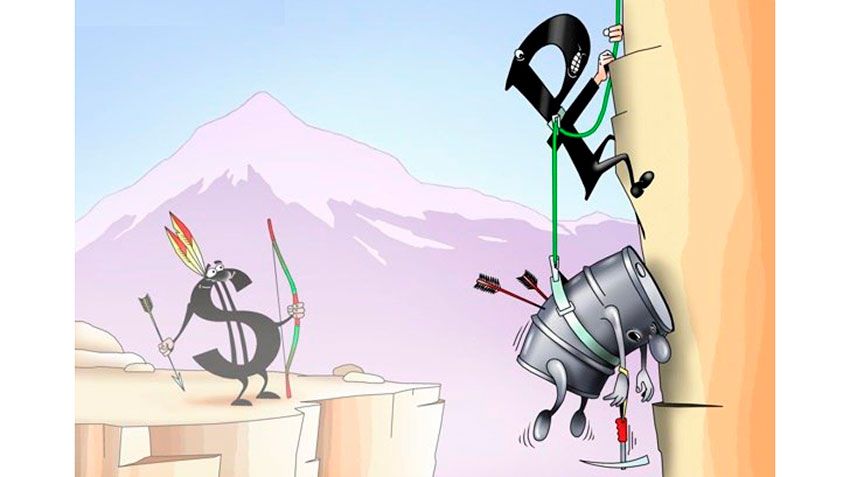

Oil falls, the ruble keeps hitting?

25 December 2018

The stability of the ruble – a new quality of Russia's financial system or trick?

Today there is a quite unusual pattern on the Russian financial market against the background of the black to the world's stock exchanges already for 90 years, Dec, but still aggravated by the collapse of prices for the main export goods of Russia – oil, the Russian ruble, in principle, kept a stiff upper lip, as the entire financial system as a whole. Continuing today, the stability of Finance of Russia on the background of such "black swans" in the fourth quarter – something so amazing that borders on the miraculous. So that even Analytics, for many years specializing in the prediction of all sorts of abominations and horrors for Russia, its businesses and citizens are in a state close to shock and all that I can yet offer is wait, and maybe Russia still collapses.

Indeed, the fourth quarter of 2018, just extremely "able" in almost all respects. In fact, it is the second largest shock of the collapse in oil prices for the Russian economy over the last decade. So, with the peak in October to the present time the price of oil has fallen by more than 42%, i.e. almost $86 per barrel to today's $49,3. And the Russian ruble (₽) responded to the ongoing recession (the decline and no more) against the us dollar by 5.7% from the level of 65 rubles/$ to 68-69 RUB/$. This allowed in the current Bulletin of the Bank of Russia to speak about the process even a fairly indifferently.

And yet, what factors explain such "pokrasivshe" ruble economists? For example, according to the calculations of Bank stabilization is "bilateral" in nature. So, simulation by the Bank of Russia to peg the ruble to the oil price shocks 2003-2018 he shows quite uverennuyu the relationship between the strengthening of the ruble and the so-called "positive shocks". And if, for 2013-2018 years, the effect was subtle, and only the "budget rule" (introduced in 2016) of these results could be allowed. So, today we face a paradox in a country where falling "home prices in the Russian economy" by more than a third in just two months even few people noticed, because it was about the same reaction to the same trend with a different sign (i.e. growth) of the same oil prices since the summer of 2017 to autumn 2018. This time was quite sluggish devaluation – from 57 RUB/$ in the summer of 2017 to nearly 70 RUB/$ in August 2018 that just the oil market had a minimal relationship – so the whole of large business of Russia trembled before the regular anti-Russian sanctions. However, with the Russian stock market in December withdrawn over $1 billion, but this is "remnants" remain speculative capital, which has long been gone from Russia.

According to the results of the December stress test of the Bank on financial markets the result is such that the approves of the Russian Federation during the two-day period on all financial instruments have withstood the shocks of the scale of the 2008 and 2014 (as of December 3) almost without noticing.

Now 15 January will have near-final testing of the system, when the Central Bank will enter the market with regular purchases of foreign currency for the Ministry of Finance (of course, in minimal amounts because of the very low oil prices). By the way, as the price of a barrel continues to fall, then buy, perhaps, did not have to. However, according to experts of the "Kommersant" real range of volatility of the ruble will be determined by may, when the market will finally see that the recent stability of the ruble exchange rate is not a trick of the authorities, and reached a new qualitative state of the financial system.

About the gas record:

Energy Minister Alexander Novak said today: "this year, Russia produced a record amount of natural gas – 733 billion cubic meters, against 691 billion cubic meters in 2017". Thus, the growth of gas production in Russia amounted to 2018 about 6.1%. Exports of gas increased by more than 10% up to 20 billion cubic meters.

According to Novak, the growth of production and export of blue fuel in the current year stems from the increased volume of gas consumption in the world. In addition, export growth, for example, contributed to the launch of the plant "Yamal LNG", which ensured growth in the production of "fashionable" liquefied natural gas by 70%. Delivery with it was carried out even in the United States (in connection with the storm in the new York area).

The growth in gas demand occurred despite the triumphant cries of "green" (including Ukrainian) of "unprecedented" growth of wind and solar generating capacity in the world and in "nezalezhnoy" in particular. The share of so-called "alternative" energy based on renewable energy sources is still relatively small in the global energy mix and a significant decline in prices for oil and gas and even more leads to less investment in green energy.

According to the forecast of the International energy Agency (IEA) World Energy Outlook, Russia will be the main supplier of gas to Europe until at least 2040, despite all the efforts of Washington to push on the market of the Old world of its liquefied shale gas. According to experts of the American "ridculously" export in the next decade (although, by 2020 the supply of liquefied gas is expected to grow by half) is only able to partially compensate for Europe, retiring by reason of exhaustion of Norwegian gas from fields in the North sea.

The main part of gas to Europe will continue to put Russia, as much as it infuriated someone beyond the ocean, and closer..

|

|

|

Element was not found.