Owners of electric cars in California will not go away from vehicle tax

28 January 2019

In California, offered to transfer the electric vehicles with 100-dollar vehicle tax for flexible collection of RUC

Remember the joke: a man runs into a bar and says I'll have a whiskey not yet started. The bartender in disbelief pours the pile – male chugs and says pour another has not yet begun. The bartender pours another one – man drinks. The bartender asks: what hasn't started? You gonna pay for those? The man breathlessly: well, here goes! So the owners of electric vehicles have been proud for the whole world to the Internet network so that "jumped off the gasoline needle", but "this happiness" lasted even shorter than expected. Since the lion's share of the cost of petrol is tax (even in the US, where gasoline is considered a commodity, "consumer" and is cheap relative to other countries of "Golden billion", and the difference in price of petrol and kilowatts of electricity least among Western countries), the authorities of the localities with the largest concentration of fleet of electric vehicles, such as California, have already experienced falling revenue. Therefore, the state government seeking options for new taxation models for electric vehicles (BEV).

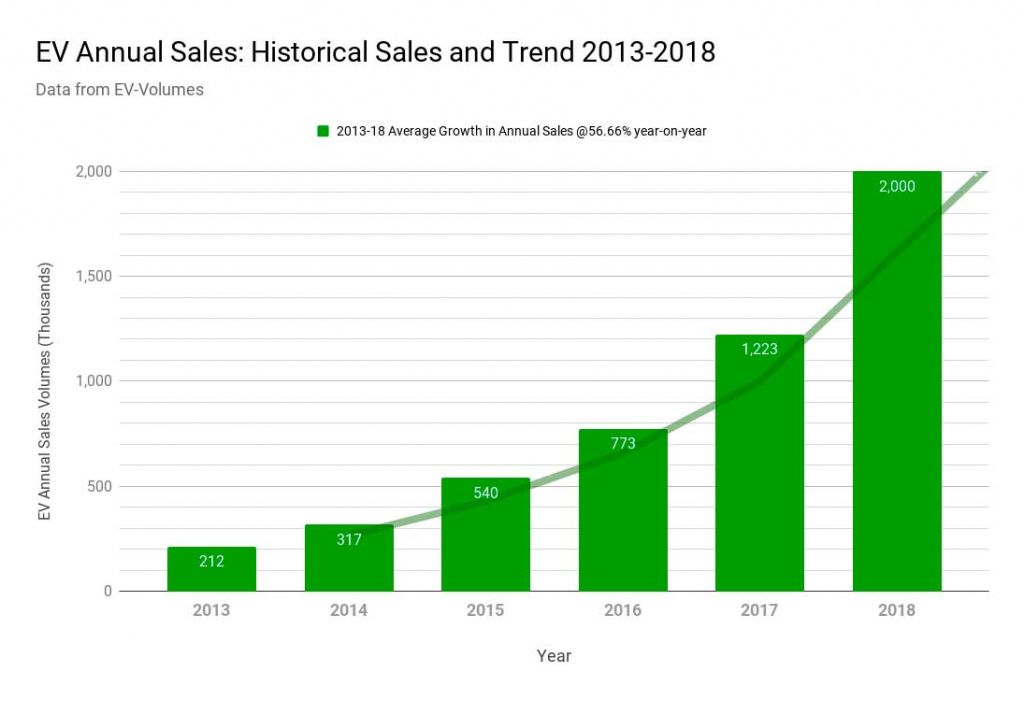

Portal EV-volumes estimates the growth of global electric car sales in 2018 are about 2 million

Deductions from tax on gasoline (in Europe also with diesel fuel) as it is known traditionally serve as the main source of financing road infrastructure. Thus, each driver of the car with the engine (now often abbreviated as ICE) Willy-nevolens contributes to the road Fund in proportion to the mileage of your car, which is true. However, the growth of the fleet of electric vehicles (it is already possible to speak about the Park EV) on the roads will inevitably lead to a reduction in revenues from excise taxes and taxes on gasoline and diesel fuel worldwide. Speaking of natural gas out of the question because of its relatively low prevalence in the world and relatively less environmental damage, by the way, in some countries, e.g., China, methane gas (especially liquefied – LNG), even contribute to the number of types of 'alternative fuels'.So, here are some places on the planet the loss of gasoline taxes began to be felt actually. And above all, of course, in Sunny California, also known by the strictest environmental regulations and environmentally advanced audience (no wonder the famous Silicon valley located in its territory), which recently also has the highest number of electric vehicles, and therefore the largest revenue losses from the reduction of taxes on fuel. Local authorities do not shelving them solved the problem by using an annual gathering of owners of electric transport in the amount of $100 (yet). But even these fees are quite reasonable critique of this mechanism.

