Drivers will attach MSC

25 September 2018

Reform of insurance has passed both houses of Parliament

Today in the press center of ITAR-TASS held a press-conference on results of the parliamentary hearings (in the lower and upper chambers of Parliament) on "Improving the Federal law "On mandatory insurance of civil liability of owners of vehicles".

Among the participants of the press conference (left to right) were: head of Department "Stock market and financial engineering" of the faculty of Finance and banking Rankigs Konstantin Korischenko, the President of the Russian Union of insurers Igor Yurgens, Executive Director of the Russian Association of motor insurers Evgenie Ufimtsev, coordinator of the Society blue buckets Peter Shkumatov and head of the Department of quantitative Research holding ROMIR Svetlana Polikaninai.

I. G. Jurgens

During the press conference there were a number of interesting points and numbers is important to understanding the current state and the vector of future development of CTP market, and its influence on accident statistics and the mentality of Russian drivers in General.

E. V. Ufimtsev

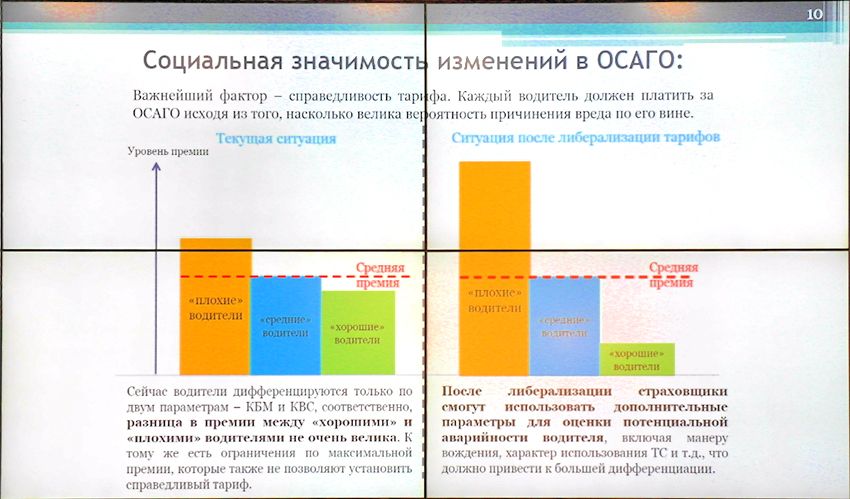

So according to ROMIR 50% of road accident make only 5% of drivers (i.e. about 1.5 million of the 3 million accidents a year across the country), just forcing the insurance company to bear the main costs. Accordingly, they should therefore be directed (and I want to write "punishing hand of the law"), i.e. increased MSC (age and experience) insurance.

P. M. Shkumatov

Meantime, according to Peter Shkumatov turns out paradoxically unjust situation, when law-abiding driver with many years of trouble-free driving forced to pay a significantly large prize, and the driver-a slacker with a low social responsibility, even in the case of a conviction under article 264 (repeated DWI) pays a minimal amount for insurance, for example, in the Crimea (for the area adopted by the Chur gentle reduction factor equal to 0.6). With such dangerous violations as repeated red light, etc. in any way in the pricing of insurance is not affected.

K. N. Korischenko

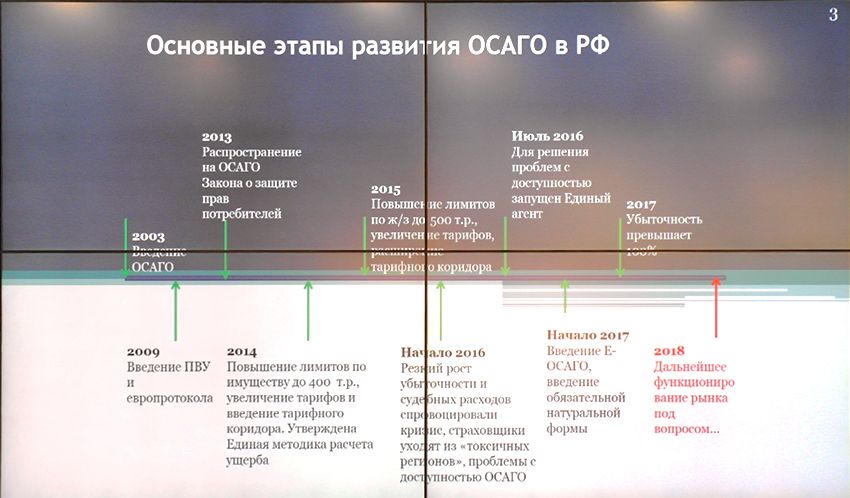

"The big way" the history of insurance in Russia (from the report of the K. N. Korischenko)

