Friday was for oil black

23 November 2018

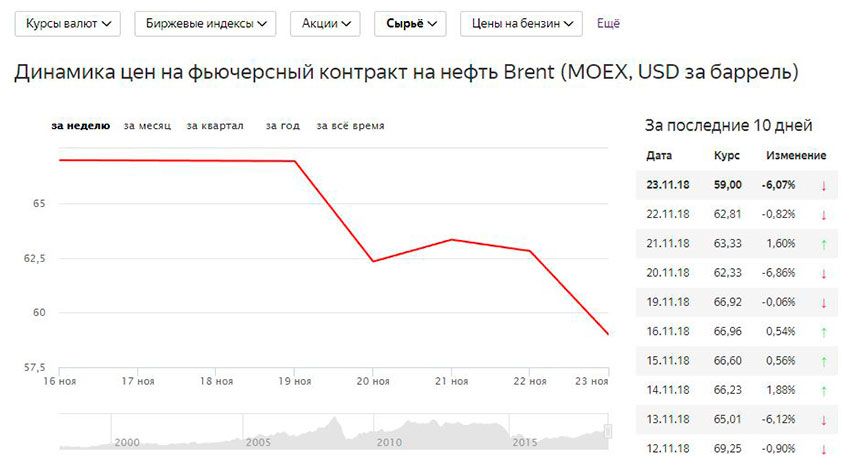

23 November crude oil fell below $59 per barrel

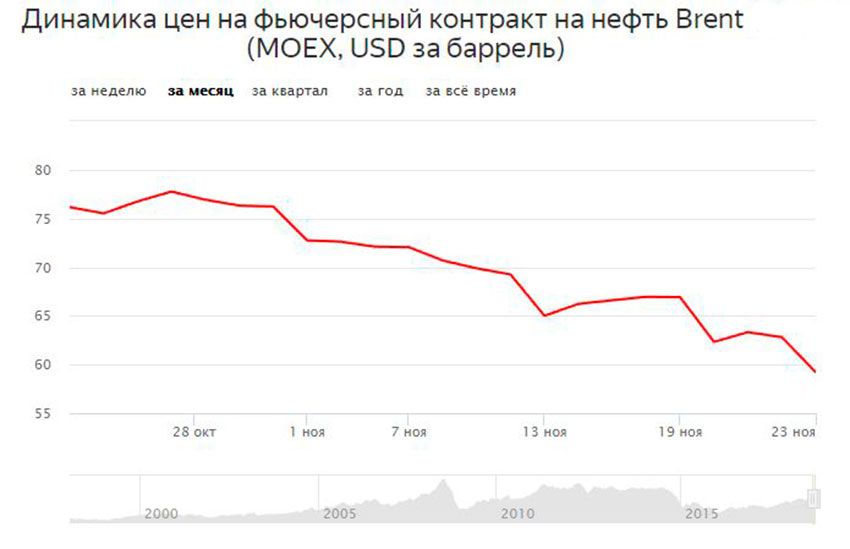

Although the oil markets fell all week, but on Friday November 23, simply collapsed. By the end of the day Brent crude oil prices fell 7%, to $58,76 per barrel (159 liters). Thus, from the beginning of November the oil has lost more than 1/5 of its price.

Today the future of the Alliance OPEC+, which so recently was proud of our government already does not inspire market is no optimism, i.e., the doubt that its members (read Saudi Arabia and Russia) are able to agree again on the next production cuts at the next meeting in December is minimal, and this against the background of a significant decline in demand for "black gold" against the backdrop of slowing the progress of the world economy. So that once the threshold for quotations is likely to be the level of $55-58.

More recently, Russian energy Minister Alexander Novak has already predicted the return of the barrel to the level of $50-55. He noted that the rising cost of a barrel over &80 wore short i.e. opportunistic in nature (due to fears of tough sanctions against Iran), but in the long run the price of a barrel will not exceed $50. About the same forecast adhere, and other eminent analysts.

|

|

|

Element was not found.