New VAT drove gasoline prices up

9 January 2019

Will they stop the rising price of gasoline at +to 1.7% as promised by the officials?

According to the head of the state company "Rosneft" Igor Sechin, the growth of value-added tax (VAT) from 18% to 20%, which means the increase of this tax by 2%, and 11.1 percent count out the calculator to add to the retail price of gasoline is only 1.7%. In his words: "the Fuel is, everything is fine. The price increase will be small, VAT and excise duties will not be affected, because there is provided the damping mechanism". In addition, Mr. Sechin explained his vision of the collapse of world oil prices, which has been developing almost since the conclusion of a new agreement on the reduction of oil production within OPEC+: "the Main factor in this case was the increase in the fed rate, which led to the erosion of financial speculators from the market, but... We are ready for any situation".

The same in fact, the idea was confirmed by the head of Department on fuel and energy complex FAS Dmitry Makhonin: "In some regions from January 1, 2019, we draw the growth rates in the amount of not more than 1.7%", for which according to him are responsible, first of all, the major oil companies: "Other reason and prerequisites we do not see, because the margins are quite acceptable". However, he believes that the current growth of prices is consistent with the agreements of the government with oil companies concluded in the fall of 2018.

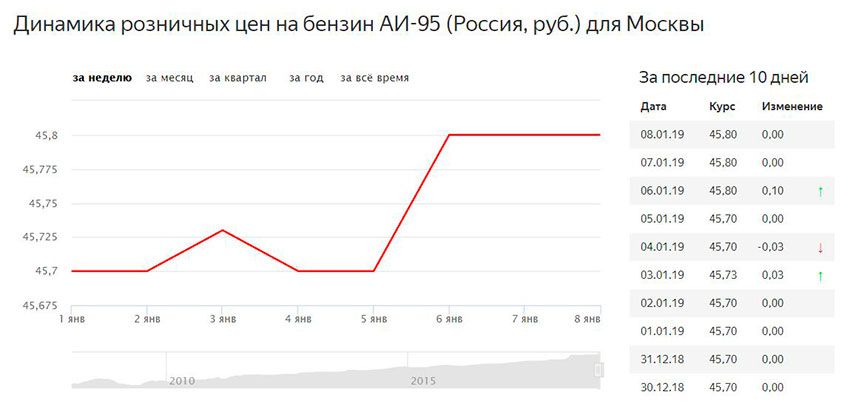

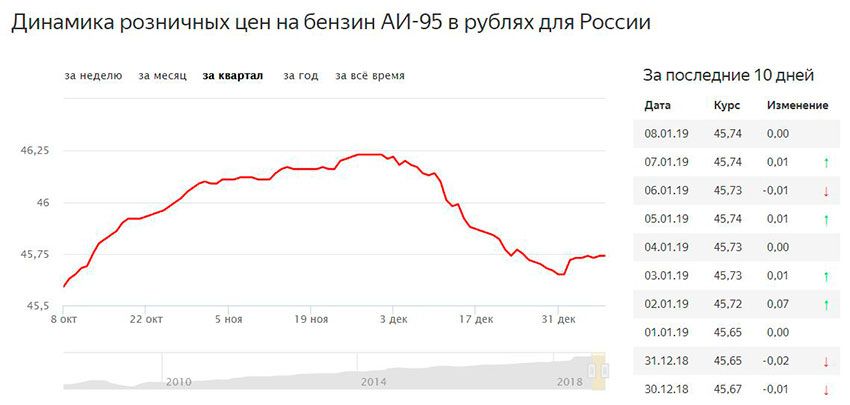

Graph of gasoline prices from Yandex shows that the rise in gasoline prices really accelerated in the first week of January of 2019 in the capital city and...

By the way, earlier the Minister of energy of Russia Alexander Novak reassured that the reduction of Russian oil production under OPEC agreement+ added to the budget in two and a half years in surplus ₽5 trillion, but domestic oil companies have increased their assets additionally on ₽2 trillion.

across the country, although the price graph looks similar for the price of a barrel of oil

However, the downside of this agreement with OPEC (i.e., the creation of OPEC+) was the creation of a situation in which the implementation of oil and, most importantly, a motor fuel inside of their own country has become so unprofitable for the producers that they are, of course, started by hook and by crook to force up wholesale and retail prices for main types of fuel on the domestic market. So, the first wave of growth of the fuel prices came in may of last year, and the second followed in August-September of 2018. At the same time the government and oil companies have agreed to fix prices taking into account the high levels of oil prices until the end of March 2019. As a result, the oil received an additional profit, and domestic sales became more profitable than exports, besides the falling oil prices. But it was more flowers, and "sweet berry" went on when in October the price of oil fell from $85 per barrel to $59 per barrel. It is here that the oil industry and went to "real" profit as the reverse mechanism of lower fuel prices in the agreement as "not provided". In addition, the excise tax on gasoline and diesel fuel raised from 01.01.2019, respectively, 48.6% (from ₽8213 for 1 MT to ₽12 374) and 50.8% (from ₽5665 to ₽8541).

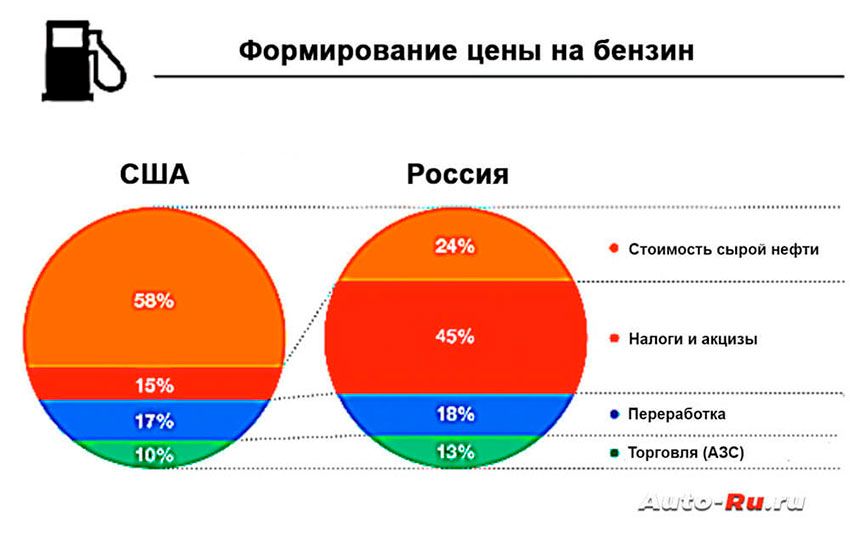

Graphics from Auto-Ru clearly shows that the structure of pricing of petrol in our country or rather conforms to the European "tax model" than the American "raw"

So that the promised "soft" growth Ben of gasoline in the range of 1-1,5% promised by President Putin in the middle of last month, today is already the "past" reality, but even still the first holiday week of January. According to the same CBR to hope for an increase in fuel prices is less than 4.6% is not worth it. Yet it seems that with the current volatility of the oil market to our fuel market will be "shoulder" and a higher rate of growth. That's just not something that the decline in prices, but their stabilization for years on our market, if they did, then only in relatively brief moments.

.

|

|

|

Element was not found.