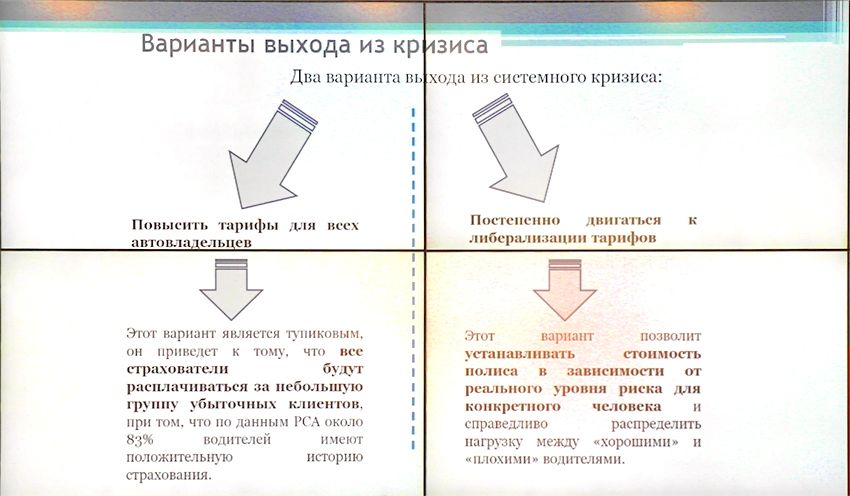

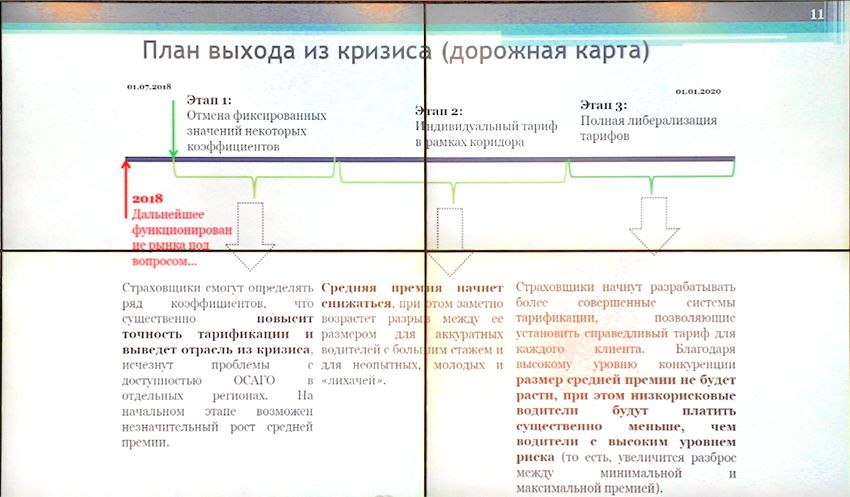

So, the main thesis made by Igor Yurgens and Evgeny developed Ufimtsev, and strongly supported by the Peter Shkumatov and confirmed given by Svetlana Polikanina the results of public surveys of motorists conducted by ROMIR, was the fact that the reform of the CTP (including market liberalization) have not only long overdue, but overdue, and the fact that the MSC be implemented from January next year fully reflected the views of the public on social justice. The insurance fees must be revised in the direction of differentiation, increasing and decreasing coefficients for adventurers and law-abiding drivers, which are now virtually on the principle of "broken unbeaten luck" paying for the artistry of the aggressive minority, the identification of which, by the way, today is no technical and organizational problems is not. Even inexperienced driver in just three or four months are already fully reveals your individual style of driving, allowing then to adjust its behavior just through MSC. The Ministry of Finance at the hearings also proposed to increase the amount of payments on OSAGO to ₽1 million or even ₽2 million, but so far as voluntary for drivers measures (respectively, coupled with the increase in insurance premiums).

