The Chinese market for electric vehicles and hybrids in September and the brilliance of aliens on a background of depression local

22 October 2019

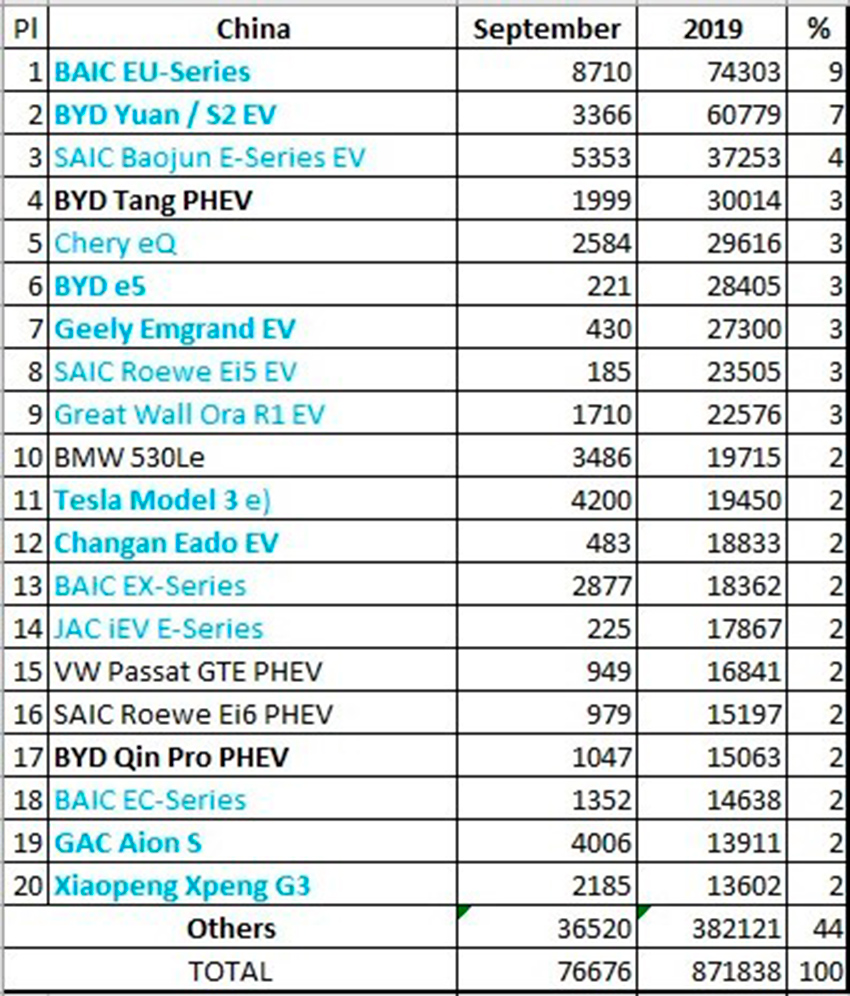

Top 3 NEV market in China is Tesla Model 3, GAC Aion's and BMW 530Le

Portal EV Sales says: it seems that in the Chinese market transport new sources of energy (NEV) there is no end to the hangover – due to end apogi stimulate sales fell last month by 27% over the same period in 2018, while plug-in hybrids (PHEV) lost, in General, 45% while battery electric vehicles (BEV) went to the red zone, falling by 20%. The total market decline was not as catastrophic, showing only minus 6% yoy.

In the midst of this storm, the proportion of penetration of NEV fell in September to 4%, with the result that the share of the PEV market from the beginning of 2019 has decreased to 5.7% (from 4.4% showed only BEV), which, however, still higher than the result of 2018 (4,2%). However, if the market will continue to decline until the end of the year, the growth rate in 2019 will be minimal compared to the exponential than in previous years.

The reason for this chain of falls is in the reordering of the grants, which occurred June 26, when Beijing completely phased out subsidies for electric vehicles with power reserve on a single charge of the rechargeable battery is less than 250 km, while for electric vehicles with a large power reserve of subsidies has been halved.

And although since then the market has become less dependent on subsidies, but smaller and cheaper models, local producers can no longer compete after the loss of the subsidy, while the opposite segment of the market with premium models continued to flourish, and in favor of foreign manufacturers, which increased its market share to 13%.

Currently, China remains the fastest growing market of electric vehicle on the planet: several new models are superior to the bestsellers of the last year, for example, the just-released BYD e2 (2078 units.), crossover SOL E20X (2236 units) from JAC and a new sub-brand from Volkswagen – NIO ES6 (2190 units).

BYD e2

SOL E20X

NIO ES6

In September, among the bestsellers was the following model: the third place Tesla Model 3, on a 4-m – GAC Aion S and 5-m – BMW 530Le, which should become permanent players in future ratings of the Top 5.Here last September's Top 5 best-selling passenger cars segment, NEV:

No. 1 – series BAIC EU: electric sedan EU7 sold last month in the number of units of 8710, so the Beijing Auto brand regained the monthly title of "Best seller", improving sales by 15% on a monthly basis. Advanced design and specifications (158 kW, 416 km on the NEDC) and the price of $32 500 allow him to remain popular, but with increasing competition every month BAIC ahead of hard work, if he wants to continue to lead the way.

