The world will conquer the "soft" and "full" hybrids

28 October 2019

JP Morgan believes that by 2035 most will be sold unconnectable hybrids (HEV)

Analytical Agency JP Morgan released a report that explores the development of electric cars and how the automobile industry will look like in 2025.

In their study, the group JP Morgan predicts in the coming decades boom in the market, there is not electric and(or) plug-in hybrids, but the boom of the so-called "soft" (Mild Hybrid) and "full" hybrids (Full Hybrid), ie vehicles with 48-volt power system with generator-starter and a small booster battery operating in the recovery mode, as well as hybrids of the type Toyota Prius without connection to the charging network. They should oust traditional petrol and diesel internal combustion engines now increasingly referred to by the acronym ICE. Pure battery electric vehicles (BEV) will also receive a certain spread, but mainly in the richest countries of "Golden billion", as well as in China and India, but plug-in hybrids (PHEV) mass distribution and will not achieve.

The automotive industry is undergoing a radical transformation, and most automakers agree that the next 10 years will bring more changes than the two previous decades (and all the previous century – ed.). The following target date named by the automakers as a turning point was the year 2025 when all of the materials and fuel to the cost of the companies-producers will look completely different.

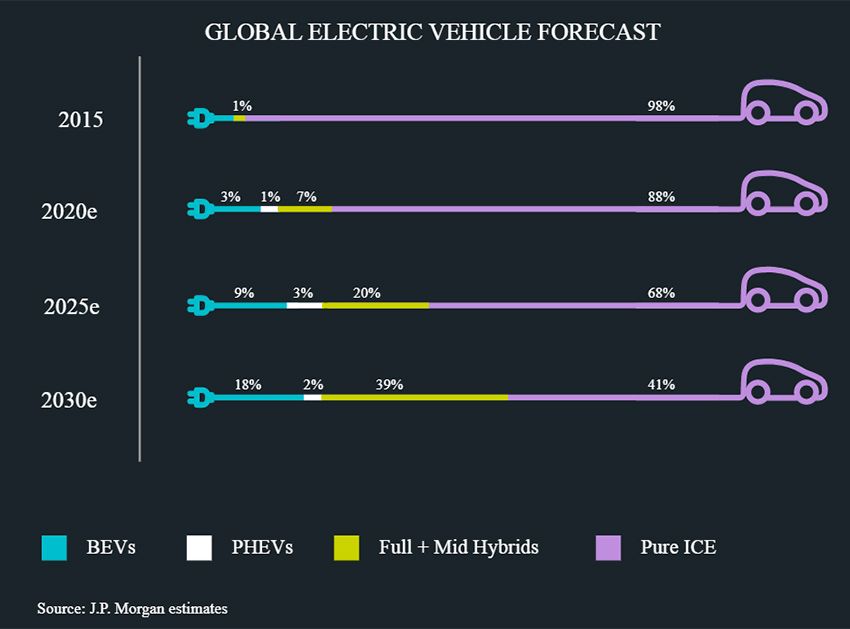

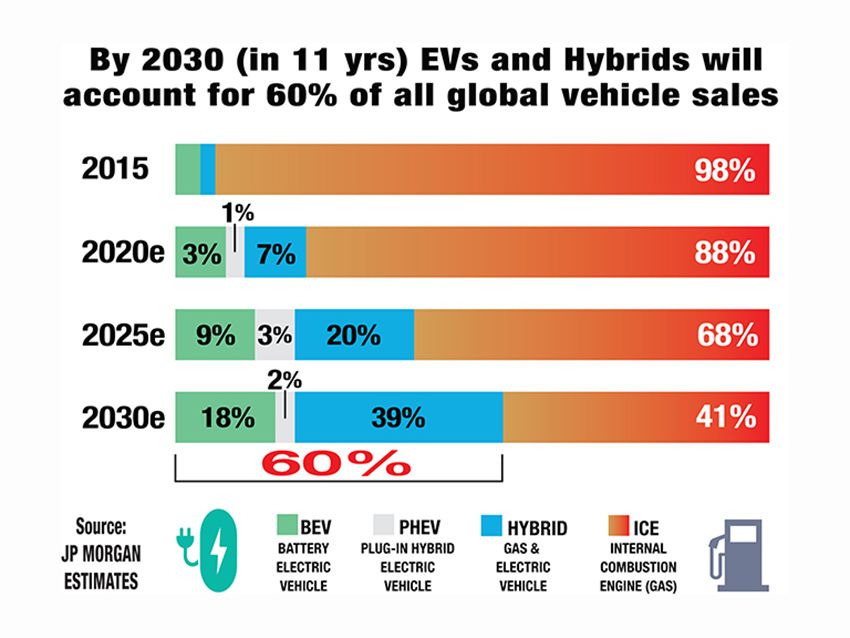