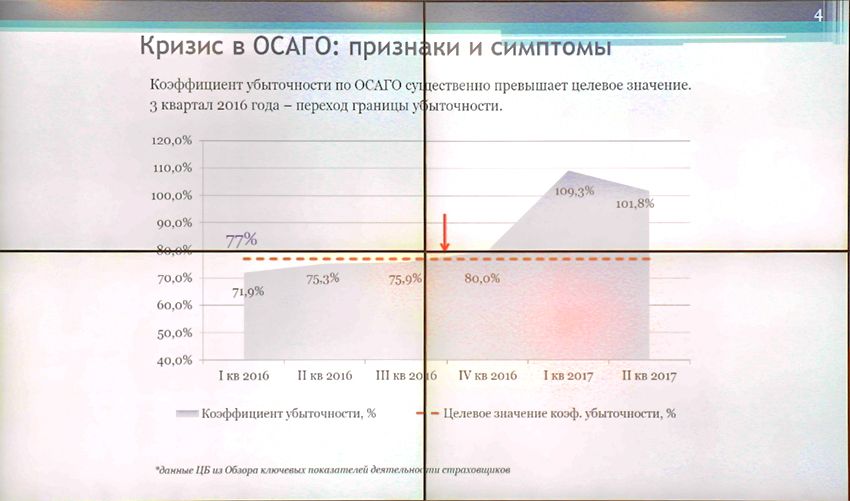

Border break-even CTP was in the third quarter of 2016

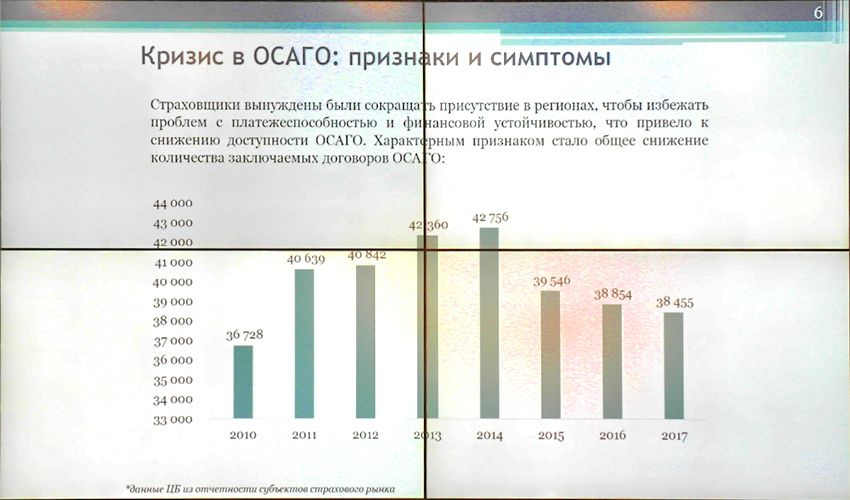

In addition, it was noted that the CTP market has experienced three years ago the shock period due to the fall of the ruble by 18%, caused by the anti-Russian sanctions, which has led including to the departure of insurance companies from a number of regions, thereby causing a physical shortage of policies in certain regions, reminiscent of the words of Igor Yurgens about the days of shortages in the Soviet Union.

The CTP market is shrinking both absolutely and relatively

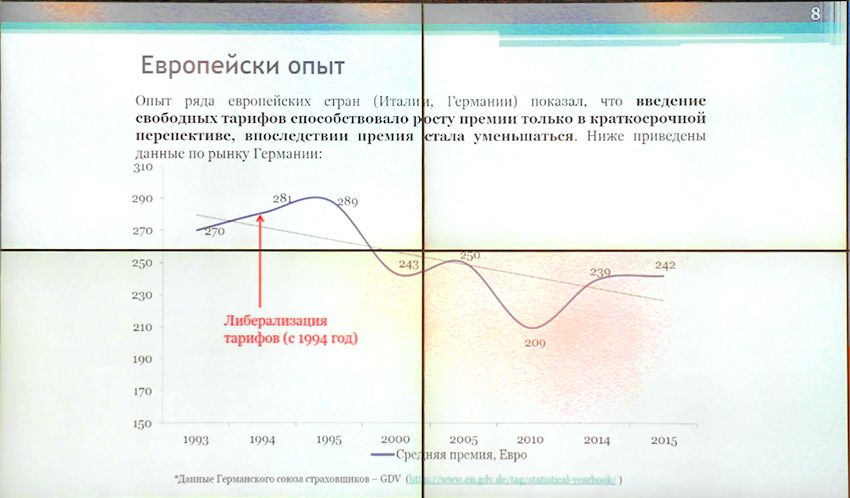

However, while it at the expense of avoiding monopolies and increasing competition among insurance companies, allowing you to reduce the price of insurance policies by about 15%, as well as stabilization of the ruble and the economy as a whole, is still some "margin" for insurers (despite the fact that only in 2017 a direct loss for insurance for insurance companies amounted, according to the Central Bank order ₽15 billion), but the current strap is 10% up and down from the base fare does not allow insurers to offset their losses in case of dramatic changes of the ruble, from which Russia is not yet guaranteed due to the possible tightening of sanctions.

