"Interauto-2017" not afraid of devil's dozen

25 August 2017

In the exhibition complex "Crocus Expo" began the exhibition "Interauto-2017"

Wednesday, August 23, in "Crocus Expo" has started 13 at the exhibition of auto components and equipment in Russia, known as the "Interauto". On this site for more than a decade there are annually more than 30 thousand specialists and professionals of the automotive industry. Information sponsors of the exhibition traditionally are of NP "Association of Russian automakers" (oar) and the national Association of Automotive Component Manufacturers (NAPAK).

Components for Interauto presents a variety, for example, seat covers...

This year the exhibition occupied three halls of the First pavilion of "Crocus Expo" – a total of more than 26 000 m2, which is the display of some four hundred companies from fucking dozens of countries from Belarus to Japan, and 34 regions of Russia: from Saint Petersburg to Primorsky Krai, and from Perm to Astrakhan, which presented the latest developments and innovations in almost all areas of the automotive market: auto components, car service, car care, auto electrician, repair service, security systems, tire and others.

...or the original armrests

Among the giants of the world of accessories, fuel and other automaterialen present TD "TAKEN", "BUSINESS KAR REFINISH", TD "grass", "Evrodetal", GK "Sapphire", NGOs, CIVIC, SUPROTEC COMPANY, TRITON-IMPORT "Troll Car", ABRO, AGA, Brain Storm, Chicago Pneumatic, IMG, INTERPUMP GROUP SPA, JTC, KIEHL, NORDBERG, ROSSVIK, SNA Europe (RUS) LCC, Solar Gard, TWINMAX OY / Apollo Vredestein B. V., Xenum, and many, many others. And their number is multiplying every year – in 2017 beginners "Interauto-2017" were th "AKKOR", "Arsenal Service", "ATAS KEMIKL", "GELENA HIMAVTO", "KAREKS" ha "N.Com", "Modern Technologies" (DKR), "Nevsky Filter", "Wild", network, car wash self, "My-ka!", Elprom Elhovo, GOLDEN SNAIL, International Group For Modern Coatings, Washtec.

Chinese manufacturers offer a variety of accessories and components.

In an increasingly popular segment of the body repair represented the company "Russian Paints", Axalta Coating Systems, NIPPON PAINT, ceramic tiles, TROTON, MIPA CARTEC OSCCAR, MULTI FULLER, successfully otvoevyvaya their place under the sun.

For example, the nameplates of well-known brands – for collectors?

Not struck in a dirt the person in the field of import substitution and domestic manufacturers of automotive components, equipment, paint products and accessories, presenting the products are not worse imported counterparts.

The tire on the highest level

The best way for the manufacturer to be awarded the independent national award "Autocomponent of year" which will win the brand that showed the best results in the comparative trials.

And yet, the most interesting event for professionals was the IV Assembly (MAA-2017), which includes 12 thematic sections on issues including the state of the Russian market of cars and components and problems of development of infrastructure of electric vehicles (on 25 th).

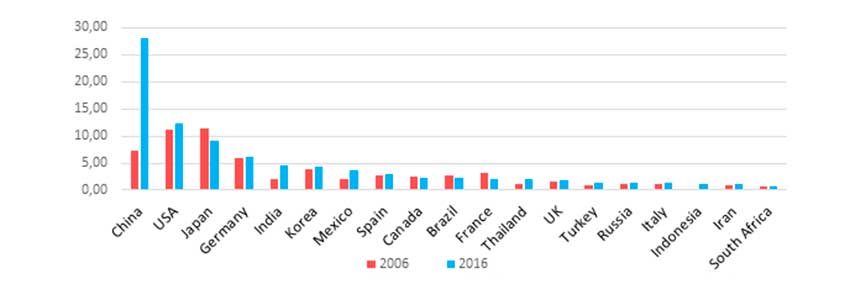

World production by country, million

Thus, in the framework of the seminar on the Russian automotive market, the representative of NAPI T. Arabadji clearly the graphs showed that the Russian car industry on a global scale is not too much added over the period 2006-2016, and today is only the 15th place, just between Turkey and Italy, only just going out of the crisis well.

