MC bank Rus has successfully reported for 2018

24 January 2019

The success of Mitsubishi in 2018, came mainly due to the affiliate Bank

At the final press conference of "MMC Rus" 22 January 2019 their achievements over the 2018 shared affiliate is JSC "MC Bank Rus" (the Bank).

The Chairman of the Bank Mr. of Savaii of Norihiro said: "the results of the 2018 talking about continuing the steady growth and development of the Bank, who confidently took up positions among the market leaders. We are pleased to offer a convenient credit products, in a high degree the interests of Russian car buyers. We intend to help realize their dreams into reality, offering competitive services."

For 2018, the Bank entered into a 22 000 credit contracts for the purchase of cars Mitsubishi, which is more than 2 times exceeded the indicator of 2017. The share of new Mitsubishi cars sold on credit through JSC "MC Bank Rus" was third – 13 405 units (growth in 2 times) or three out of every five new cars. Pre-owned, respectively, units were sold 8522 (growth in 2,5 times).

The most popular model of Mitsubishi, purchased on credit using borrowed funds of the Bank, remains the Outlander crossover. For the entire 2018 through loans subsidized by the Russian government, JSC "MC Bank Rus" was able to sell 2165 of such vehicles, which accounted for a quarter of the total number of Outlander sold on credit. However, in recent months, the popularity and novelty of 2018 is a compact sports crossover, Eclipse Cross. In the past year with the help of the Bank's loans were more than 22% of all sold cars of this model. In theory, the sales and the volume of loans at the Eclipse Cross could be higher, but by the end of the year the quota for this model was already selected.

During the reporting period, the Bank showed a record increase in the loan portfolio. At the end of December its size was more ₽20 billion, which provided a 2-fold increase compared to the same period of 2017.

Largely this is due to high demand from car buyers a special loan product with a residual payment "Pay Easy". For 10 months of 2018 on "easy Pay!" fell 41% of the total number of credit sales of Mitsubishi.

In absolute terms, car sales on credit programs rose to almost ₽18.5 billion (11-e a place in the credit market), and loan portfolio increased to ₽20 billion (13-e a place among all banks in the Russian financial market).

The program "easy Pay!" has become extremely popular among the Bank's clients through a combination of a number of advantages, one of which are comfortable for customers monthly payments.

Current offers Bank give a car loan on an average interest on the model Eclips Cross and ASX at the rate of 6.9% and 7.9% for models of Pajero Sport and Outlander. Benefits for the client when using the trade-in is to ₽350 000, in addition, provided comprehensive protection: CASCO+"Protection payments", and regular (repeat) customers can count on 1 percent discount on the rate on the loan.

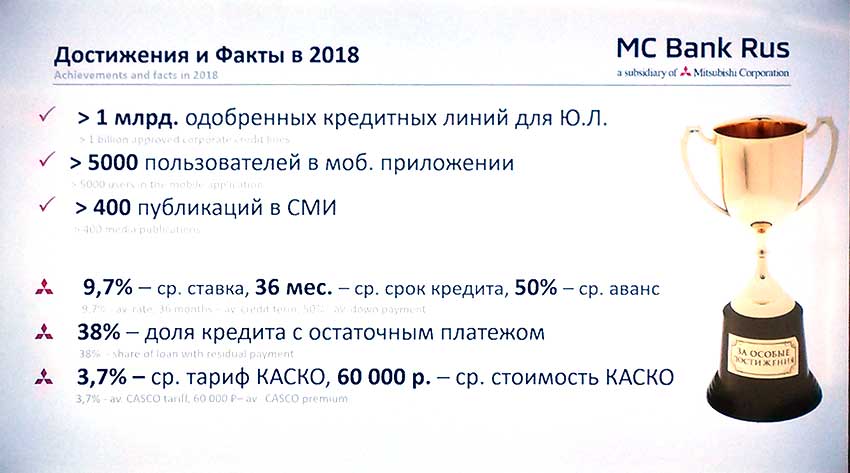

Another of the achievements of the Bank in 2018: the discovery of more than billion of credit lines for legal entities, recorded over 5000 users in the mobile app, posted more than 400 publications in the media. The average size of interest rates on loans of the Bank amounted to 9.7% for a period of 36 months and 50% down payment. The share of loan with a residual payment was 38%. Under contracts KASKO average tariff was 3.7% and the average contract pulled at ₽60 000.