The most "toxic" for CTP regions in the lead and the number of losses from "avtoyuristov"

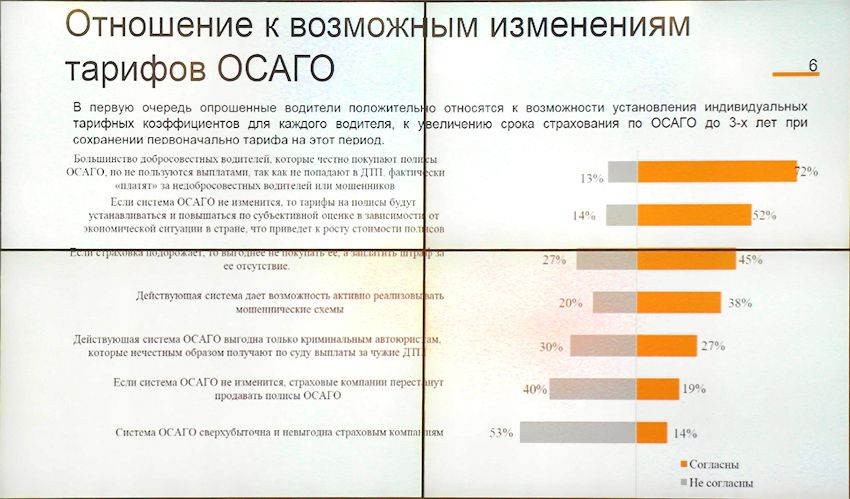

In addition, in some regions the number of insurance cases is much higher than other regions, in the application of the current regional factors, it turns out that law-abiding drivers, for example, Omsk pay aggressive-emergency driving of the rotor. Therefore, the Finance Ministry voiced increasing plug rate up to 20% up or down (and not necessarily the rates immediately soar, they could fall to dumped levels), and in addition, to decouple the MSC from a specific vehicle, tying them individually to each driver during the insurance year. In addition, it will allow owners of multiple cars to do just one policy, instead of buying them each their own car. It is also necessary to restore order and to pay for insurance of the harm to life and health of victims of road accidents that have so far limited ₽500 thousand, while the victims of public transport passengers now receive a refund in the range of ₽2 million in addition, under discussion increase the validity of the insurance policy is up to 2 or even 3 years, to which, however, on the part of the insurers followed the objection voiced by Mr. DAMI Jurgens and Ufimtsev, about so far in Russia is difficult to predict the volatility of the ruble and other "black swans", especially against the backdrop of foreign tensions. Also pending insurance payments, excluding depreciation of the car (yet such is only possible with compensation repair).

In General, the area of auto insurance is still very nedouregulirovannymi condition, for example, on today, the current penalty for absence of the driver's insurance policy is only 800 RUB. (but for early payment and all 400 rubles), which causes many drivers to drive without it insurance policy is actually abusing their civil rights and leaving in case of accident with law-abiding drivers, the latter a priori by the injured party.

However, Peter Shkumatov noted that with the introduction of the MSC can be seen a conflict, as here are the best 5% of the most aggressive and emergency drivers will be the most persistent objectors from CTP, and whether from them or to get on the court injured them in a traffic accident is still a big question (especially if a driver from another region, for example, from the North Caucasus Federal district). The future law on insurance must take into account all these nuances, though final completion will be in the course of its application – only in advance not provided.

By the way, about the thesis of "better safe than sorry" – in the words of Peter Shkumatov lately due to the massive proliferation of DVRs, significantly reduced the flow of complaints his organization "Blue buckets" on avtopodstavy – where there is reliable documentary evidence, there is no place for speculation and fraud. Avtopodstavy themselves avoid cars equipped with DVRs (especially a double – posted front and rear). Those who skimp on such a faithful and vigilant assistant is necessary to hope only on your own luck, in this case less and less likely.

According to Igor Yurgens, after the appearance of generalized resolution on the liberalization of insurance in the Duma and the Federation Council, the document will go to the Federal authorities (DOJ) and, he hopes, will be signed no later than November of the current year so that from January 2019 to come into force: "Parliamentary hearings were conducted in order to understand the problems and looking at the CTP market to begin to reform it.

The main idea of the sessions in both houses was the establishment of a just rate, which for law-abiding drivers even fall, but for aggressive drivers to install as high as possible the coefficient of the MSC, so the ruble to get to behave in a civilized manner."

