Electric vehicles are increasing their share in the market of Europe due to the WLTP

20 November 2018

Tougher standards for fuel consumption crippled the European hybrids

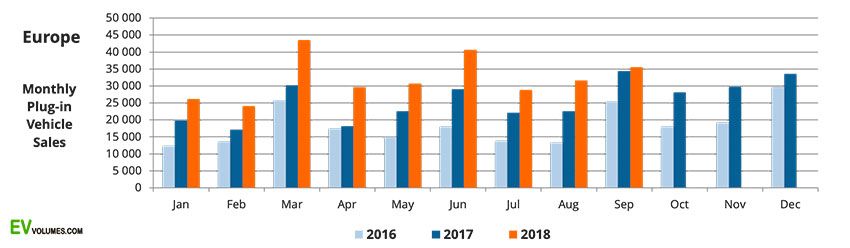

According to the site EV-volumes.com the volume of PEV sales in Europe in the third quarter of this year amounted to 290 550 units, which is 35% more than in the same period of 2017. To the segment "plug-in electric vehicle ", i.e. PEV in Europe include all battery electric vehicles (BEV) and rechargeable hybrids (PHEV), including passenger cars and light commercial vehicles. Accordingly, in September, the share of PEV in the European passenger car market reached 2.7%, which was the highest figure for a single month. However, in terms of sales, the Sep has come under attack due to the introduction of new standards for WLTP fuel consumption and emissions of harmful substances. Because of this, the implementation of PHEV grew only 3% in September compared to the same period last year, although their overall market share rose by more than 20%, reaching a new record high.

Obviously, the decline in September was the result of his jump 25% in August, when the auto industry did everything possible to sell ICE cars (including PHEV) by leaving less strict certification rules on fuel consumption.

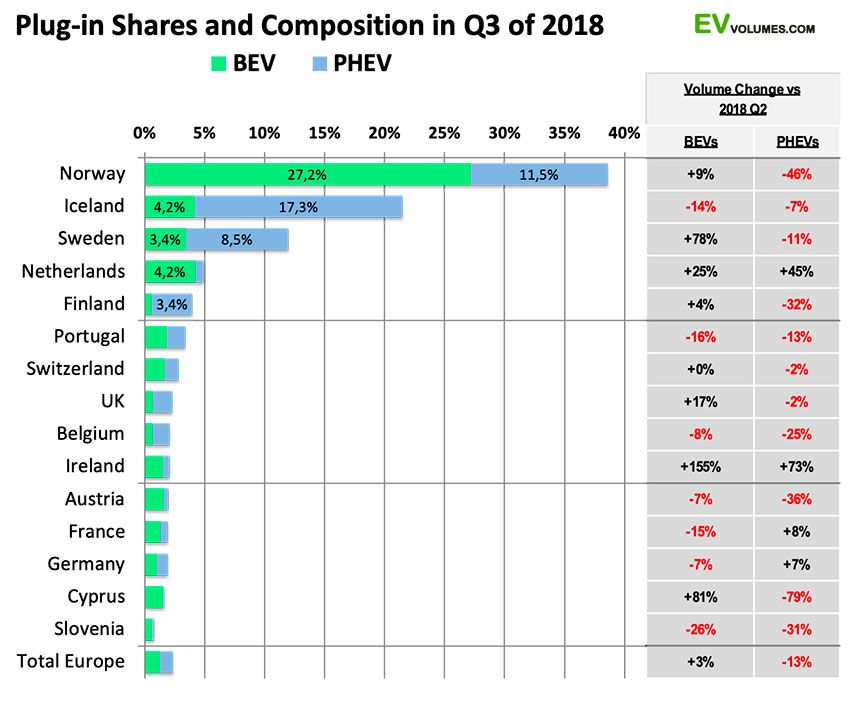

In addition, new standards WLTP is much more difficult than the original test standards NEDC and for hybrids of these procedures in the test laboratories do not differ from those for ICE, i.e. regular cars. As a result, many PHEV German OEMs due to the new long certification procedures are in deficit. Registration PHEV has declined significantly in September, although the first figures for October showed a slight improvement. Restrictions on import for a PHEV has led to increased sales of battery electric vehicles (BEV), which made up 62% of all PEV sales in September, and the level of 50% is normal for Europe. For the third quarter of PHEV sales decreased by 13% compared with the second quarter, while sales of BEV, by contrast, rose 3%. Loss in physical volumes were higher than profit.

