The prospects of new budget LCV in Russia pessimistic

28 June 2019

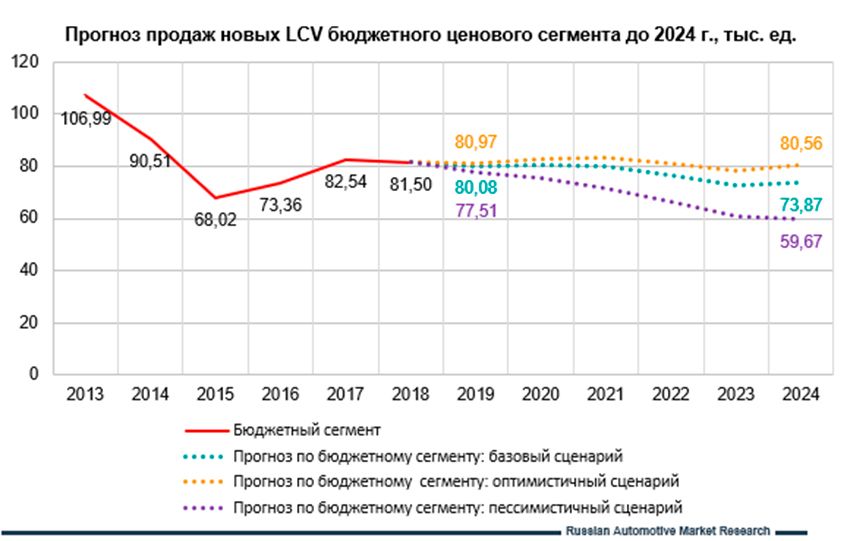

In 2019, the market of new LCV will fall by 3.6%, but 2024-mu could fall by more than a quarter

Report RAMR on the market of new LCV (light commercial vehicles and pickup trucks) in addition to financial capacity, price changes, production volumes, size of dealer networks, legal factors, and macroeconomic indicators vkluchaet and forecast of sales of new LCVs in Russia in the years 2019-2024, and the production forecast for LCVs.

Thus, according to the baseline scenario, the current 2019, the market of new LCV can be reduced by 3.57% to reach thousand of 116.44

The share of LCV budget price segment (the Russian brand GAZ and UAZ) can be increased to 68.77%, and the share of the middle (localized foreign cars, for example, Ford) and premium (European brands) segments can be reduced to 5.63% and 25.6%, respectively.

In 2024, the share of the budget price segment may be almost the same 68,37%.

optimistic market in 2019 the budget segment LCV will drop slightly – to 80,97 million, and by 2024 will remain virtually at the same level – 80,56 thousand

worst case scenario is much bleaker. So this year, the failure of LCV will be a significant budget by 4.9% to 77,51 million, and by 2024, it may even fall to 59,67 thousand, representing -26,8% to 2018. Thus, it is the budget segment may LCVs in Russia may be the most depressive, this means that domestic producers, now residing in the doldrums you will need to "run faster".

|

|

|

Element was not found.