Automakers are preparing for the phasing out conventional vehicles (ICE), driven exclusively by internal combustion engines (ice), as governments seek to solve the problem of climate change due to emissions of carbon dioxide (CO2) in the use of fossil fuels. Sales of electric and hybrid cars grow, and by 2025 they will account for about 30% of the total car market. For comparison, in 2016, a plug-in electric vehicles (PEV) had less than 1 million units or 1% of global sales.

According to estimates by JP Morgan, by 2025 this figure will increase to 8.4 million cars, or 7.7% of the market. Although this leap is quite significant but it can not be compared with the expected sales growth of HEV – hybrid vehicle, in which the internal combustion engine combined with an electric drivetrain. It is projected that this sector will increase from 3% of the global market up to 23% of global sales, or to more than 25 million vehicles. Thus, in 2025 on the ICE (including the NGV – cars to natural gas – ed.) will account for about 70% of the world market, and by 2030 this figure will decline to 40%, and sales will focus mainly on emerging markets (which, JP Morgan will undoubtedly include Russia – ed.).

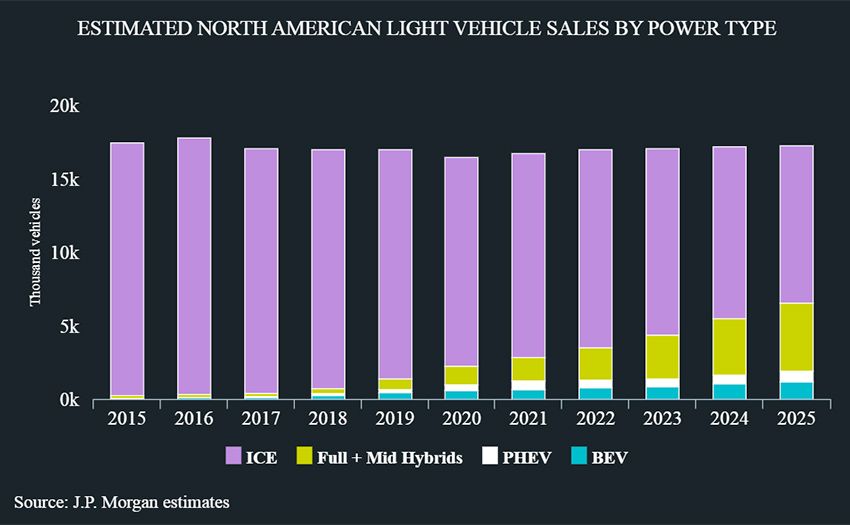

As in North America and in Europe, hybrids (HEV) and electric vehicles (BEV) will lead in the next decade, while plug-in hybrids (PHEV) will not be too popular in any region. In Europe, the PEV segment (BEV+PHEV) will increase from approximately 2% of the total sales of new vehicles in 2017 to about 9% by 2025 that by the middle of next decade to exceed 1.5 million vehicles. By 2025, it is expected a sharp change from vehicle type ICE exclusively to BEV and HEV. In this period, JP Morgan predicts that sales of BEV in Japan and Korea reached 384 million, which is 6% of the market, and the HEV market will approach 1.8 million or 27% of total sales.

