Chinese EVS beat in November, another record growth and market share

21 December 2018

The PEV segment in the PRC reached rose in November at 59% and amounted to 6.3% of the total market!

After two record months (Sep 105 Oct thousand and 120 thousand), electric vehicles (BEV) and PHEV in November to continue the winning momentum and up by registering on the Chinese market more than 140 thousand cars with electric drive, which is 59% more compared to the same period last year when the record was +18%.

If the current data is extrapolated to December, sales may exceed the previous high of 155 million, while sales for the whole of 2018 will jump the coveted level of 1 million PEV. And this just a year after this milestone has been achieved on a global scale!

If this continued impressive growth, amid the deepening drop of the entire automotive market (-14% in November), the proportion of PEV achieved another record level of 6.3%, while its share for the 11 months of 2018 rose to 3.8%. A new record is significantly higher than the previous 2.1% in 2017. While sales are expected to continue to grow and in December, improving the share in 2018 in General. The annual proportion of PEV then just surpass 4% when the penetration rate in December will exceed 7%.

If the pace of growth will continue through 2019, in a year the share of the PEV market will exceed 10%, and here is when the fun begins...

When purely symbolic export performance (relative to production volumes, of course), size of the domestic market is still more than enough to absorb the growing production of Chinese auto industry, with most foreign OEMs are only now beginning to respond to current seismic changes, being involved in the electrification of its model series upcoming sales quotas PEV that led to the fact that the share of foreign brands still remains at 6%.

Inside this small piece of the "pie" share of 2% is owned by BMW – the best seller among foreign brands, and about 2% of Tesla, and all remaining manufacturers same 2%.

In November, the main news segment of the PEV was the fact that the dynamic Duo BYD (models Tang and Yuan) continued strong growth, and model Tang entered the Top-10.

Here are the Top 5 best-selling passenger models of PEV in November:

#1 – BAIC EC-serie - after a record October sales, which amounted to 20 648 units, compact electric brand BAIC returned to its usual volume last month was delivered 14 units of 205 Surpassed in 2018 closest pursuer BYD Qin almost doubled, EC continues to monopolize the Chinese market, copying the case of the Tesla Model 3 in the United States. A revised design and improved technical characteristics (new battery with a capacity of 30 kWh) has resulted in a series of EC to remain a bestseller in Chinese Metropolitan areas, boosted by the competitive price of ¥171 400 (of$25,000 excluding subsidies).

BAIC EC220 MY2018

# 2 – BYD Tang PHEV : seven months on the market the second generation of hybrid crossover Tang only continues to increase sales, showing the personal record with units. 6405 Sale of this successful flagship brand BYD, apparently, will remain high in the future, so we can expect new record sales, although promising elektroversiya Tang BEV can make vnutritrekovye cannibalism, taking over the sale. With regard to the current specs of the Tang PHEV, the Sport version has got a battery capacity of 24 kWh, which led to the increase of "electric" range of up to 100 km according to the NEDC standard (about 70 km in real life), while in the powerplant remains the same and produces peak power of 500 HP and acceleration to 100 km/h in less than 5 seconds. For BYD Tang PHEV asking ¥279 800 yuan ($816 40).

BYD Tang PHEV MY2018

# 3 – Yuan BYD EV : what new "Baby Cross Crossover" company BYD was simply doomed to success, was known in advance, so it's another monthly record in 6188 units, proves that the "electroconducting" BYD lives up to the expectations of expectations. Whether the Yuan will become the strongest competitor in 2019 for a while that the all-conquering series BAIC EC? Given the queue of 40,000 waiting for his buying clients, this task will likely depend not on demand, and the ability and desire of the company BYD to produce this best-selling in larger volumes (since the model Tang to it financially more beneficial) than the actual demand is still "sparsely populated" market segment subcompact electrocreaser BEV. This boom also contributed excellent constructive parameters: battery capacity 42 kWh, power electric motor 128 kW cruising range in NEDC 305 km and the price of ¥171 400 (of$25,000). In the face of this new model of the brand BYD could find his cherished star, which is appropriate would decorate his already strong model lineup.

BYD Yuan EV360 MY2018

# 4 – BYD e5 : electrostan BYD e5 is a favorite among taxi drivers – literally their "bread and butter", which ensured record sales of 5573 units. However, this impressive result was overlapped by the rise of the Tang and Yuan models. This downhole electrostan line of BYD gear several strong characteristics: battery 61 kWh, power 160 kW, range (according to NEDC) reaches the coveted 405 km And all at a very competitive price ¥220 650 ($34 600). Unfortunately, the poor design casts him in the shadow of such bestsellers as BYD Tang, Qin, Song and Yuan.

BYD e5 MY2018

# 5 – Baojun E100 : giants Shanghai Auto and General Motors have high hopes for their joint tiny double electromobility, and, it seems, despite the initially poor sales, he finally begins to exert its influence on the Chinese PEV market, selling in the month of November in the amount of 5155 units, which became his best result of the year. Thanks to the upgrade version 2018 (250 km on the NEDC), the new battery capacity of 24 kWh and a price of only ¥93 900 ($14 700) excluding subsidies was much more attractive, especially given its modern design and functionality.