No. 2 – Baojun E-Series: with the end of subsidies for most of the city's electric cars, unable to attain a minimum mileage of 250 km, those manufacturers who still retained access to subventions from the local budgets, increased sales, and none of them did it more impressively than JV of Shanghai Auto and General Motors – the Baojun series E-Series (E100 and E200 – ed.). Recent months have become for a tiny double sitemobile best, so in September they were recorded 5353 units Updated filling, thanks to the new battery capacity of 24 kWh, has become an important tool to achieve the minimum required to obtain the subsidy reserve, which coupled with its competitive price 93 900 yuan ($14 700) excluding subsidies, made him a very attractive model, especially considering its modern design and good for its class of equipment.

No. 3 – Tesla Model 3: "banner" modern electric mobility has not yet captured this market segment by storm, as it was in other places (in the US and Western Europe – ed.). However, the Tesla Model 3 is already paving his furrow in the Chinese market: the implementation of approximately 4,200 machines in September allowed him to reach the podium. At the moment, the Tesla brand is far from domination in North America or Europe but with the launch of a local plant Gigafactory 3, which should happen in a few weeks, sporting the silhouette of the Model 3 should soon become commonplace in the Top-5 models of NEV.

No. 4 GAC Aion S: a few months ago, EV Sales have already mentioned the great potential of this elektrosetey, predicting that it could reach sales of even 10,000 units per month. And so far, Aion's doing quite well, so this streamlined sedan, which is on the market only a fifth month, has become a 4-m 4006 units, and this is its third consecutive month in the Top 5. Inspired by the Tesla Model 3, GAC has high hopes for its new range of electric cars under sub-brand Aion. Today it includes sedan Aion's, and soon will be followed by a midsize SUV LX. Itself Aion's in addition to stylish and sleek (Cx=0,245) of the body, and shows other impressive features: so, its battery model CATL NCM 811 with a capacity of 59 kW·h, implements the reserve according to the NEDC is equal to 510 km and included a system of Autonomous driving 2 level, but the real problem for Tesla is its price: about 180,000 yuan ($26 000) before subsidies. As told to Kanye West: "Now I'm not saying it's right Tesla killer, but Aion definitely goes on the best sellers...".

No. 5 – BMW 530Le: the rise of sales of a luxury BMW sedan in the local market shows two intersecting trends: first, the enormous potential demand for environmentally friendly vehicles in China, and secondly, the need to comply with quotas for sales of imported NEV. Put them together and you get 3486 units, which was a new record result for the import of foreign cars, even without access to subsidies (again, let's face it, subsidies for hybrids with such a price tag not really matter much, just their buyers will rather spend the money saved on more sophisticated light alloy rims or accessories...), so the category of "Luxury", will likely remain with the sales of over 3,000 units per month, much higher than its direct competitors, would be happy to get to the bar in 1000 units per month.

Rating for the first three quarters 2019

The market is now adapted to the new reality that many models have lost access to subsidies.

BYD Tang PHEV

The most important changes in the ranking of sales NEV since the beginning of the year: BYD Tang PHEV became the 4th and Chery eQ – 5, up one position due to the BYD e5, whose sales decreased by 221 units.

BYD e5 450

Electrostan BYD e5, popular among taxi drivers, is now caught between a rock (subsidy reduction) and a hard place (internal competition, with a new electrocreaser BYD e2), so the automaker needs to do something if he wants to revive a sufficiently large-scale sales of his model-nurse.Such foreigners as the BMW 530Le and Tesla Model 3 has benefited from strong deliveries last month that allowed them to climb a few positions in the ranking: the German sedan has reached the 10th position, and Californian, respectively, 11.

However, based on the difference between the models separated by only 265. we will surely see the end of this year quite interesting race for the title of best foreign models. Follow the news...

BYD EX5

Another model, benefiting from the drought, which affected many of the models, was a series of BAIC EX5, who rose to 13th position, while her younger brother EC, stuck in the 18-th position.

GAC Aion S

Another important event was the fact that the GAC Aion's entered the Top 20 in 19th position due to 4006 units, which was his 4th in a row the best result in just 5 months on the market, and left it another 3 months, so will not be too surprising if at the end of 2019, he will even enter the Top 10. Well, next year he probably will be on the shoulder of the entry and the top five... the

Apparently, the new sub-brand SOL has launched a regular supply of E20X – which resulted in 2236 units, while in September, NIO ES6 reached 2190 units, which allowed the brand to remain among the best-selling start-UPS,

SAIC MG eZS

well, electrocreaser SAIC MG eZS have sold 1800 units, which is very successful for models with high ambitions in export markets.

Tesla Model X

You can also mention the implementation of about 1400 units electrocreaser Tesla Model X – the best selling premium SUV last month, but the California brand I bet 1500 units. NIO ES8 sold (8500 units of cars of this brand since the beginning of the year)

NIO ES8

so that by the end of 2019 for Tesla can be a very difficult task to surpass NIO from this segment of the market.As for the rating of manufacturers, BYD (19%, down 4%) is losing momentum, while being much below him BAIC (13%, up 1%) and SAIC (10%, up 1%) benefit through new products, increasing their shares.

Beyond the catwalk is Geely (6%), which is only watching the leaders from a distance, and at the same time dominates smaller players (Chery, Great Wall, JAC...) behind him.

Will this artificial "natural selection" in the market become more competitive? At the moment the best foreign car (from Tesla, BMW and VW for 3% of the market) already exceeds by several local brands, and these leaders have now got the decisive break in this highly competitive market.

On the other hand, it seems that in the future only about 5-6 Chinese manufacturers of electric cars will be able to work with the best international brands,

Any bets on where and with whom they will be?.

|

|

|

Element was not found.