S. P. Polikaninai

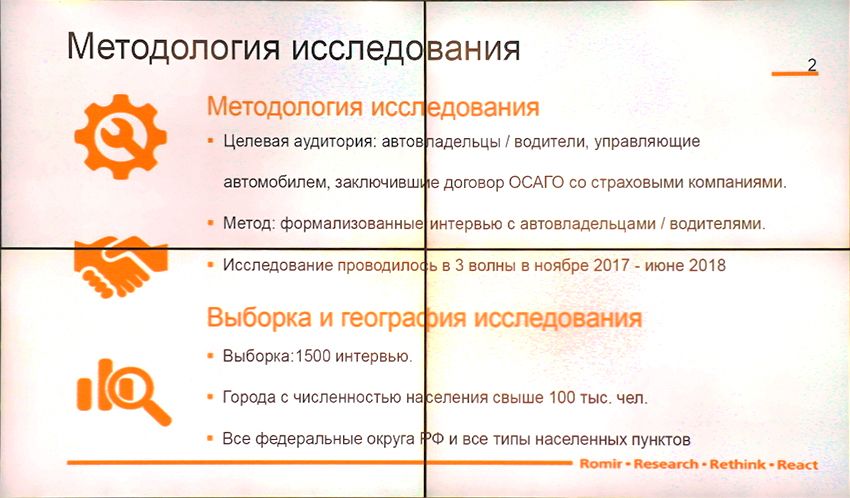

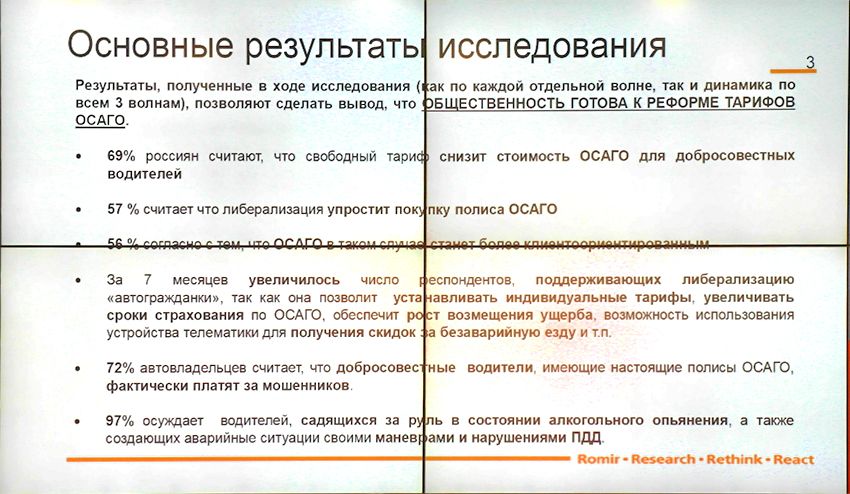

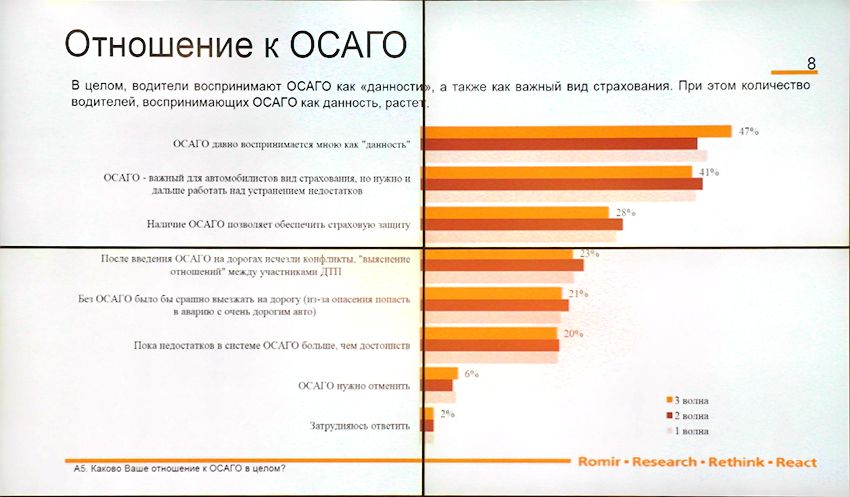

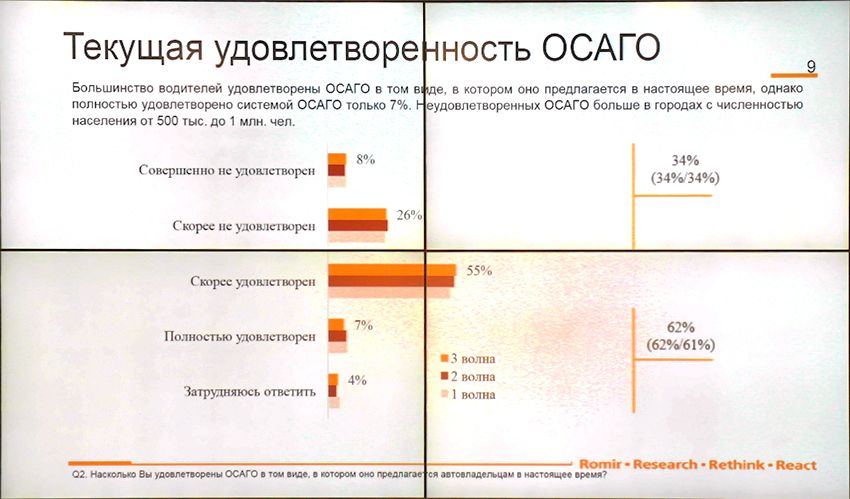

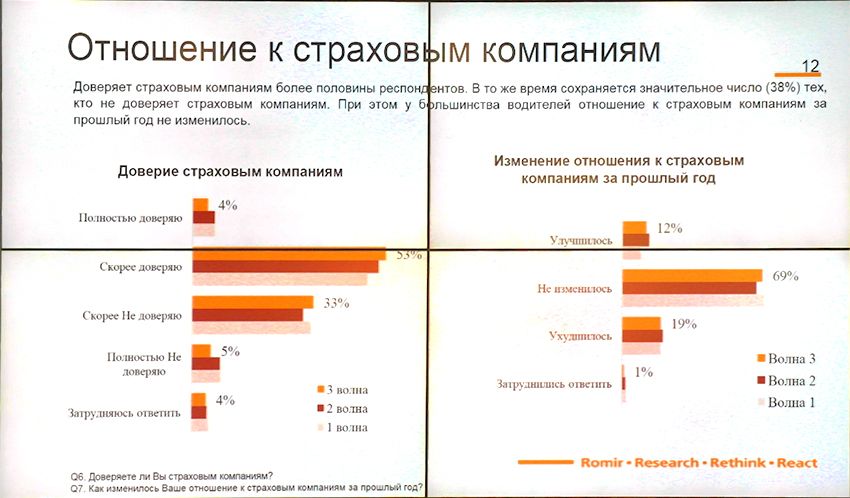

In the latest study by ROMIR, presented by Svetlana Polikanina, considered a number of outcomes surveys of motorists on the insurance

The ROMIR questions answered directly by the users of CTP

The main result of the research ROMIR — the public is ready to reform the insurance fees!