Against the fantastic backdrop of the rise of China over the same period from 6 to 28 million vehicles per year it could even be called sad, besides the lion's share of production now constitute the Russian foreign cars with very different degree of localization (some of which honestly should have been wholly imported). By 2022, production of the domestic industry in accordance with NAPI will not even reach 2 million (or rather will be produced 1,968 million cars – amazing accuracy at such a time warp – as they say, wait and see).

Would you like a seat cover from the skins of the Shanghai leopard?

Russian market according to this forecast will reach a strap 2.5 million, and the optimistic scenario – if for any force majeure reasons, such as ending tax incentives for assemblers (1.4 million) they go from here, the remaining capacity of domestic producers (0.7 million) just will not be able to cover the resulting deficit – I never thought that along with the other "greetings from the USSR", at least theoretically, can come back and queue for cars. Of course, even faster than the Russian market with such a "pessimistic" scenario would leave foreign manufacturers and this will also be a factor in reducing production, because a considerable part of and "domestic" models uses imported components. Another interesting chart shows the overwhelming position of Russia on the market of the Eurasian Economic Union (EEU). So in 2016, its share in exports to the EAEU was 56%, and import from them – only 1% of the Russian market. By 2022, nothing will change in Russia, the same will be sold 2,5 million cars, and in the other countries of 250 thousand against 200 thousand in 2014. Respectively, and production in Russia will rise from 2014 to 2022 with 1 888 000 up to 1 000 968 million, and in other countries – only from 63 to 65 thousand the Level of localization to mid-2018 will reach 50%.

Visitors were attracted by the cute models-stand models...

One of vectors of development of Russian market will curb growth, owners of new cars because of the demographics – the population is aging but living longer without changing their old vehicles with new, while in Metropolitan areas also reached the limit of saturation due to traffic jams, lack of Parking, and priority development of public transport, in addition, the market for second-hand increasingly presses on the market of new cars.

...and even female robots!

In 2019 under the agreement of Russia at accession to WTO import duties on cars will be reduced to 15%, and in 2020 will end the agreement on industrial Assembly – here the question arises – what will happen to 75% of the nation under foreign brands of cars? Leave foreign producers or stay?

Only a few manufacturers used real cars show stoppers and models

Cars for export from Russia the best time never comes, because the requirements of foreign markets localisation, stricter standards on emissions, tariff barriers and other factors will only increase, however, as the price of the market penetration of specific countries.

Clear demonstration of the possibilities of the compact miniLIFT lift from the company KosmetikAVTO

The passenger car market will move to more economical and at the same time more specialized models, while in the cities the demand will be more sluggish due to competition with public transport and taxi (car sharing), and in rural areas, on the contrary, will increase due to the request for increased mobility, including in the segment of 4x4.

Do you want to clean up and vacuum?

In the longer term will be extended to apply telematic systems and unmanned control.

On the commercial vehicles market of Russia the prospect of a more favorable, though, due to the size of the market – today we have the 4th largest fleet on the planet. Russian car industry is large enough by the standards of Europe, and are present in almost all major world producers. The share of domestic brands in the segment of trucks (both LCV and HCV) in the segment of buses is much higher than in the passenger car segment, but experiences significant fluctuations from year to year: among the trucks 45 to 70% and among the buses from 50 to 70%. In addition, when recovery of the market have hard to compete with imports. Consumers are beginning to demand more reliable lifting and at the same time is cheaper to run model. Develop telematic and logistic systems as well as GLONASS. In the cities there is a replacement of minibuses in favour of larger machines, while in small towns and rural areas there is competition from LCV cars. But export prospects for the Russian commercial vehicles better than for cars, but for the markets of the third world countries face a serious battle with Chinese and Indian competitors.

You only have to align, or even paint?

