The Scandinavians lead the PEV market

15 August 2018

The European market for electric vehicles and hybrids increased by 42%

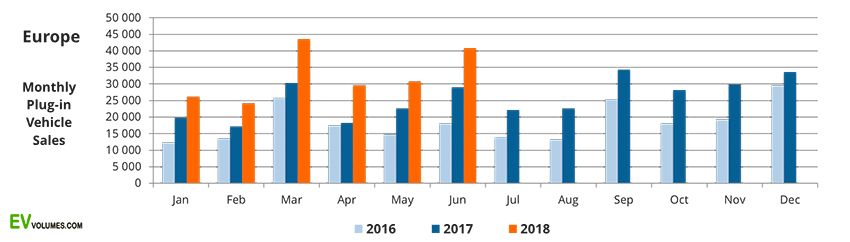

In the first half of 2018 PEV sales in Europe reached 195 million, which is 42% higher than in the same period of 2017. The category of PEV in Europe are all electric with batteries (BEV) and rechargeable hybrids (PHEV) in the form of passenger cars and light commercial vehicles. The proportion of PEV in the European passenger car market reached 2.2% in June and 2% in the first half. Trend, yet, points to further increase their share to about 40% by the end of the year. Accordingly, 51% of sales in the category accounted for pure electric vehicles BEV, and 49% for a PHEV. In this reporting period were sold just 87 units of vehicles on fuel cells (FCEV), compared to 66 units in the same period last year. Such paltry numbers given behind them powerful brands such as Hyundai and Toyota speak for themselves.