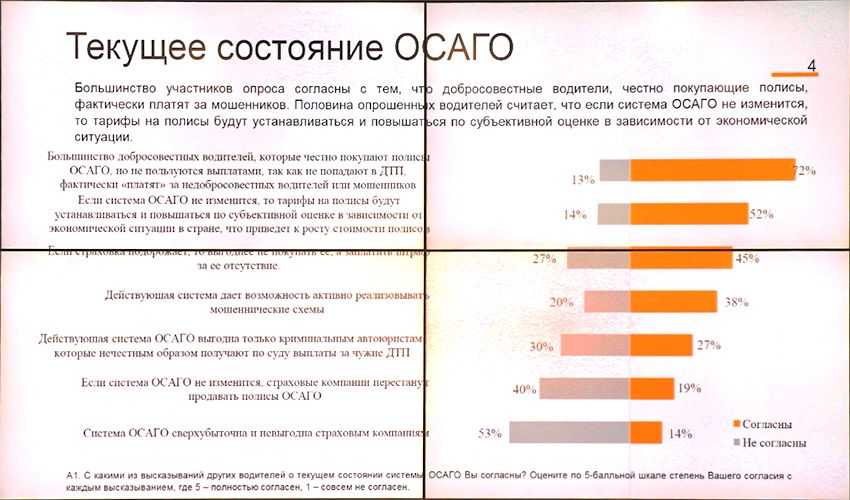

Good drivers don't want to carry on your neck speeders and avtoyuristov

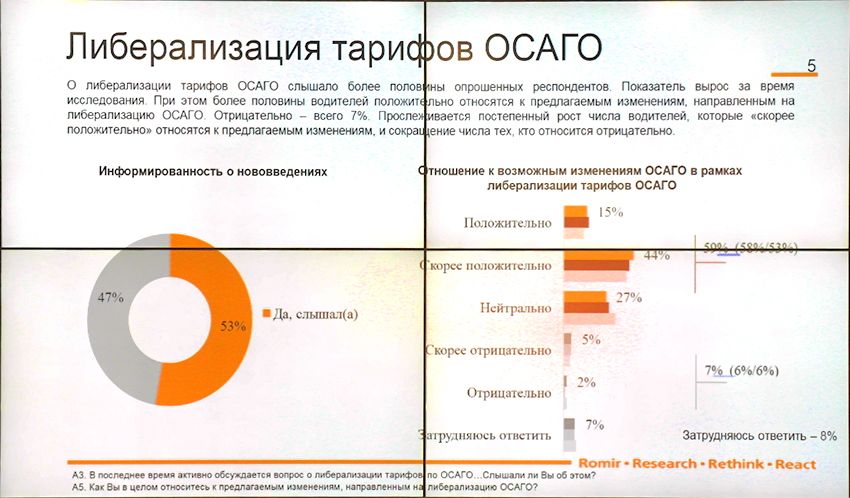

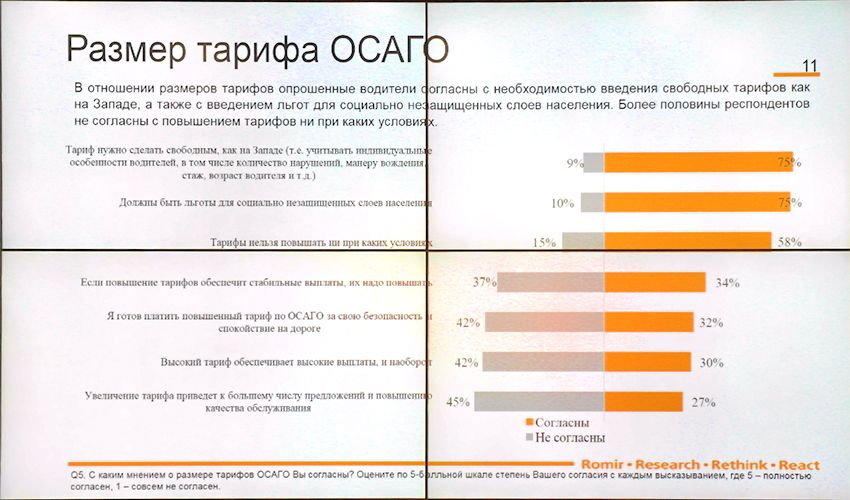

A majority of 59% of drivers are already in market liberalization CTP, and unequivocally negative attitude only 7%

Good drivers behind the increase in term of insurance policy, but those who still cheaper to pay the penalty for his absence, too short

Today, insurance has become as common as a driver's license, but no limit to perfection...

The ratio of satisfied and unsatisfied insurance while 1:2

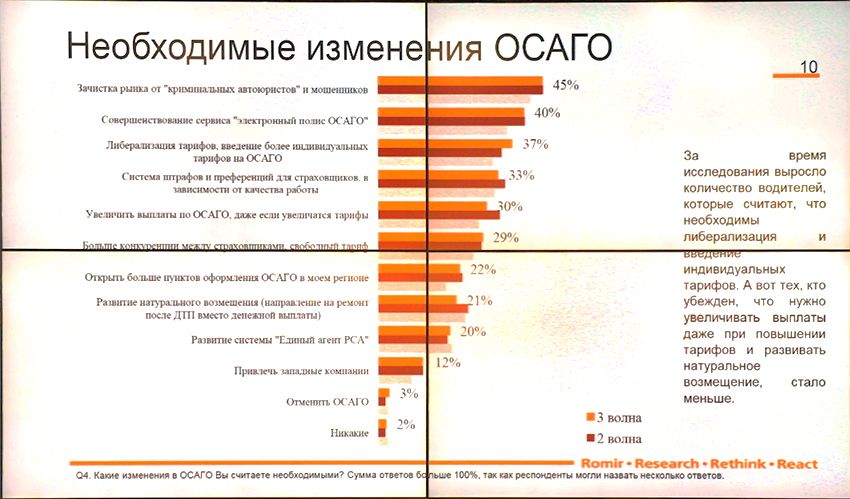

Most of the users of CTP longs for deliverance from a criminal avtoyuristov and fraud, as well as the development of convenient service of "electronic insurance policy" and tariff liberalization

Most car owners still choose freedom, although not forget about the disadvantaged

Trusts insurance companies while the majority of car owners, but the trend of confidence-building is still not visible

