ROAD reported for 2018

22 January 2019

The results of the 2018 for the Russian car dealers has been mixed

Last week in the International multimedia press center MIA "Russia today" held a press-conference of the Association "Russian automobile dealers" (ROAD) on the results and plans for Russian auto-retail.

President of the Association of ROAD Oleg MOSEEV reported results of auto retail in 2018 and advancement opportunities in 2019:

So, the dynamics of dealer network in Russia (according to AEB, AUTOSTAT and ROAD) in recent years (as of 2014) continues to decline. Only in 2018 closed 55 DC, and their total number dropped to 3355 units.

But the number of DTS of Chinese brands is growing before our eyes – from 411 in 2016 to 552 in 2018, and that number has grown to 16.5%.

the Market of new cars in Russia in 2018, the volume reached 1.8 million (according to AEB), which is 12.8% more than in 2017, but it's only the recovery which has not yet reached the level of 2014, with its 2.4 million

Interesting dynamics of dealer network brand: LADA dealers was 27 less than the DTS, while sales on 1 DC increased by 27% to 1251 of the machine, and all were sold 360,2 thousand "Lad". The KIA network growth amounted to 13 to 193 DC DC in sales growth 1 DTS 17% to 1179 units (sales of the brand rose 25 percent to 227,6 million). In third place the Hyundai dealer network with +11 DC to 187 DC in sales growth 1 DTS 6 percent to 953 units (sales of the brand rose 13% to 178,3 thousand). The highest increase as sales of 1 DC (+32% to 668 units.) and sales as a whole (+31% to 81.5 thousand) were observed in the Skoda, although the number of DC decreased by one to 122 DC. Grew network from Toyota (+2 DC) and VW (+4 DC), and Gas their number (112 DC) remained unchanged from the other network DC decreased.

Market pre-owned Russiaand in 2018, made up 5.42 million (+2.5% by 2017) of which 760 million (+14%) was sold to authorized dealers. It is expected that by 2022, the share of official dealers in the secondary market will be at least 30%. Overall the market recovered, since failure 2015 (6.5 million) and reached in the amount of 7.22 million, which, however, still very far from 2012-2014, when the total market volume was 8.5–8.7 million

Interesting the average ratio of sales to 1ДЦ in 2018, it amounted to 536 new units and 227 units owned (a total of 763 units), etcE. ratio were 0.42 vs 0.43 in 2017, but 0.24 in 2015. i.e., the segment of the secondary sales through DC (mostly in the form of a trade-in) – the main trend on the secondary market. However, it is hampered primarily by the problem of cleanliness of cars older than 7 years. Cancellation of double VAT (which pays the seller and the buyer of the car), the introduction of electronic title, the formation of a unified database for liens and other encumbrances and toughening of responsibility for "twisting" of the run should, in theory, move the process to a civilized state.

In rubles, the market capacity of new cars in 2018 rose to 2.38 trillion, against 1.97 trillion in 2017, in addition to market growth in physical volumes still indicates a continuous process of price increases, including in connection with the cycles of devaluation of the national currency.

Similarly, market capacity pre-owned also grew, but much more moderate – to ₽2.37 trillion against ₽of 2.29 trillion in 2017. Total market capacity has grown to ₽to 4.75 trillion, with almost equal shares of segments of new and used vehicles in contrast to the apparent prevalence of the secondary market in previous years.

Against this background, it is interesting to estimate the dynamics of deposits of the population (data of the Central Bank), according to which between 2013 and 2018 it has grown at ₽11 trillion (before ₽to 27.27 trillion) of which about ₽2 trillion just share of the savings postponed by the population for purchase of cars, but never implemented due to a number of reasons.

Forecast to 2019 is the growth of the new car market by 3% to 1.85 million, and market pre-owned to 3% to 5.6 million total car market will be in 2019 of 7.45 million vehicles.

Specifically, the ROAD unites for today 1100 DC (600 vs DC in 2016). That covers 60% of the total automotive market of Russia.

The most important event in 2018 in the industry was the signing of a Memorandum of understanding between the Association of European Businesses (AEB) and the Association of Russian automobile dealers (ROAD), which should eventually lead to a civilized country in the automotive market, including secondary (in the U.S., for example, the national automobile dealers Association was established back in 1917!). The Memorandum has been joined by 430 members of the ROAD and 15 brands, so it really took effect.

After that, the Vice-presidents of the Association of ROAD Vladislav RADEV, Julia BABANOV and a representative of the company "Avito Auto" Vadim IVANOV highlighted a number of ROAD projects, problems, insurance, dealer training Academy ROAD, as well as obtaining timely and reliable statistics of the market (i.e. the index of the ROAD).

Regulation of the service market, for example, should lead to the creation of equal market conditions for all market players, official dealers and Independent Dealerships.

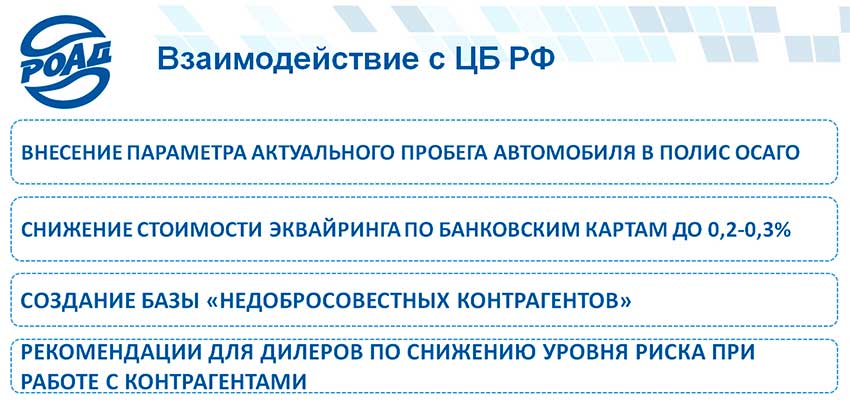

CTP is invited to:

Moreover, the market potential repairs for insurance is not less than ₽100 billion a year. In 2018 there was a significant increase in the share of payments in kind for insurance. Insurers in droves enter into contracts with dealers on terms EMR without wear. ROAD breaks the topic of accounting for depreciation when you return the amount of compensation as obstacles "consumer extremism" which was privedeno the decision of the Priozersk court where the customer for the car price is ₽2.35 million counted a capital ₽42 million!

.

|

|

|

Element was not found.