Baojun E100 MY2018

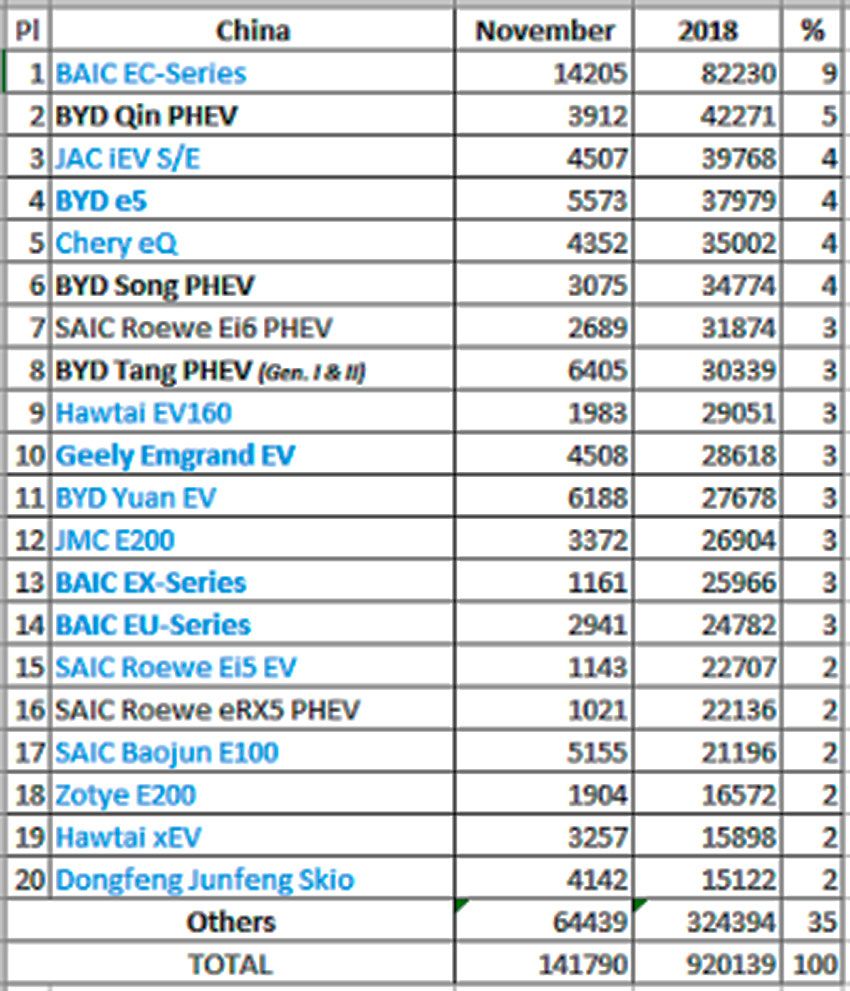

HitsR of the PEV market in the first 11 months of 2018For 11 months of 2018 on the market PEV flashed quite a lot of successful models, in addition to the above Top 5 best-selling record, for example, a compact electrocreaser Hawtai xEV was 19th with record sales 3257 units. and shutting twenty electro hatchback costs Dongfeng Junfeng Skio first appeared in the Top 20, with completed 4142 units, was not only a new record for compact cars Dongfeng, but for any of the manufacturers of PEV.

In addition, the rating occurred some significant changes, so the Chery eQ has risen to 5th position, while the bestsellers of the BYD Tang and the Yuan, continues its never-ending growth. So, a mid-size hybrid crossover Tang moved to three positions up to 8th place, back in the Top 10, while the subcompact electrocreaser Yuan proved even better, taking off from four positions to 11th place and is already preparing to enter the Top 10 in December, bringing thus the number of brand models, BYD in the top ten 5 (!)...

This impressive result of the company BYD, which unlike other manufacturers, each independent from the success of his one and only bestseller, allows is this brand processes, with an Arsenal of best sellers, became a Megastar in the universe PEV. So that due to the long waiting list when only on the model of Yuan there are 40 000 pre-orders, is scheduled for 2019 production and sales of 400,000 units of PEV, it seems quite feasible.

In addition to the Top 20, there are a lot of other information about kotoroy worth mentioning, for example, continues to amaze hybrid sedan BMW 530e, which showed another record sales 2649 units because of this he became not only the best selling hybrid in its category, but also the most efficient foreign car, placed on the 22nd place.

In November of this model BMW has had to compete fiercely for the title of best selling foreign model Nissan Sylphy EV, which in turn also shot 2400 units So that December promises to be the hottest month and the winner in this category will be determined only at the finish...

Including because only recently appeared on the market the Volkswagen Passat saloon PHEV may well spoil all their candidates winning music.

Mid-size sedan VW Passat PHEV showed sales at the level of 1513 units in its debut month, which was the best result for a foreign model in history, while the compact hybrid crossover Tiguan PHEV also gained considerable 618 units So that November signaled the actual output of the Volkswagen Group for the PEV market. If we take in mind that the German carmaker is the most popular OEM-manufacturer of traditional passenger vehicles (ICE) in China (total a JV with FAW and SAIC – more than $ 3.3 million in 2017), then its output is among the leaders of the PEV segment is just a matter of time.

Impressive growth to 3089 units demonstrated and premium electrocreaser ES8 newest brand Nio, again becoming the most popular luxury SUV last month, which allowed this new Chinese startup to push electrocreaser Tesla Model X SIZ leaders in this category.

It is reported that in mid-2019, the Chinese startup has thrown to the market mid-size electrocreaser ES6, so maximizing the short time that he was destined for growth and market penetration, before the "Big Brands" will swing with his too long awaited BEV.

Tang BYD EV MY2019

As for the rating of manufacturers in 11 months, the first Hierarch BYD took 20% due to the already mentioned growing models Tang and Yuan, while the runner-up to BAIC, finally, benefited from the slow rise of sales of the series EC, which allowed him to keep his share, well, and in third place was Shanghai Roewe with 7%, which, on the contrary, November was a disaster – all with only 6700 units of sales, which was his worst result since February. This allowed us to approach him brand Chery with its 6%, which gives hope to the brand for the first time in 2014 to climb the podium..

|

|

|

Element was not found.