Thus, in the report published by the Institute of transportation studies at the University of California at Davis States that: "the Registration fee was not a sustainable mechanism for adequate funding, as California moves to fully vehicle with zero emissions (ZEV). In addition, the charge slows down the transition to cars with zero emissions."

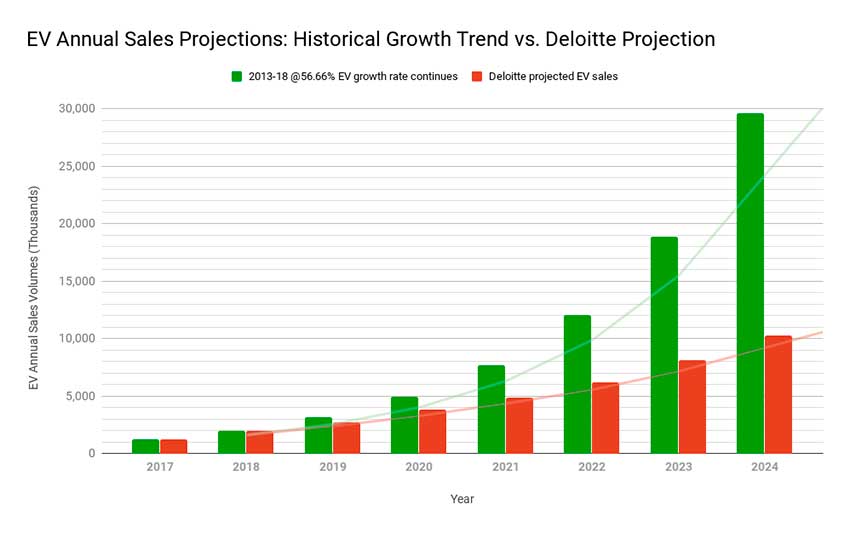

Two different dynamics-trend of market growth of electric vehicles (in million per year) – optimized from the Historical Growth Trend (green) vs conservative Projection from Deloitte (orange)

That is why experts suggest that instead of annual contribution go to the levy road user charging (RUC). According to this model, drivers will pay in proportion to how many miles they drove. Theoretically, such a fee for the use of roads can be extended to any vehicles. However, according to researchers yet most cost-effective compromise, you will save the tax on gasoline for vehicles with internal combustion engines (ICE) and the transition of electric vehicle drivers on the RUC.The report stresses: "According to the analyzed data, the best solution to create a stable, reliable funding system is the implementation of a RUC program (paid for actual mileage), apply only to electric vehicles with parallel conservation tax on gasoline, which gradually will "atrophy" and will eventually disappear."

PS Tax on mileage, of course, the thing is technically fairer than unitary rate (and only in America can count every cent), but the fact of the increasing tax burden on owners of electric vehicles are obvious – it is obvious that the absolute majority of ZEV drivers have to pay more than the proverbial "hundred bucks". But whether still will be! Obviously, now dramatically increasing taxes on EV's yet to come! For example, first it can come through the growth of tariffs for sorbitrate "the chargers", with a capacity of 300 kW and above (and without them not exactly cost due to the increase in battery capacity when the battery capacity of 500 kWh will not be fantastic). However, the thicker will be charging the network is, the less the owners will care capacity and limit the cruising range of their electric vehicles. This is reminiscent of the now thoroughly forgotten the problem of growth of productivity of processors at the turn of the 20th and 21st centuries – when the clock frequency of the microprocessor has exceeded 1000 MHz (1.0 GHz), this characteristic has practically ceased to worry the public as it achieved actual performance for virtually all popular user applications. By analogy: when the capacity of batteries in electric vehicles will reach sufficient size to run, is comparable to the car with ice, a much more important feature will be the speed of charging, and then it will cease to affect consumer interest, since in any case will suit the vast majority of consumers. After that, the size of the battery on average will even decline, which will give good savings when purchasing or leasing a BEV, even if the cost of batteries will fall another two times. But, in terms of operation, the differences are more substantial: cheap night electricity from household or adapted industrial power and relatively "peak" electricity of high power, which consumers will inevitably be forced to pay about both the modern high-octane gasoline with its taxes and excise taxes. Well, nizkovoltnoy household electricity also can "attach" additional taxes, for example, entering "social high consumption" of electricity, over which tariffs will be very biting. In any case, the phrase of the great founder of electrical engineering Faraday Minister of Finance of great Britain about the meaning of electricity: "don't know Yet, but one day you will be able to take this tax" perfectly corresponds to the vector of development of electrical engineering in the 21st century..

|

|

|

Element was not found.