive format of automotive events – combining elements of the exotic-motor-show fair entertainment and open dealer sites for visitors of all ages (including families), and diverse interests to the cars, including journalists.

background: the automobile Manufacturers Committee of the AEB is operating in Russia for 21 years (since 1998), has 26 member companies (from AVTOVAZ to Volvo Cars, including divisions of General Motors Russia and CIS FCA) and 46 car brands (Acura and from Ala Romeo to UAZ Volkswagen and Volvo), which are responsible for 98% of passenger car sales in our country. The automobile Manufacturers Committee of the AEB is partnering with international and national associations and unions..

|

|

|

Element was not found.