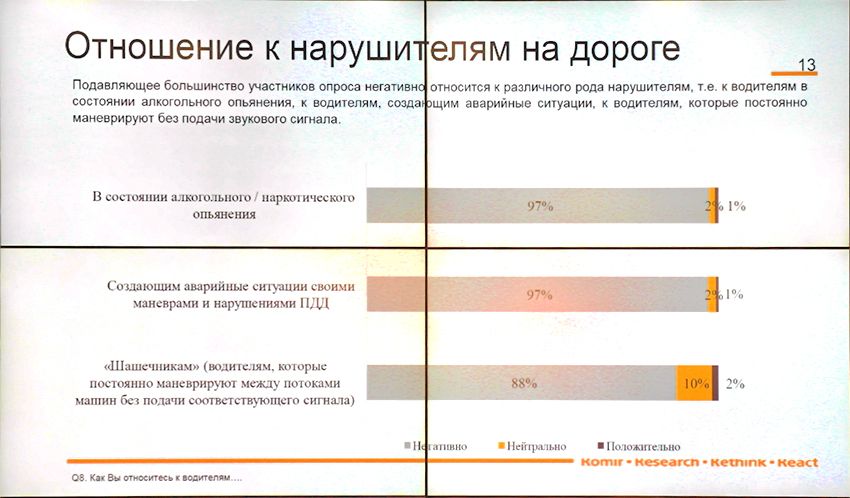

The attitude of taxi drivers ("the shashechnye") of the majority of drivers much better than the drunk driving and avtohuliganov

by the Way, P. Shkumatov noted that Moscow taxi drivers – one of the emergency drivers but pay the same insurance fees as normal drivers. "Generally, the question of insurance fees for commercial vehicles is one of the most difficult," he said.

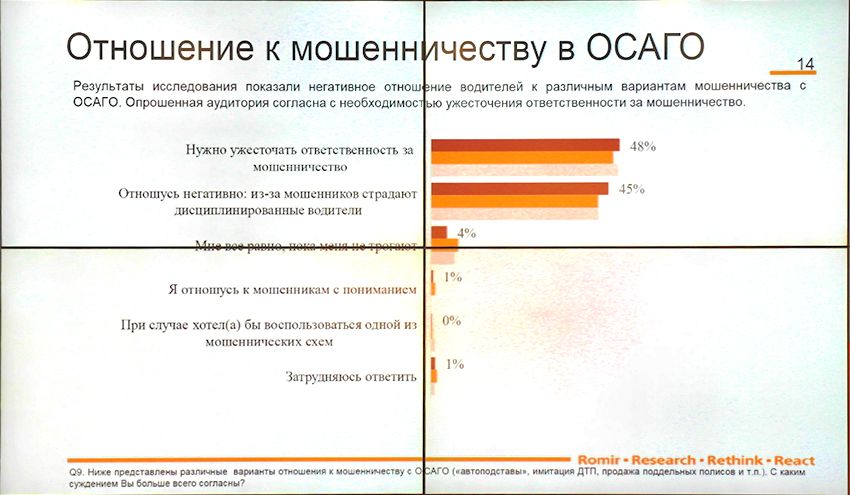

Though in a forehead, though on the forehead, but around insurance fraud have to do something!

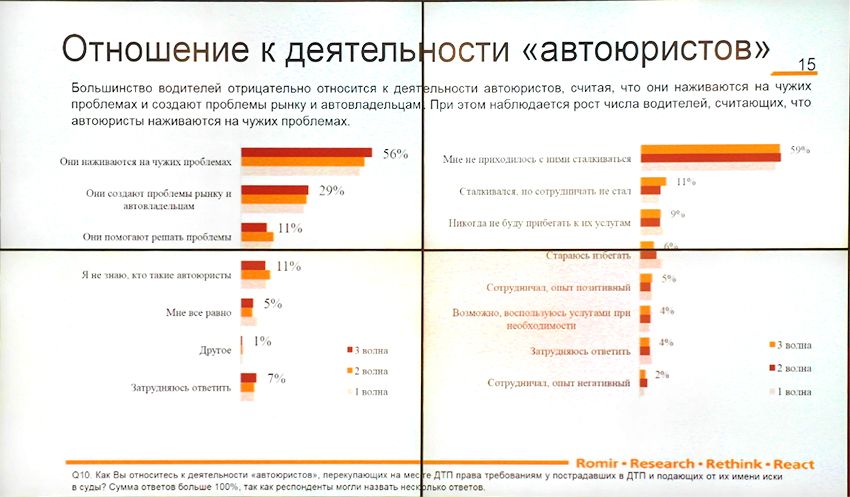

The attitude of "Avtoyuristam" rather disdainfully, although in reality encountered them a few

.

|

|

|

Element was not found.