Among the manufacturers of the highest level (TIER1) with full localization includes only AVTOVAZ and UAZ, to the second level TIER2 (partial localisation and CKD Assembly) – Renault-Nissan, Hyundai-KIA and Volkswagen. Respectively the largest segment for manufacturers of spare parts for cars – is a Russian brand, as well as foreign cars of an average price segment, sedans, SUVs, diesel models and cars of Japanese brands. In the medium term will be added to the Korean car brands.

At the stand of avtoperevozchikov and encyclopedias from Yearbook "world Cars" honorary top spot

In the LCV segment is the highest level TIER1 domestic Gas, UAZ, AVTOVAZ, and all of them are in low-cost segment. For suppliers of spare parts for LCV the most attractive segments of the domestic brands, the diesel and petrol models, but the LCV market in natural gas still will not be attractive even in the medium term because of its small size. In the segment of trucks (MCV and HCV), domestic producers TIER1 KAMAZ and GAZ Group also occupy the low-cost segment and the recovery of the market is also beginning to feel pressure from the cars. One of the biggest segments of spare parts in the market are aftermarket parts from third party suppliers, in addition, most sales are made on spare parts for Russian and Belarusian (MAZ read) stamps and diesel trucks in General, but the prospects for gas trucks is weak.

Stands the car is located on the outside area

Bus segment during recovery, the most attractive for cars (it rose sharply in the second quarter of 2017), but remains an important segment of the it budget (low-cost) segment. A major producer TIER1 here is GAZ Group. The most significant segments of the parts here is the domestic brands and aftermarket suppliers.

The most powerful and original stands, however, tire companies

In General, the problem with the supply of components of the Russian manufacturers is reduced to an actual lack of suppliers of the first level, the slow rate of recovery to pre-crisis level of production, a vague prospects in the field of state tariffs, customs and certification regulation and low level of domestic perspective of the development in telematics, robotics and other leading for the global automotive industry innovation. Respectively for domestic producers is too high input investment barrier. The majority of Russian suppliers (SME) component has no experience of exporting its products and does not aspire to it, quite content with the internal market. At the same time they have access to new technologies and know-how, financial tools, but no experience in international cooperation and division of labor.

Most attractive stand was in the car wash self-service "My-ka!"