Meanwhile, in the US, stricter fuel economy (CAFE) are likely to push automakers to expand their range of electric vehicles, but not at the same pace as in Europe, where already in force the penalties for CO2 emissions. However, total sales of PEV and unconnectable hybrids (HEV), estimated to constitute more than 38% of total sales in 2025.

From the point of view of production and sales of electric vehicles, no other country can match with China. It is expected that by 2020, the share of China will have a staggering share of 59% of global sales, then by 2025, according to JP Morgan, it will drop slightly to 55%. Previously, the growth segment of urban mini electric cars with batteries of smaller capacity, designed for movement over short distances (100-150 km), helped to increase the popularity of electric vehicles in China in General. Prices on mini electric vehicles has begun with about 40,000 yuan ($6250), which made them available. Research group JP Morgan predicts that the compound annual growth rate (CAGR) of the Chinese vehicle market to new kinds of energy (NEV), i.e. BEV+PHEV+FCEV will reach 46% by 2020, while in this year, there will be 2.5 million such cars, which is 25% above the target of the government, leaving 2 million units. This forecast is based on several key factors:

Rapid decline in battery costs

Prices on rechargeable cells drop by 15-20% annually, as the scale of production all increase, and the suppliers of the batteries increasingly reduce their profit margins. This should allow China to 2020 to bring production electric vehicles to parity of costs with compact ICE. However, the abolition with July 2019 schemes of subsidies introduced in 2018, led to a sharp decline in sales BEV with insufficient reserve, although not stopped the growth of some PHEV premium segment.

BATTERY

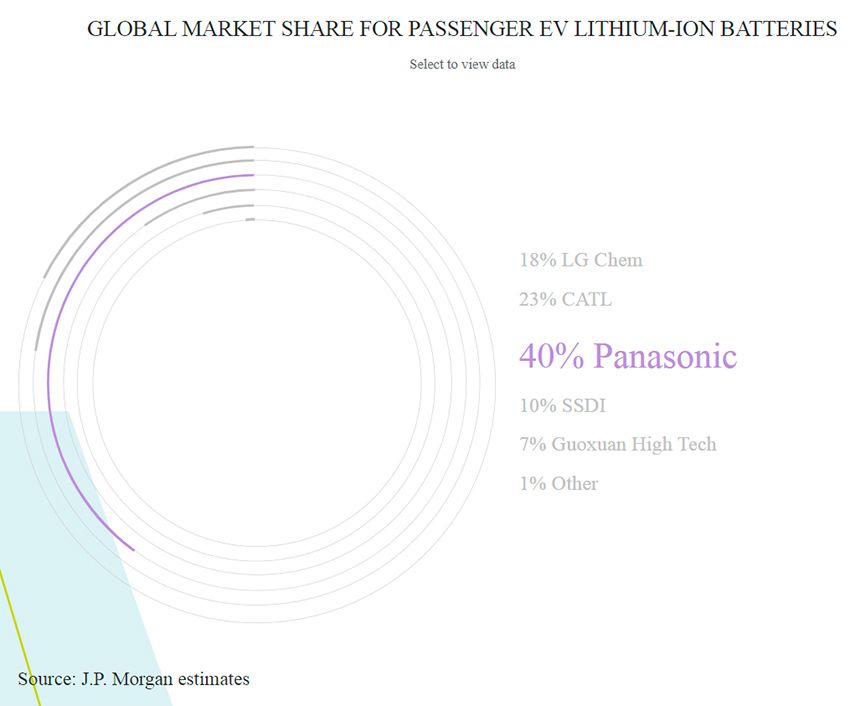

In the production of batteries for electric and hybrid cars today is dominated by a relatively small number of players. Asian manufacturers take the lion's share in the world production. So, Panasonic have 40%, LG Chem – 18% of the market. The company CATL is in the lead in investing in China and currently holds 23% of the world market. The price of batteries has fallen sharply over the past decade from about $1,000 per kWh in 2010 to ~$210-230 per kWh in 2017 and continue to fall in 2018-2019. To BEV steel at a cost competitive with ICE, the cost of batteries should fall below $100 per kWh, it is estimated that JP Morgan Research must come to the middle of the next decade or earlier.