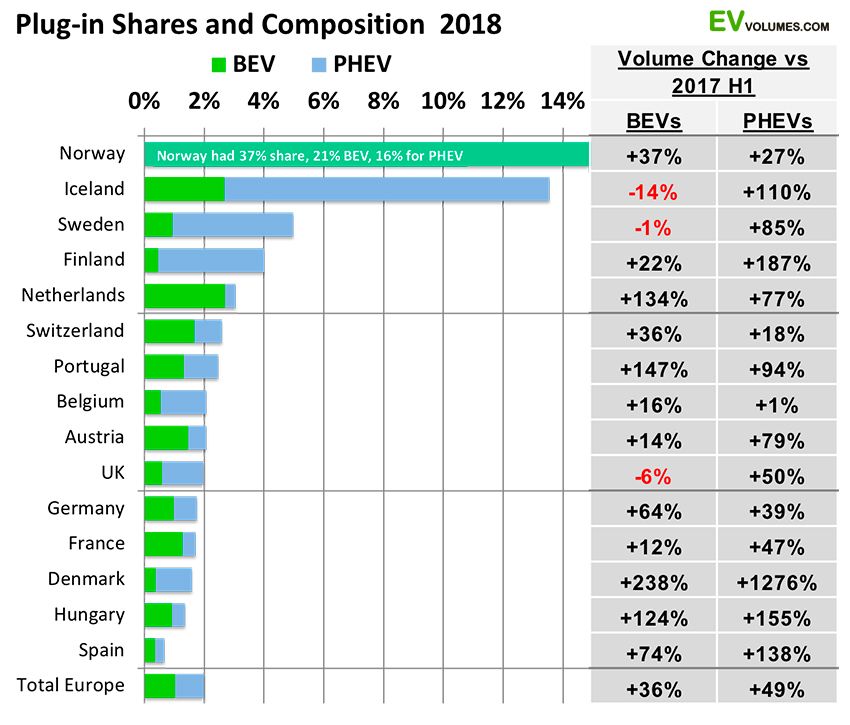

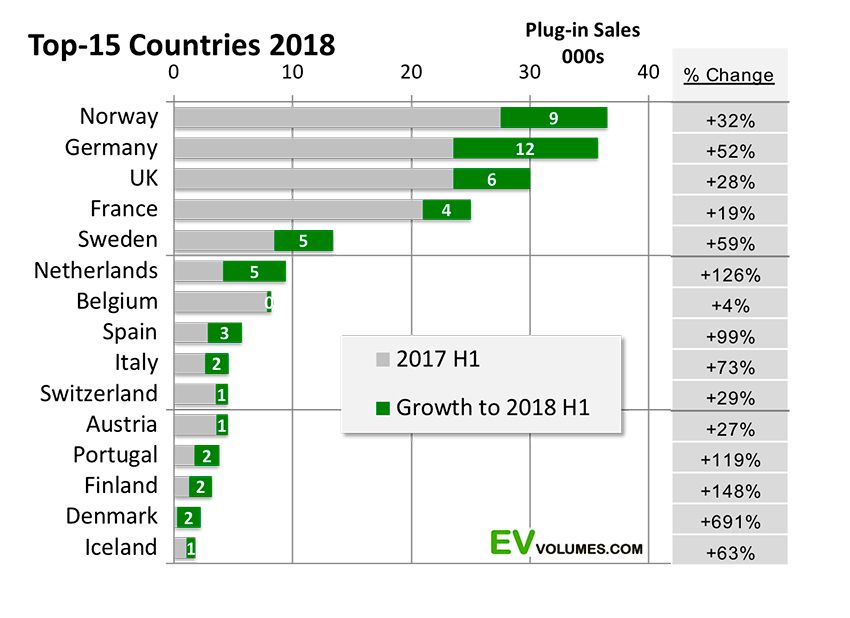

The German market was the main engine of growth in the PEV market. Even if the growth rate of this market was not achieved this year 100% compared to last year, and already achieved in the first half and 52% in combined with the huge size of the German market, pushing the volume of the entire European segment forward. Norway remains Europe's largest market for PEV with stunning other countries a share of 37% of the total passenger car market. If you consider only passenger cars during the first half of 2018 accounted for, in General, to 46.5%. This is a great indicator of what is possible to achieve in the promotion of the actuator, when securely constructed system of privileges for transportation tax, Parking, free use of highways and ferries, to significantly lower operating costs and well developed infrastructure of charging batteries.

All European countries are seeing an increase in the PEV market in the first half of 2018, many of its growth is greater than 2-fold, albeit from a low initial numbers. By the end of 2018 it is expected that sales in Europe will amount to 430 thousand electric cars and hybrids, but their market share reaches 2.35%. This applies to all EU and EFTA countries. Currently, the European Park PEV has more than 1 million cars, and by the end of this year it will increase to 1.35 million.

Among the European countries in the first half of 2018, the top selling PEV continues to be led by Norway. In June it was sold 36.5 thousand such cars, and by the end of 2018 is expected 84 million, which is 45% of the Norwegian market of passenger cars and light commercial vehicles. However, sales in Germany are growing even faster so it is expected that it will take at the end of this year leading position in Europe with registrations in the amount of 88.5 thousand

Although all the markets of European countries and demonstrated growth in the first half of 2018, but with different pace. So, sales in the Netherlands and Denmark has been high after several years of losses in sales due to poor incentive schemes. France and Britain continue to only moderate growth, due to the fact that their domestic OEMs (PSA, Ford and Vauxhall) have no attractive offers in this segment. Belgium has cut benefits for the premium PHEV and therefore sales grew by only 4%. All other countries showed double-or triple growth over the period, albeit from lower starting positions.

In General, the volume of PEV sales in Europe increased by 42% compared to the same period of 2017. First-quarter sales increased 40% and the latter 45%. A possible problem for high growth in the second half of the year may be shortage of supply. Today the period of supply of machines available in the warehouse is only 4 days after a two-month waiting for the order. In a number of models with queues of more than 10 thousand includes Kona Hyundai, VW e-Golf, Jaguar I-Pace and the Nissan LEAF, and, all of them electric cars.

Electric cars in Norway have the usual sign of the local landscape

This diagram shows the share of electric vehicles (BEV) and hybrids (PHEV) among all passenger cars sold in the country, and their share in the European market as a whole.With the exception of Denmark, where the market collapsed due to an abrupt change in the taxation of electric vehicles and hybrids, other Scandinavian countries are leaders in the market of PEV. Norway, we can say, already has a long tradition of exploitation of electric vehicles, it is possible to recall, for example, early mikroelektroniki Th!nk and Buddy, and the mass distribution of electric vehicles in this country began several years before other European countries.

Sales growth of electric cars in Norway also contributes an extensive benefits package and also cheap electricity from hydropower plants

Thanks to the thoughtful and stable incentives in the form of generous tax breaks and other preferences exactly electric cars have become a profitable alternative to conventional cars, despite the rather large annual mileages and quite harsh Norwegian climate with a strong winter cold. Their dissemination also helps to cheap electricity for 99% of the generated hydropower. Is in a similar situation and Iceland.

Incentives for electric cars – the most reliable driver of growth of their sales in Europe

The ratio of the BEV and PHEV varies greatly in different markets, is heavily dependent on the national incentive schemes. Rechargeable hybrids PHEV captured a large share of the market compared to 2017, aided by growing sales of German car brands. For the first half of 2018, the share of hybrids had 51% of sales of models with electric drive in Europe.It is on a PHEV has a large part to high sales in Iceland, Sweden and Finland. It can be expected that future incentives scheme will reduce the support segment, PHEV in favor of pure electric vehicles BEV. Example was, for example, the introduction from 1 July in Sweden, more stringent taxation of such vehicles on the system "bonus-Malus". This has led to an increase in BEV 10% in the July registrations..

|

|

|

Element was not found.