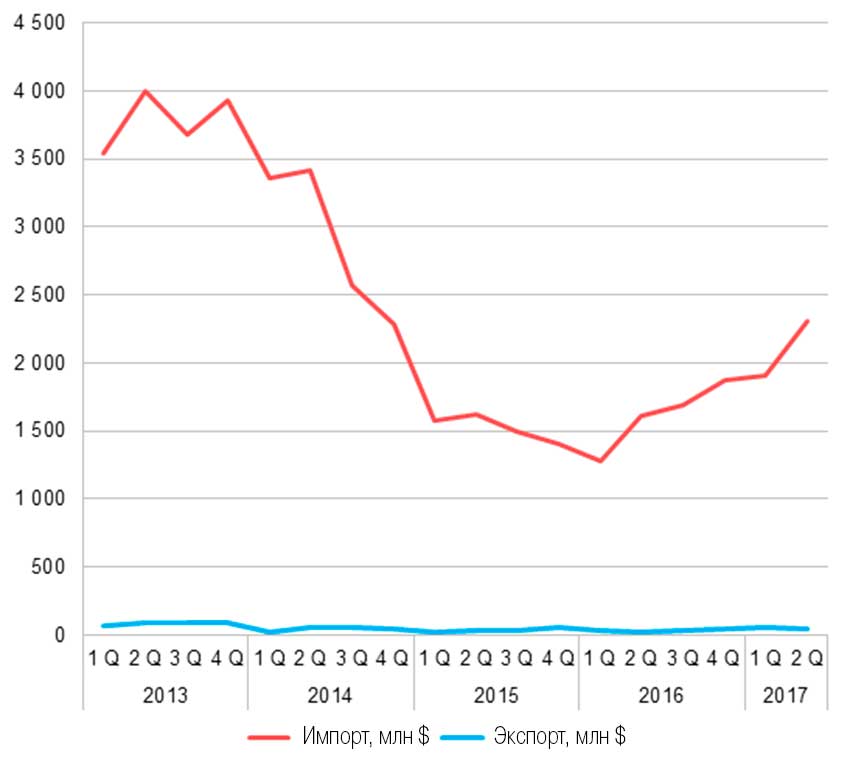

In the period 2013-2016 import automotive components and spare parts in Russia fell in 2014 and 2015 after the exchange rate, but in 2016 began to recover (5.7% in USD). For the first half of 2017, the recovery went even faster (45.7% compared to the same period in 2016). And the most rapidly growing import of it spare parts for the aftermarket. The export of auto components and spare parts from Russia continuously decreases starting in 2013 (6.7% in 2016). However, here the trend is beginning to change, so for the first half of the year the growth amounted to 55.6% on the background of the appreciation of the ruble against the dollar and the Euro.

Import and export of automotive components in Russia

Against this background, a definite exception is the tire industry, does not receive any special state programmes of support, but is developing quite steadily. Now in Russia there are localized production of almost all major global tire manufacturers and exports in 2015, on par with imports, and in 2016 even surpassed it. The power of domestic producers constitute 29.3 million tires per year, and foreign brands – 37.7 million a year. Thus, it is the size of the market, not the level of protectionism, is the decisive factor. However, to remain competitive the market needs an inflow of foreign investment and technology.

Conclusion NAPI – the Russian market is one of the largest in the world for budget parts. It is most attractive for the supply of it parts and not components for the Assembly OEMs. Therefore, the main goal for today is to localize the production of it parts, not accessories.

The report NP oar (Association of Russian Automakers) held on his head by I. Korovkin it was noted that the "development strategy of automotive industry in Russia until 2025" does not actually take into account such factors as environmental safety (yet not even an approximate time frame of implementation in Russia of Euro-6, which is already affecting our international carriers due to bureaucratic slowness of the bodies of the UEC EEU).

In addition, despite the active development budget utilization fee, the real implementation of environmentally sound technologies there, including at the level of the EEC, EEU, and no construction waste disposal vehicles, as, for example, disposing of environmentally hazardous lithium batteries electric cars never started at any level. Also the sad state of Affairs on energy saving and energy efficiency. In the framework of the Strategy until 2025 the production of cars in the country is expected to grow in 2016 from 1.12 to 2.12 million, LCV – from 110 thousand to 220 thousand, trucks – from 61 thousand to 110,3 thousand, and buses – from 12.7 to 20.1 thousand thousand Market would increase from 1.31 million to 2.21 million in cars, from 120 thousand to 210 thousand for LCV, from 65.4 to 99.8 thousand thousand on the truck and from 12.64 to 19.43 thousand thousand buses. Imports, respectively, will increase: from 265,2 340,9 thousand to thousand for the automobile, from 12.4 to of 21.43 thousand LCV, from 10.82 to 11.69 thousand thousand on the truck with 470 units to 650 units on buses. Estimated SAR, the actual proportion of localization for the models and Russian brands "Russian foreign cars" for 2016 made: automobile 70% vs 45%, according to LCV – 75% against 35% for trucks, respectively, 80 and 30%, and buses 80 and 15%. In this case the budget for the whole period until 2025 projected annual costs at the level of 65 billion rubles, which means the actual gradual reduction of inflation and the devaluation of the ruble. National Association of Automotive Component Manufacturers (NAPAK) – Rapporteur M. Sviridov, in turn, says that domestic manufacturers of automotive components there are prospects not only in fuel and paints, but also in the production of plastic products, aluminum die casting, and so forth, but only under the condition of introducing a vertically integrated multi-level database of suppliers of automotive and industrial components, competencies of suppliers and technology transfer. NAPAK facilitates the localization of innovative projects suppliers in the regions of Russia. Ultimately the Russian car industry should be fully implemented in the global automotive market.

.

|

|

|

Element was not found.