Head of research and strategies the metals market JP Morgan Natasha Kaneva said: "Automakers and battery makers are very sensitive to the cost of raw materials. In proportion to the cost of raw materials will increase relative to the total cost of the battery. In fact, if the average price of batteries will drop from $209 per kWh to $100 per kWh, but raw material costs will remain the same, then the share of raw materials will account for 56% of the battery, which is significantly higher than today's 27%".

Because the range of electric cars is changing, and the industry is expanding, it will affect demand and therefore price of some goods. According to forecasts of JP Morgan Research in the year 2025 the global demand for lithium will grow, mainly due to growth in sales of electric vehicles in China. Increased demand for Nickel in electric cars is also expected to push gold prices to rise, while the segment of the battery will be on the way to becoming the middle of the next decade, the second largest consumer of Nickel after market stainless steel. Of base metal after Nickel on the second place from the point of view of potential demand growth is copper. This metal is used not only in all elements of the power system of the electric vehicle, but in the stationary charging ports, stations and cables. Aluminum demand will also significantly increase, as it made the body of the electric vehicle, and their popularity is growing. By the way, it is possible that a wide application you will find the air-aluminum ECG, and this is translated into the need for "aluminum fuel" to a whole new level.

CHARGE

The growth of sales and the fleet of electric vehicles, the charging infrastructure needs to catch up, and China also benefits in this area. By 2020, the Chinese State Council plans to create 4 million new charging posts and 12,000 charging stations construction in which state companies such as China State Grid and investing significant funds. In Europe will be major drivers utilities and oil companies such as Shell and Engie came on the market in 2017 with the acquisition of companies and NewMotion EVBox, respectively, (in addition to the German automakers have organized a consortium IONITY – ed.). In the United States (the richest and most ecologically sensitive – ed.) California takes the lead and plans to invest $1 billion network of charging stations.

WHAT MANUFACTURERS CHOOSET the LEADER?

China's largest manufacturers of electric vehicles are Beijing automotive industrial Corporation (BAIC) and BYD company and ZhiDou. Last year BAIC model EC180 became the best selling electric car in China, which cost after subsidy was about $7750 with a power reserve of about 177 km and a maximum speed of 100 km/h. General Motors recently announced plans to launch in China, 10 new electric cars and hybrids in the period from 2021 to 2023 by adding them to 10 models already scheduled for 2016-2020

The Company Tesla Inc. with headquarters in California specializiruetsya on premium cars, since the price of the Model S sedan and Model X SUV close to $100 000. The automaker launched in the summer of 2017 on a "mass market" mid-size electric car Model 3, announced a basic version at a price of $35,000, but the delayed production prevented its wide diffusion. In Europe sports coupe BMW i8 has become one of the most expensive electric cars in the local market with a price tag of $140 000. Compact elektrochelovek Nissan LEAF and Renault Zoe were the most popular, winning by 20.6% and 19.3% of the BEV market, respectively, due to its relatively large reserve (250-300 km) and competitive price.

The head of the European automobile Department JP Morgan Jose Azumendi said: "the Market will soon be flooded with plenty of models of electric vehicles from different manufacturers. Interestingly, among the manufacturers of premium brand such as BMW first brought to market electric vehicles of smaller size (meaning the subcompact model i3 – ed.) and only then decided to enter the market of large electrical crossovers. This marketing strategy is clearly different from the actions of the brands Audi and Mercedes-Benz"..

|

|

|

Element was not found.