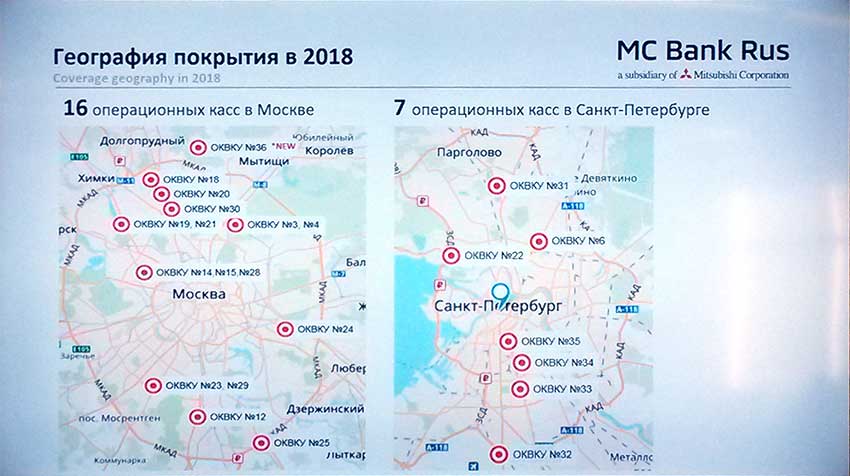

For the convenience of users in 2018, the Bank has opened 16 operating cash desks in Moscow and 7 cash offices in Saint Petersburg.

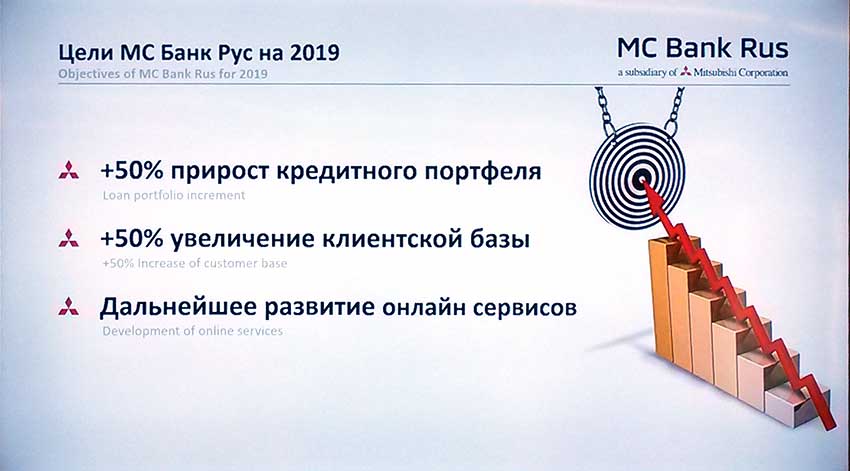

For 2019 "JSC MC Bank Rus" aims to raise to 50% increase in the loan portfolio, 50% increase in the credit base and prodoljit further development of online services.

background: , JSC MC Bank Rus was established in 1994 year (General license of Bank of Russia No. 2789 from 14.11.2014 g). Initially, the Bank's mission was to the financing of legal entities, crediting of the enterprises of automobile business operations with cash foreign currency. With APR 2014 year, the Bank began the activity on lending to individuals for purchase of cars of Mitsubishi in the program Mitsubishi Motors Finance (mitsubisha motors Finance) in all the salons of official dealers of Mitsubishi cars.

In the framework of the program for buyers of cars of Mitsubishi is offering special reduced interest rates on the entire range to make Mitsubishi more accessible and reduce costs for our customers associated with buying a car in credit.

.

|

|

|

Element was not found.