Almost all European countries, except Belgium and Greece, said the growth in 2018 with the beginning of the year, and in many of them it exceeds 100%, though still remains very low in actual volume. By the end of 2018 EV-volumes expect that in Europe will be sold 410 000 units of PEV, and their market share will amount to 2.3%. This is 20,000 units below their previous forecast given in June and is only limited due to the introduction of WLTP proposal.

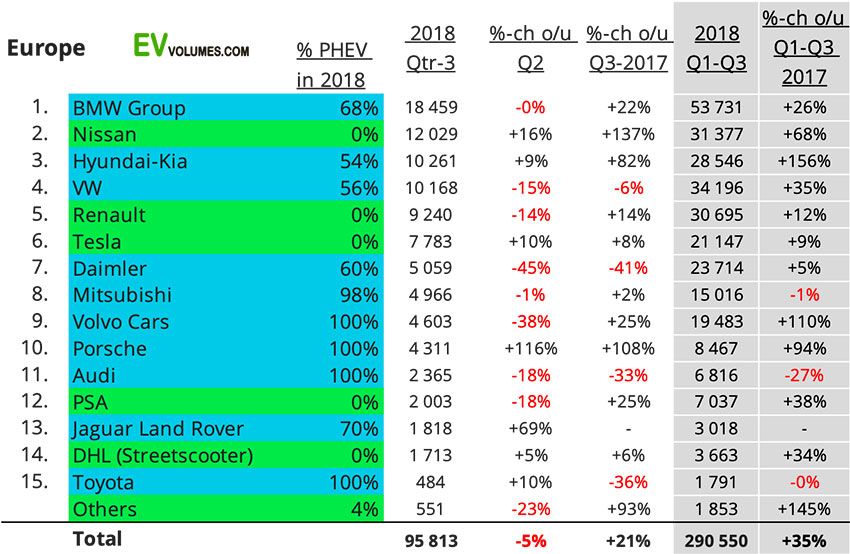

Heavyweights are losing market PHEV sales

Sales of hybrids German brands Volkswagen, Audi and Mercedes-Benz is stronger than all suffered from the introduction of the WLTP. Their lineups include a large number of PHEV, but now their supplies are reduced. Sale popular models of the PHEV, such as the Mercedes GLC and C-Class, VW Golf and Passat, Audi A3 and Q7 decrease rapidly. Model 2019 model year so far, and it is unclear when they will actually appear on the market.

Other brands generally showed the best results. So the fall in the third quarter compared with the second Renault and PSA can be explained by the failure of the August in France. In other cases, they still show a profit.

Apparently, BMW is still less influenced by the WLTP as it will electrocreaser kompakter Mini Countryman and the BMW 2-series still sell well. However, losses for other models of PHEV increase. A hybrid successor to the popular 3rd will be unavailable until summer of next year.

A huge boost Porsche sales in the third quarter gave new Cayenne, but September deliveries indicate that the problem gets WLTP and the brand.

Early in the third quarter the low level of sales showed a Volvo, but now sales are recovering again.

Electric cars offset the failure of sales only partially

In comparison with the results for the 1st half of the year, the share of Norway in the third quarter increased by 2%, Iceland exceeded the 20% bar, and in Sweden the share of PEV reached 12.5%. The Netherlands is closer to 5 percent share, and most of them made BEV. She then quickly crashes, making up about 2% in larger countries.

The third quarter was full of political events, so Sweden in July introduced a taxation system Bonus-Malus, and Norway again limited incentives for PHEV, Germany announced a package of benefits for Berlin and, of course, set standards WLTP from 1 September. This caused a boom in the August and the September decline in sales of cars in Europe.

PEV sales continue to remain unstable for more than a quarter of the countries under consideration. More long-lasting trend is the transition to pure electric drive, since the state incentives have pushed the increase in sales is BEV, but sales of many models of PHEV suspended. When comparing the third and second quarters is also evident seasonality (for example, in France and Belgium).

In the third quarter of PHEV sales were 13% less than in the second quarter, where they increased by 10%. Electric cars in the third quarter sold for 3% more than in the second. However, more rapid growth in sales of BEV have been hampered due to limited supplies. The total sales of the BEV can achieve in Europe, 70 000 units of over 15-18 months of waiting for the supply of electrocreaser Kona and Niro from concern Hyundai-Kia..

|

|

|

Element was not found.